It was a strange day of scan results. With the market doing well and knowing that it is being led by aggressive sectors like Consumer Discretionary (XLY), Technology (XLK) and Communication Services (XLC) I decided to make my selections from growth areas.

What was strange was seeing so many Pharma stocks. The group is underperforming the market by a lot, but I had at least four or five come in from this area. We'll want to monitor this moving forward. Financials also were greatly represented. I don't like the sector right now so it was interesting to see these stocks push through into my scan results.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": AVID, DV and QSR.

Runner-ups: JO, ISEE, GOTU, BCOR, MRNA, AEM, COLB and LII.

RECORDING LINK (1/20/2023):

Topic: DecisionPoint Diamond Mine (1/20/2023) LIVE Trading Room

Passcode: January#20

REGISTRATION for 1/27/2022:

When: Jan 27, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (1/27/2022) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording (1/23):

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Avid Technology, Inc. (AVID)

EARNINGS: 02/28/2023 (AMC)

Avid Technology, Inc. engages in the provision of technology services for media and entertainment industry. It develops, markets, sells, and supports software and integrated solutions for video and audio content creation, management and distribution. The company was founded by William J. Warner in September 1987 and is headquartered in Burlington, MA.

Predefined Scans Triggered: Elder Bar Turned Blue, Stocks in a New Uptrend (ADX), Hollow Red Candles, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

AVID is down -2.17% in after hours trading so a pullback to support may be lining up to make this one less overbought. That was the only thing I didn't like about this chart--the RSI is overbought. We have a strong breakout out of a longer-term trading range on a strong steady rally. The Price Momentum Oscillator (PMO) is on a BUY signal, but admittedly it is looking a bit overbought. Stochastics look great as they move sideways above 80. There is a new Long-Term Trend Model "Golden Cross" BUY signal as the 50-day EMA has crossed up through the 200-day EMA (a golden cross). Volume has been steady based on the OBV. Relative strength is a big plus on this chart given the group is doing well and AVID is doing well against the group and the SPY. The stop is set below support at 5.3% or 28.75. I think you could tighten it up even more if you wanted to.

The weekly chart is another reason I like this one. If we weren't in a bear market I would say this one could be an intermediate-term trade. Remember if we're in a bear market, all investments are short term or should at least be managed that way. The weekly RSI is positive and the weekly PMO is rising out of an oversold crossover BUY signal. The StockCharts Technical Rank (SCTR) is in the "hot zone" above 70, meaning based on trend and condition primarily in the intermediate and long terms it is in the top 30% of its universe (large-, mid-, small-caps or ETFs). We have a nice little breakout and upside potential of about 23.8%.

DoubleVerify Holdings Inc. (DV)

EARNINGS: 03/07/2023 (AMC)

DoubleVerify Holdings, Inc. engages in the development of software platforms for digital media measurement, data, and analytics. Its software, Pinnacle, is integrated across the entire digital advertising ecosystem including programmatic platforms, social media channels, and digital publishers. The company was founded on August 16, 2017 and is headquartered in New York, NY.

Predefined Scans Triggered: Improving Chaikin Money Flow, New CCI Buy Signals and P&F Low Pole.

DV is unchanged in after hours trading. We have a nice little breakout above resistance and the 50-day EMA. This looks like a cup with handle pattern and it is now being confirmed with this breakout. The RSI is positive and the PMO is accelerating higher out of an oversold BUY signal. Stochastics are nearing 80. Relative strength for the Software group is improving and DV is beginning to outperform the group again which is helping it outperform the SPY now. The stop is set below the 20-day EMA at 5.7% around 23.32.

Price has bounced off its all-time lows and is pushing toward the top of the current trading range. The weekly RSI is almost above 50 and the weekly PMO has turned up. The SCTR isn't great at 44.9%, but it is rising quickly so I'll accept it. Upside potential is about 22%.

