It was a good week for "Diamonds in the Rough" with one position up over 7.5% in just one day. Overall positions were up on average +0.75%. Only one position is listed as bearish moving forward.

The Sector to Watch this week was tricky, but after reviewing participation and breadth, I determined that Real Estate (XLRE) is set up fairly well. Energy (XLE) did an about face today, but Crude Oil is getting close to overhead resistance and it was narrowed to Oil Equipment and Services. Overall the market is still looking a bit weak so short-term declines may be necessary. It is a good idea to put in stops in case this pullback becomes a correction. Internals are still strong so I believe we are safe from a correction, but you know how these things can go.

The Industry Group to Watch comes out of the Real Estate sector, but as noted above, Oil Equipment and Services (XES) looks bullish despite some internal issues with the Energy sector. Although I must admit that participation shot up in Energy and nearly found its way in today's recap.

This week's "Darling" was Weight Watchers (WW) which shot up over 7% today. The chart looks great and upside potential is definitely lucrative on this stock.

This week's "Dud" is Chatham Lodging Trust (CLDT) which ironically comes from this week's Industry Group to Watch. I still like it partially because I see strength within its industry group. Allstate (ALL) is really the "Dud" this week even though it wasn't down quite as far as CLDT. I'm going to cover it as this week's Dud.

It appears that I will be on Making Money with Charles Payne on Monday at 2p ET (sometime during that hour).

Good Luck & Good Trading,

Erin

RECORDING LINK (7/7/2023):

Topic: DecisionPoint Diamond Mine (7/7/2023) LIVE Trading Room

Passcode: July@7th

REGISTRATION for 7/14/2023:

When: Jul 14, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/14/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Our latest DecisionPoint Trading Room recording (6/26/2023 - NO TRADING ROOM on 7/3):

