Last week the market changed character. Our Silver Cross Index had a bullish "Shift" as it crossed over its signal line. Broader participation was visible throughout as smaller-cap stocks began playing catch up with the larger-cap stocks that have led the market.

All of this opened up possibilities for "Diamonds in the Rough". The shorts of the past two weeks were unofficially closed by me last Friday. This week was mixed overall. The "Dud" this week was reader requested TG Therapeutics (TGTX) which I happened to pick up. The "Darling" was EQT Corp (EQT) from the Energy sector. I had expected the Retail 3x Bull ETF to be our "Darling" given its leverage, but it had a bad Friday. I still like it as a small position although I did not purchase it.

Picking the Sector to Watch wasn't that easy as many of the sectors could've been dubbed "Sector to Watch". I opted to stick with Industrials (XLI) and go with Commercial Vehicles as the "Industry Group to Watch". Both were picked in the Diamond Mine trading room from Friday.

Hope you have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING LINK (6/9/2023):

Topic: DecisionPoint Diamond Mine (6/9/2023) LIVE Trading Room

Recording Link

Passcode: June#8th (Sorry about mixing up the date in the password)

REGISTRATION for 6/16/2023:

When: Jun 16, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (6/16/23) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (6/5/2023):

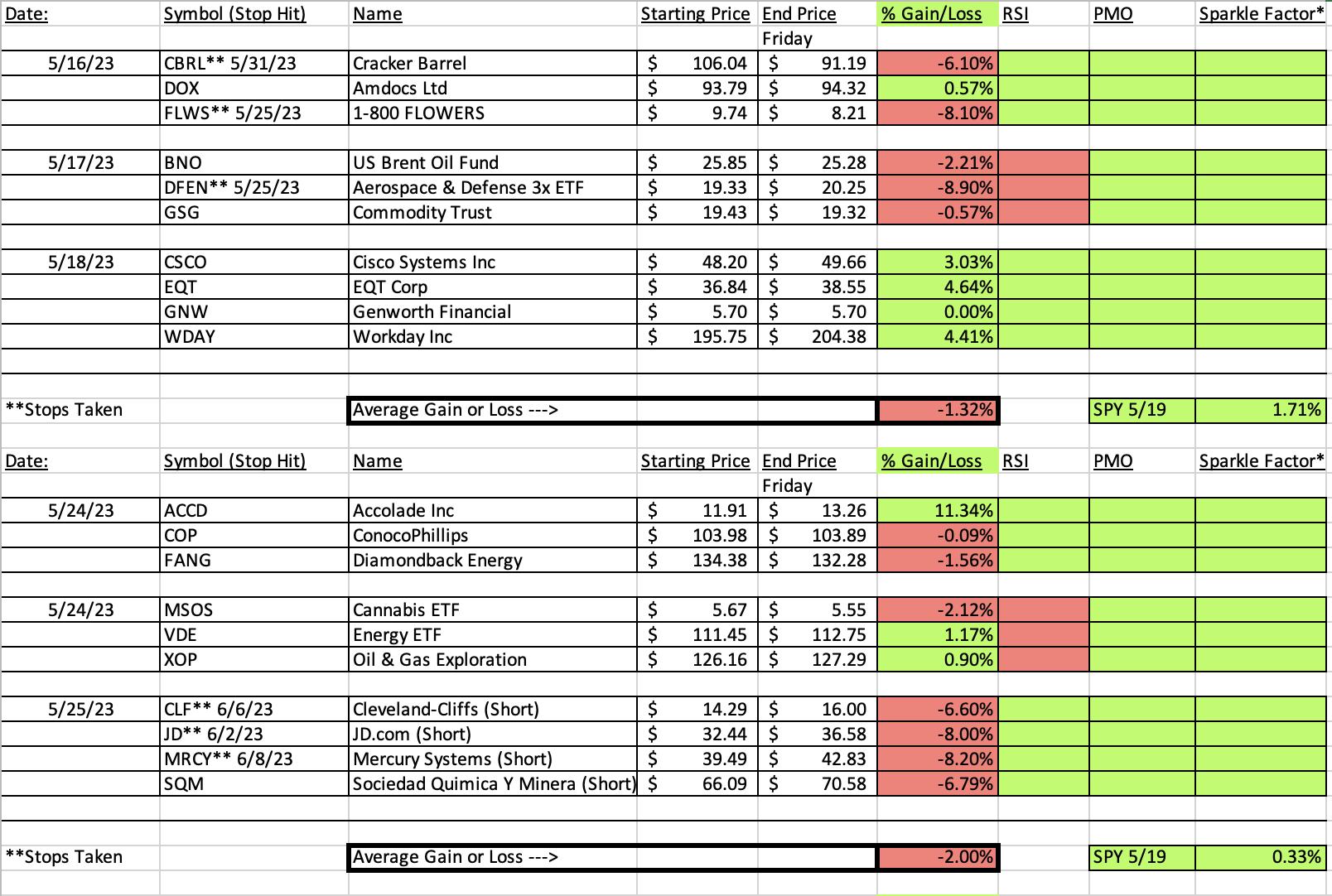

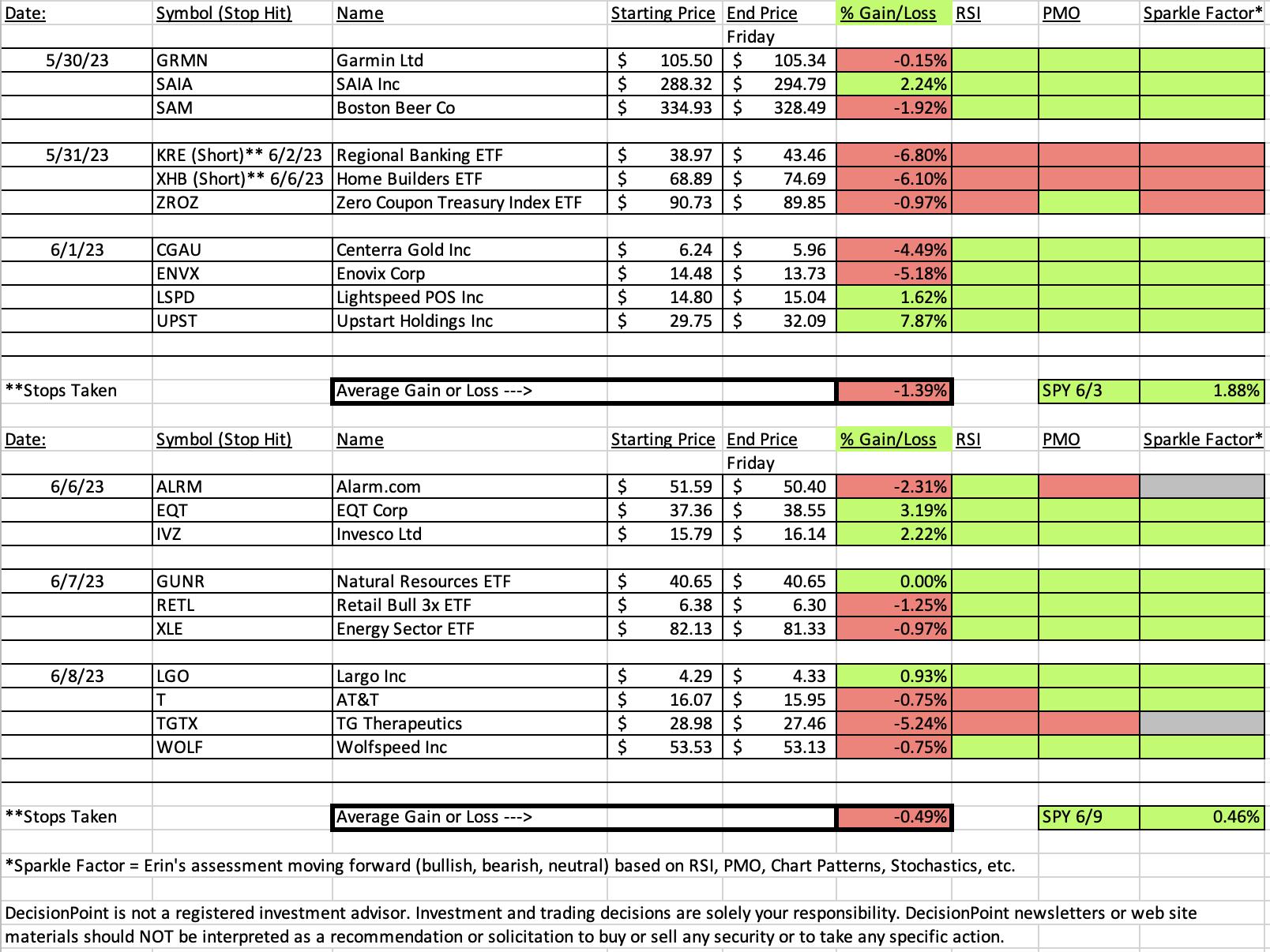

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

EQT Corp. (EQT)

EARNINGS: 07/26/2023 (AMC)

EQT Corp. is a natural gas production company, which engages in the supply, transmission, and distribution of natural gas. The company was founded in 1888 and is headquartered in Pittsburgh, PA.