Restaurant Brands International Inc. (QSR)

EARNINGS: 02/14/2023 (BMO)

Restaurant Brands International, Inc. is a holding company, which engages in the operation of quick service restaurants. It operates through the following segments: Tim Hortons, Burger King, and Popeyes. The Tim Hortons segment provides donut, coffee, and tea restaurant services. The Burger King segment manages fast food hamburger restaurant. The Popeyes segment handles chicken category of the quick service segment of the restaurant industry. The company was founded on August 25, 2014 and is headquartered in Toronto, Canada.

Predefined Scans Triggered: Moved Above Upper Bollinger Band, Stocks in a New Uptrend (Aroon) and Moved Above Upper Price Channel.

QSR is unchanged in after hours trading. I sure wish this one had already broken out, but it did technically close higher than the late November high. The RSI has been positive since late October. The PMO is about to give us a crossover BUY signal. Stochastics are above 80 and rising strongly. The group is performing inline with the SPY as is QSR. QSR is outperforming the industry group, so it could begin to show the outperformance we want against the SPY soon. The stop was easy to set below the trading range at 6.2% or 63.54.

This area of overhead resistance is a pretty strong one, but it has already closed above the 2021 high. The weekly RSI is a bit overbought which could be a problem, but given the acceleration of the weekly PMO and the high SCTR, I expect a breakout. Consider an upside target around 15% or 77.91.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

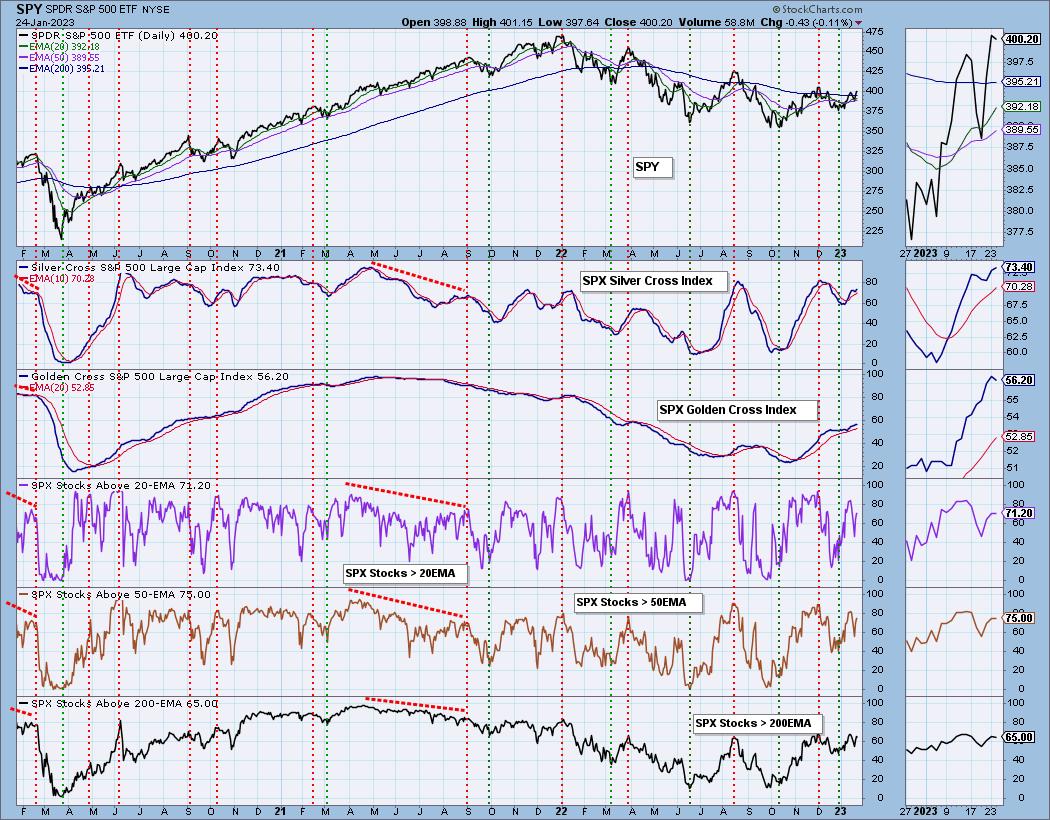

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 15% exposed.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com