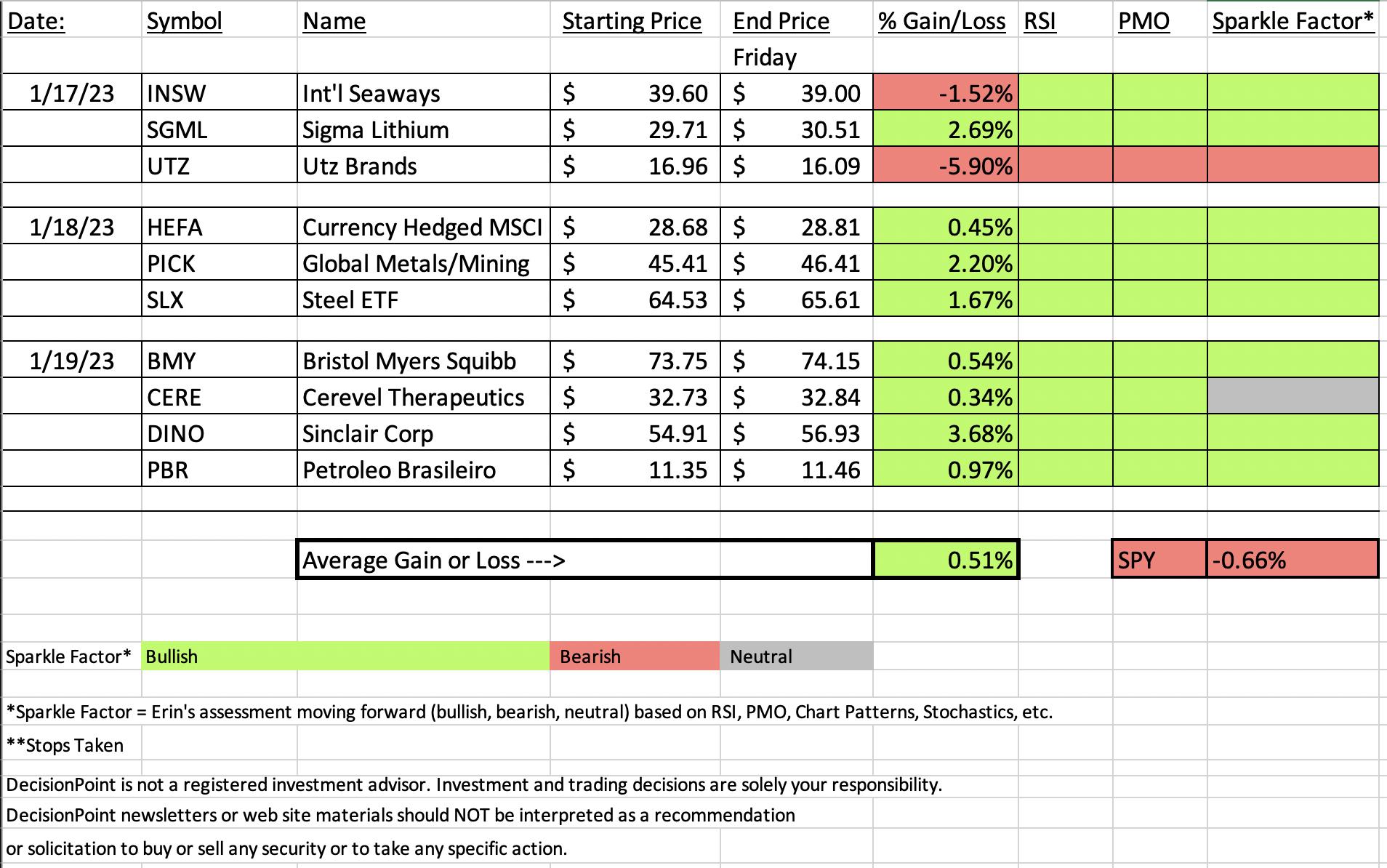

On a week when the market was down -0.66%, we had eight out of ten "Diamonds in the Rough" finish higher with all but one looking to go higher still. It was a nice recovery after the market was down so far and that helped push the already successful "Diamonds in the Rough" even higher.

It was clear which would be the "Sector to Watch" in today's Diamond Mine trading room and after the close it was confirmed that Communications Services (XLC) was the winner. It is coming on the back of both Disney (DIS) and Netflix (NFLX). They are members of the two Industry Groups, Broadcasting & Entertainment and Internet. Their leadership should bring everyone upward as well.