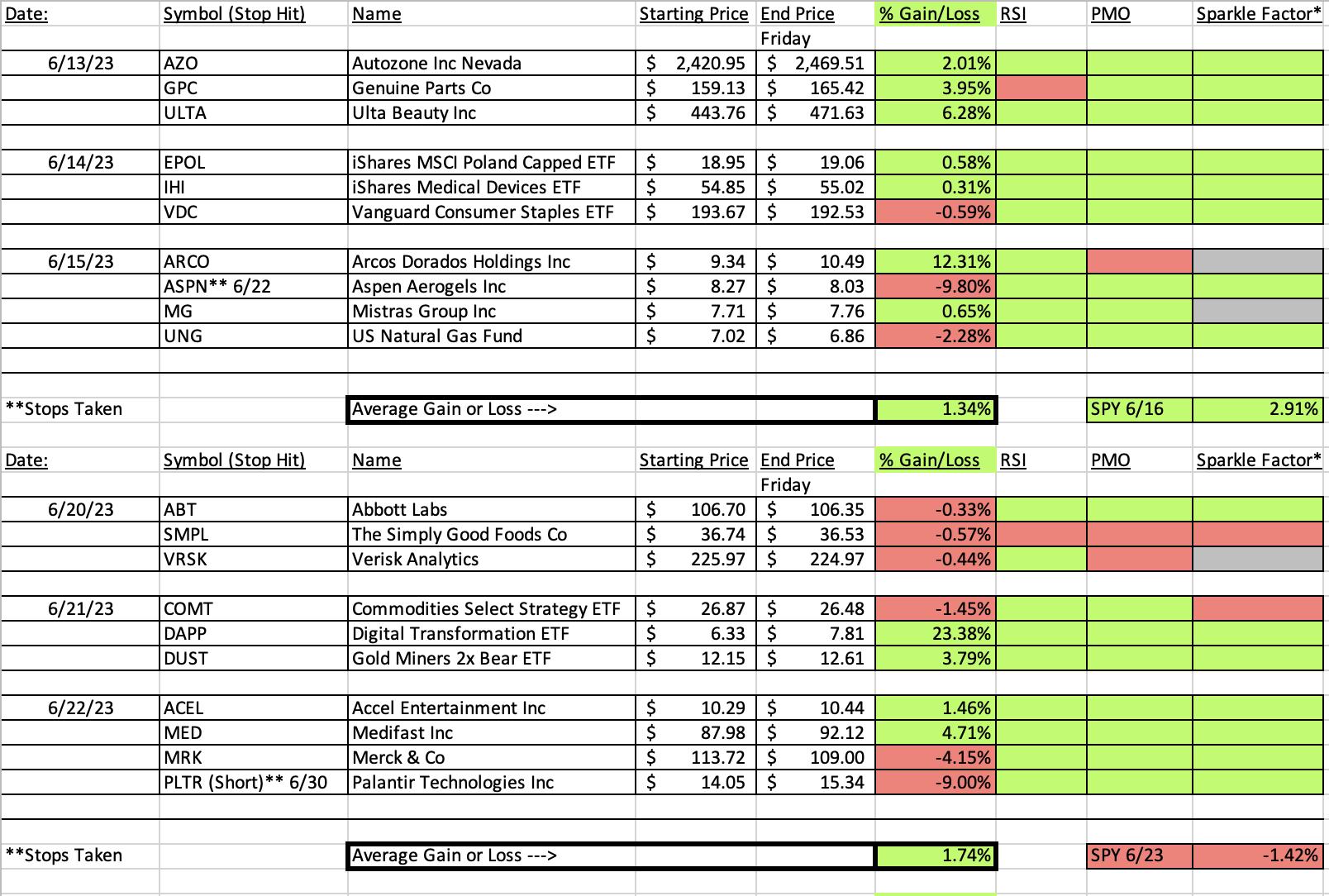

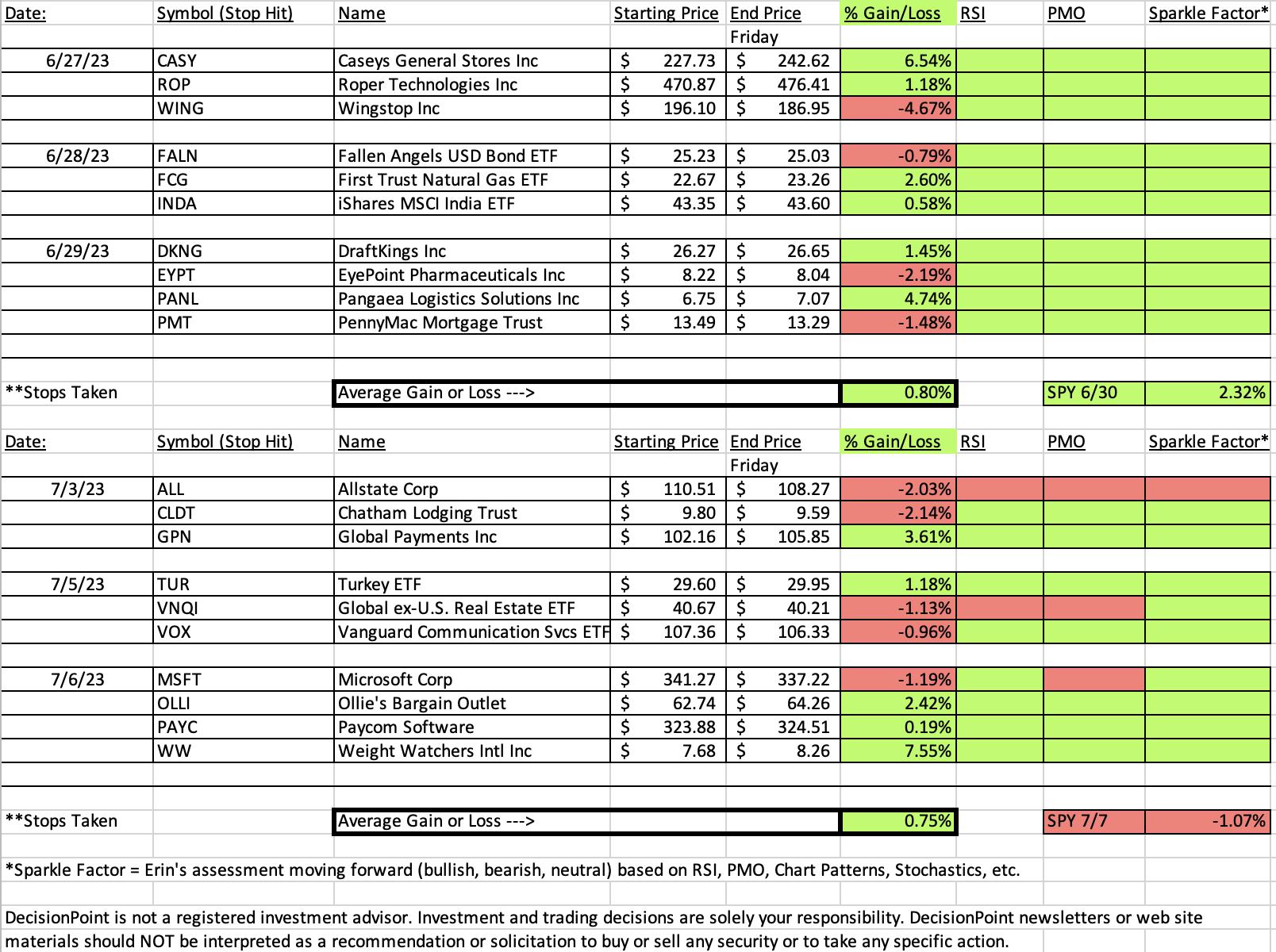

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Weight Watchers Intl Inc. (WW)

EARNINGS: 08/03/2023 (AMC)

WW International, Inc. engages in the provision of weight management services. It operates through the following geographical segments: North America, United Kingdom, Continental Europe and Other. The North America segment consists of United States and Canada company-owned operations. The United Kingdom segment includes United Kingdom company-owned operations. The Continental Europe segment consists of Germany, Switzerland, France, Spain, Belgium, Netherlands, and Sweden company-owned operations. The others segment offers Australia, New Zealand company-owned operations, as well as revenues and costs from franchises in the United States. The company was founded by Jean Nidetch in 1963 and is headquartered in New York, NY.

Predefined Scans Triggered: Hollow Red Candles.

Below are the commentary and chart from yesterday (7/6):

"WW is down -0.26% in after hours trading. WW had a strong rally and it is in the process of digesting it. Today saw a bullish hollow red candlestick. Price broke from a bullish falling wedge and appears determined to reach overhead resistance. The RSI is positive and not overbought. The PMO just triggered a Crossover BUY Signal and Stochastics are above 80 and rising. The group near-term isn't performing particularly well, but it is in a rising trend on relative performance. WW is beginning to outperform the group and SPY. The stop is set around the 20-day EMA at 7.6% or $7.09."

Here is today's chart:

Today's rally was somewhat unexpected, but the chart was really looking bullish so I'm not totally surprised. The only problem I foresee is the overbought RSI. We don't want to end up with a fake out breakout like we saw in early March. This rally while strong, could see some profit taking, but for now this parabolic rally is looks good. I'm considering adding this one the next time it pauses.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Allstate Corp. (ALL)

EARNINGS: 08/01/2023 (AMC)

The Allstate Corp. engages in the property and casualty insurance business and the provision of protection solutions. It operates through following business segments: Allstate Protection, Protection Services, Allstate Health and Benefits, Run-off Property-Liability, and Corporate and Other. The Allstate Protection segment offers private passenger auto, homeowners, other personal lines, and commercial insurance marketed under the Allstate, National General, and Answer Financial brand names. The Protection Services segment provides a range of products and services that expand and enhance customer value propositions including Allstate Protection Plans, Allstate Dealer Services, Allstate Roadside, Arity, and Allstate Identity Protection. The Allstate Health and Benefits segment offers voluntary benefits and individual life and health products, including life, accident, critical illness, short term disability, and other health insurance products sold through independent agents, benefit brokers, and Allstate exclusive agencies. The Run-off Property-Liability segment relates to property and casualty insurance policies with exposure to asbestos, environmental, and other claims. The Corporate and Other segment includes the company's holding activities and certain non-insurance operations. The company was founded on April 17, 1931 and is headquartered in Northbrook, IL.