Predefined Scans Triggered: Elder Bar Turned Green, P&F Bullish Catapult, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

Below are the commentary and chart from Tuesday (6/6):

"EQT is down -0.03% in after hours trading. I hadn't intended to include an Energy position, but the rounded, saucer-shaped price pattern kept drawing me back to this chart. It has the added benefit of a bullish engulfing candlestick today. Another bonus on the chart is the PMO Surge above the signal line. The RSI has been positive since early May. Stochastics had also been in decline, but they reversed in positive territory. The group isn't really performing much which is why I wasn't going to go with Energy, but EQT is a clear outperformer against both the group and the SPY. The stop is set beneath the 200-day EMA at 7.8% or $34.44."

Here is today's chart:

Price made it to the next level of overhead resistance and is pausing. The indicators were not damaged by Friday's decline and the large basing pattern suggests more upside follow-through. I would look for the next level of resistance to be tested at 44.00.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

TG Therapeutics, Inc. (TGTX)

EARNINGS: 08/01/2023 (BMO)

TG Therapeutics, Inc. engages in the acquisition, development, and commercialization of novel treatments for B-cell malignancies and autoimmune diseases. Its product pipeline includes TG-1501, TG-1701, Ublituximab, and Umbralisib. The company was founded by Michael Sean Weiss and Laurence H. Shaw on May 18, 1993 and is headquartered in Morrisville, NC.

Predefined Scans Triggered: Elder Bar Turned Green.

Below are the commentary and chart from Thursday (6/8):

"TGTX is up +0.79% in after hours trading. We have a nice double-bottom that has been confirmed with today's breakout rally. The RSI is rising above net neutral (50). The PMO has turned back up and Stochastics are rising strongly albeit in negative territory. The group is slowly starting to outperform. TGTX tends to outperform the group so currently it is outperforming the market. It was a big gain today so unfortunately the stop has to be set on the high side at 8% or $26.66."

Here is today's chart:

I wasn't completely surprised to see a deep decline simply because this one tends to be very volatile. The price pattern looks somewhat questionable given price closing back below the confirmation line of the bullish double-bottom, but the pattern hasn't been busted yet. The PMO has turned back down but it was an over 5% decline. What encourages me to hold this stock is Stochastics which continue to rise and have moved above net neutral (50). This is why it is listed with a "gray" or "Neutral" Sparkle Factor.

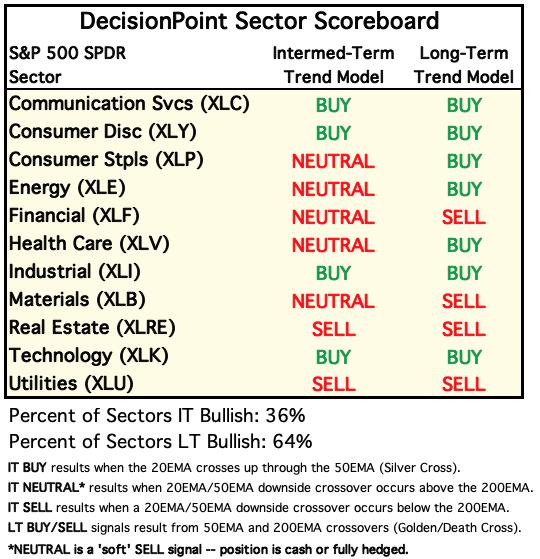

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Under the Hood ChartList!

Sector to Watch: Industrials (XLI)

I'm not thrilled with the trading range XLI has been in this year, but it is lining up for a possible breakout this time around. The RSI is positive, but the PMO is especially bullish as it accelerates higher, putting more distance between it and its signal line. XLI is one of the few sectors that have Bull Shifts on both the Silver Cross Index and Golden Cross Index (cross above the signal line). Participation is robust and better than most of the sectors. Stochastics are above 80 and relative strength is in a rising trend.

Industry Group to Watch: Commercial Vehicles & Trucks ($DJUSHR)

Nearly all of the groups in Industrials are favorable, this is just one of many. Indicators are bullish with the RSI in positive territory and the PMO just now reaching above the zero line. Stochastics are above 80 and relative strength is improving for the group. A few stock symbols we mined on Friday were FSS, TEX and ALSN.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 30% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com