Second place for Sector to Watch goes to Materials (XLB) which still has excellent participation.

This week's "Dog" is Ute Brands (UTZ). It was not a good pick. If I'd gone with just about anything else, it would be up. While overall it was down 5.19%, the stop of 5.9% was hit yesterday.

This week's "Darling" is Sinclair Corp (DINO). The Energy sector is still looking good and stocks like DINO are why. With Crude still looking bullish, this one should continue higher.

Have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING LINK (1/20/2023):

Topic: DecisionPoint Diamond Mine (1/20/2023) LIVE Trading Room

Passcode: January#20

REGISTRATION for 1/27/2022:

When: Jan 27, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (1/27/2022) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording:

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

HF Sinclair Corporation (DINO)

EARNINGS: 02/24/2023 (BMO)

HF Sinclair Corp. is an independent energy company. It manufactures and sells products such as gasoline, diesel fuel, jet fuel, renewable diesel, specialty lubricant products, specialty chemicals, and specialty and modified asphalt. The company operates through five segments: Refining, Marketing, Renewables, Lubricants and Specialty Products, and Midstream. The company was founded on March 14, 2022 and is headquartered in Dallas, TX.

Predefined Scans Triggered: Moved Above Upper Price Channel, P&F Ascending Triple Top Breakout and Ichimoku Cloud Turned Red.

Here are the commentary and chart from yesterday (1/19):

"DINO is down -0.29% in after hours trading. I love this symbol given their branding is a dinosaur and I used to watch Mr. Flintstone often in my youth. This rally may be trying to go parabolic and it is about to reach overhead resistance. Other than that, indicators are healthy. The RSI is positive and rising. The PMO is rising on an oversold BUY signal. The OBV had a positive divergence (rising OBV bottoms, flat/declining price bottoms) going into this rally. Stochastics are rising above 80 and relative strength is pretty good for the group now, particularly for DINO against the group and SPY. The stop is set at 7% around 51.06."

Here is today's chart:

One of the things I liked about this chart was the curved rally out of the December trading range. It is a bit parabolic, but it is early. It overcame near-term overhead resistance and is now up against another line of defense. Based on the very positive indicators, we have to expect a breakout here.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Utz Brands, Inc. (UTZ)

EARNINGS: 03/02/2023 (BMO)

UTZ Brands, Inc. manufactures, markets, and distributes branded snacking products. It offers a broad range of salty snacks, including potato chips, pretzels, cheese, veggie, other snacks and pork skins. The firm's brands include Utz, Zapp's, Golden Flake, Good Health, Boulder Canyon and Hawaiian. The company was founded in 1921 and is headquartered in Hanover, PA.

Predefined Scans Triggered: New CCI Buy Signals, Moved Above Upper Bollinger Band and Moved Above Upper Price Channel.

Here are the commentary and chart from Tuesday (1/17):

"UTZ is up +0.24% in after hours trading. I sense that the reason Staples are showing up is that market concerns usually lead to investment in defensive areas. Most are still quite bearish but they want to take advantage of the possibility of being wrong. One way is to go to defensive areas. We'll see if this plays out as I think, but for now I'm happy with just picking strong stocks with strong charts. The RSI is positive on UTZ and today's breakout was quite impressive. I like the bottoming formation associated with today breakout above key moving averages. The PMO just triggered a crossover BUY signal in oversold territory. Stochastics are above 80. Relative strength isn't great for the group, but the spotlight has been on growth stocks. UTZ is outperforming its group and I believe it will soon outperform the SPY. The stop is set below the 200-day EMA at 5.9% or $15.95."

Here is today's chart:

Terrible selection, but where did it go wrong? I believe the big problem with this one is the sector and particularly the industry group it is in. My thesis that a bearish bias would lead to investment here was clearly off as the defensive groups have taken it on the chin over the past week or so. I'll need to be more careful about relative strength in the future. Considering all the charts I looked at last Tuesday, I am disappointed that I picked a Dud. The stop was hit yesterday and it does appear ready to continue lower based on how the indicators have moved south.