Predefined Scans Triggered: Elder Bar Turned Green, P&F Descending Triple Bottom Breakdown and P&F Double Bottom Breakout.

Below are the commentary and chart from Monday (7/3):

"ALL is down -1.37% in after hours trading. ALL has been in a trading range for months and I'm okay with this because it is at the bottom of the range with indicators lined up to suggest another test of the top. The RSI just moved positive and there is a new PMO Crossover BUY Signal. Stochastics are rising but not above net neutral (50) so it is early in this move. Admittedly relative strength isn't great, but I don't see any underperformance so that is fine. The stop is set below support near the March low at 6% or $103.87."

Here is today's chart:

I noted in my discussion of the weekly chart that this was a reversal play. I believe this stock needs to finish pulling back to support. Given the weak RSI and topping Stochastics that support level isn't particularly sturdy. If I owned it I would hold it, but tighten up the stop a bit. Selling on a 2%+ decline isn't a bad idea either. We could put our money to work somewhere else.

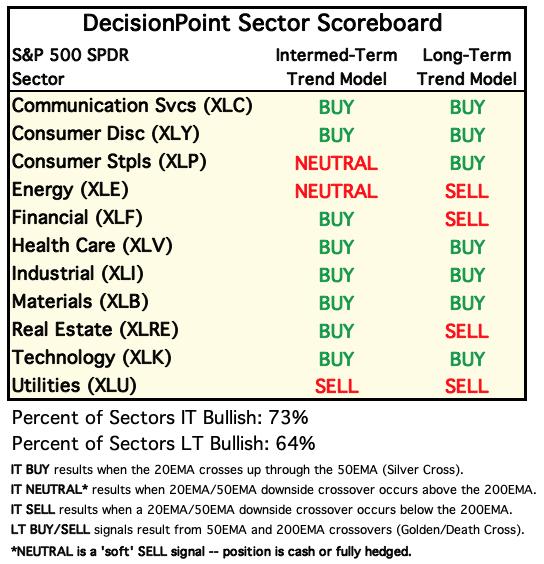

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Under the Hood ChartList!

Sector to Watch: Real Estate (XLRE)

This isn't a perfect chart by any means. The market needs more pullback, but this sector could weather the storm given it is holding above support at the April/May highs and 200-day EMA. The Silver Cross Index is technically rising and isn't overbought. Given there are a greater percentage of stocks above their 20/50-day EMAs, it can continue to rise. I don't care for the drop off in participation of stocks above their 20/50-day EMAs, but readings were overbought so this is welcomed, especially given support is holding. The PMO is rising, the RSI is positive and Stochastics look very bullish. The Golden Cross Index is rising vertically. Price broke from a trading range and appears ready to make prior resistance a strong support level.

Industry Group to Watch: Hotel & Lodging REITs ($DJUSHL)

I found some interesting areas within Real Estate, but this group looked the most bullish to me. Granted it is getting close to overhead resistance and that could be dangerous given the high likelihood of a pullback next week. I like the solid rising trend and the indicators. The RSI is positive, rising and not overbought. There is a PMO Crossover BUY Signal and the OBV bottoms are rising, confirming this rally. Stochastics just moved above 80. Relative strength is definitely picking up for this industry group. In this morning's Diamond Mine, I found three stock symbols in this group that you might want to look at: HST, PK and XHR. There is also this week's Diamond in the Rough, CLDT.

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 60% long, 0% short.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com