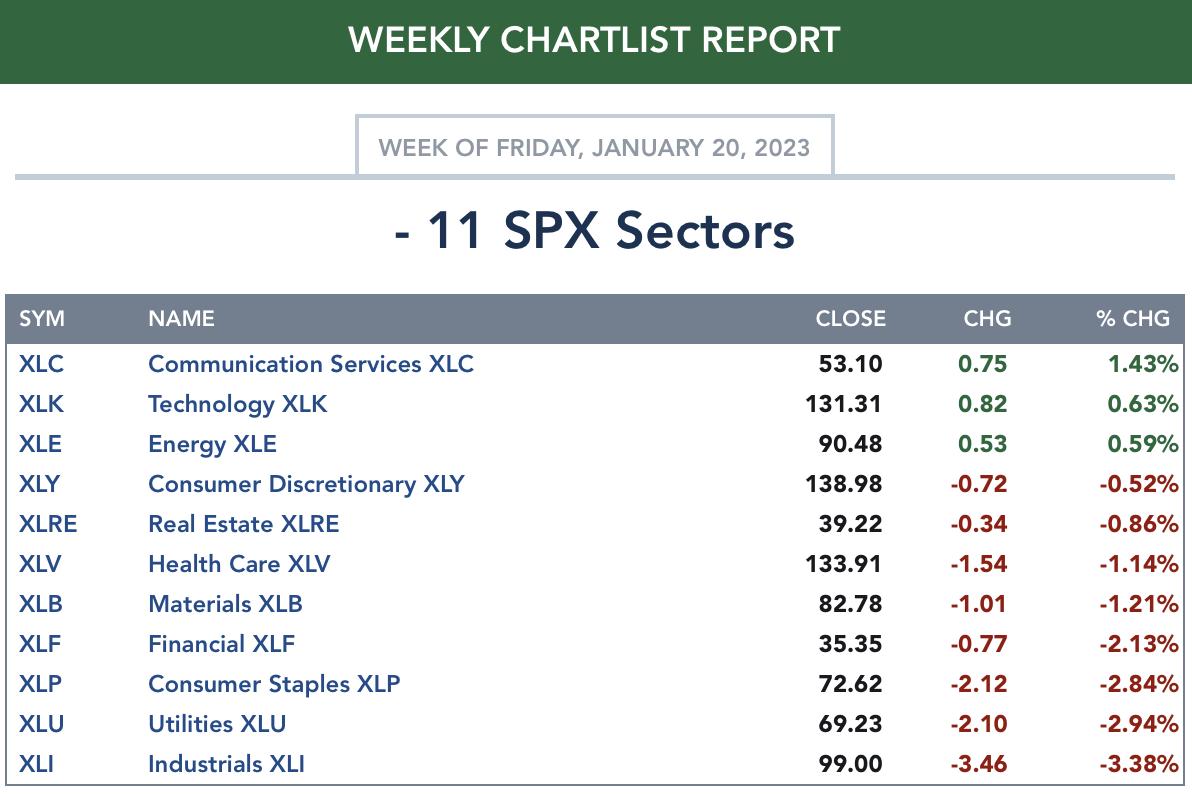

THIS WEEK's Sector Performance:

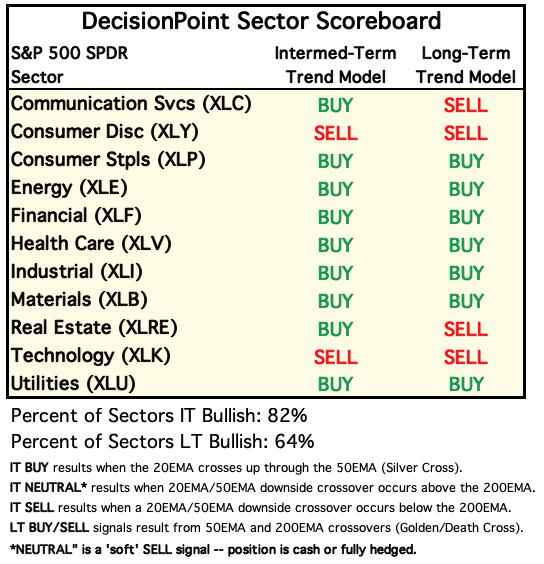

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

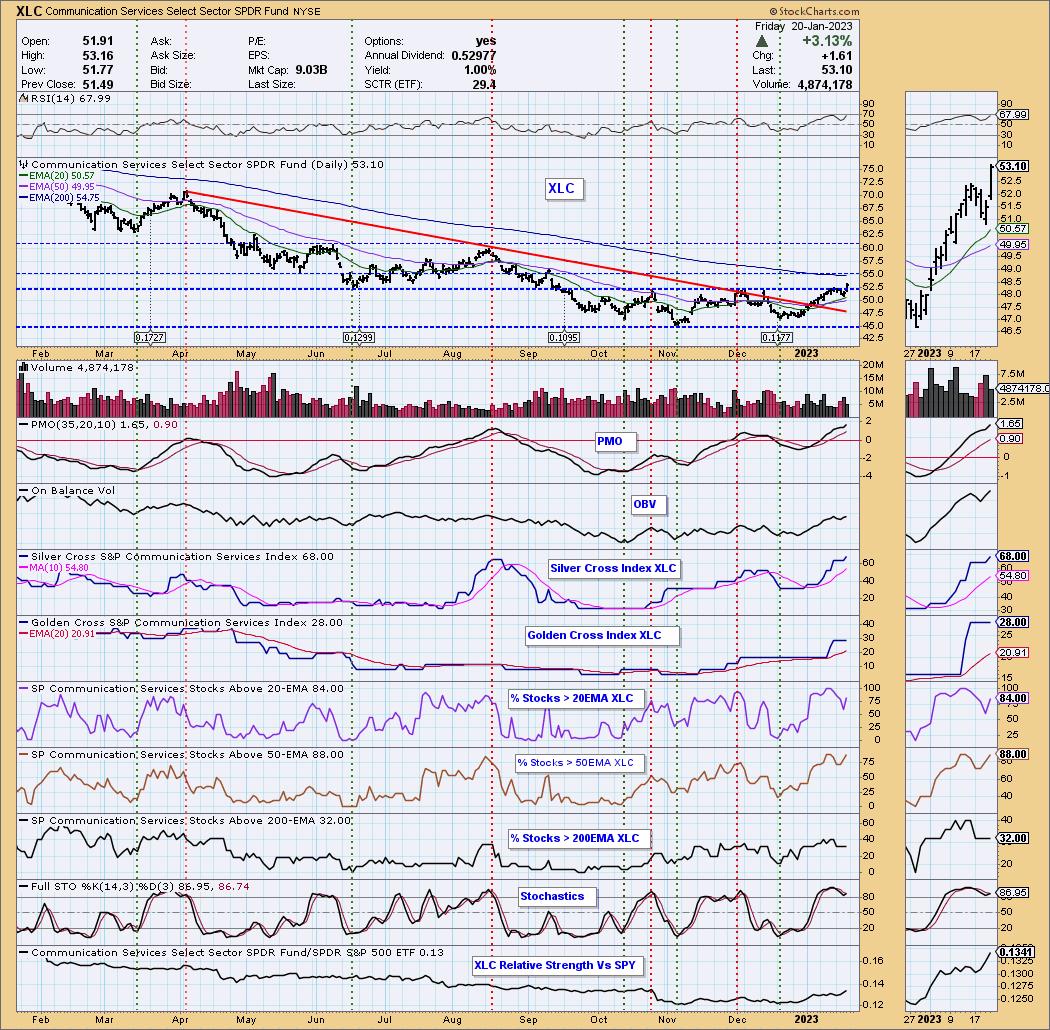

Sector to Watch: Communication Services (XLC)

Today's strong breakout was one of the things that made XLC attractive. This breakout comes at a level of extraordinary resistance. Just look at how many 'touches' that resistance line has! The next level is at $55 and the 200-day EMA. However, that level isn't nearly as strong. The Silver Cross Index and Golden Cross Index are trending higher and participation is expanding again. While Disney (DIS) and Netflix (NFLX) may be leading this charge, based on underlying participation, they aren't the only stocks seeing success in the sector.

Industry Group to Watch: Internet (PNQI)

I knew there were ETFs out there for Internet stocks, but they all are very thinly traded. The SPDR Internet is (XWEB), but it actually has a lower average daily volume than this one. Also, this one has a breakout and the other doesn't. I think this is an okay trading vehicle, but just know it is thinly traded. The indicators are positive and Relative Strength has been out of this world. I would go look at their website and get more information on this ETF before trading it. You can research it HERE.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 15% exposed.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com