I will be traveling to finish out the week so reports may go out late on Wednesday and Thursday. You will receive them prior to the open the following day. There won't be a Diamond Mine trading room this Friday but you will get the Recap.

Last Friday and even in the Monday DecisionPoint Trading Room I mentioned one sector that is showing new momentum and internal strength, Financials (XLF). On Friday, we teased out which of the industry groups we liked in this area.

The industry groups were Asset Managers and Investment Services. I presented IAI last Wednesday for ETF Day that would take advantage of the relative strength. Today I have two stocks from each of the groups I just mentioned.

The third stock comes from Containers & Packaging. The group is beginning to show some relative strength. This was the first stock chart I looked at this afternoon and liked.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": JHG, PKG and SNEX.

Runners-up: TYL, ROL, MCS, CHKP, NBIX, GLAD, HRL and LNC.

RECORDING LINK (9/15/2023):

Topic: DecisionPoint Diamond Mine (9/15/2023) LIVE Trading Room

Passcode: Sept#15th

REGISTRATION for 9/29/2023**:

When: Sep 29, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (9/29/2023) LIVE Trading Room

Register in advance for this webinar HERE.

** There will be no trading room this Friday (9/22).

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the last recording from 9/18:

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Janus Henderson Group plc (JHG)

EARNINGS: 10/26/2023 (BMO)

Janus Henderson Group Plc is a holding company, which engages in the provision of asset management services. It offers investment solutions including equities, quantitative equities, fixed income, multi-asset and alternative asset class strategies. The company was founded on Jan 23, 1998, is headquartered in London, the United Kingdom.

Predefined Scans Triggered: Stocks in an Uptrend (Aroon) and Parabolic SAR Buy Signals.

JHG is unchanged in after hours trading. While this isn't a perfect cup-shaped low, it does have the earmarks of a cup with handle pattern. Price briefly broke out today, but settled below the late August top. I am expecting a breakout given the positive indicators and chart pattern. The RSI is positive and not overbought. The PMO surged above the signal line earlier this month. Stochastics are still rising and are in positive territory. Admittedly I don't like Stochastics' pause today, but ultimately they are above net neutral (50). Relative strength studies show the group and the stock are outperforming. The stop is set beneath the 200-day EMA at 5.1% or $26.28.

The weekly chart is mixed so keep this with a shorter-term time horizon. Mainly the weekly PMO bothers me as it is on a Crossover SELL Signal. The weekly RSI is positive and the StockCharts Technical Rank (SCTR) is nearly in the hot zone* above 70. The price pattern is positive as an ascending triangle (flat top, rising bottoms) implies an upside breakout.

*If a stock/ETF is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

Packaging Corp Of America (PKG)

EARNINGS: 10/23/2023 (AMC)

Packaging Corporation of America engages in the production of container products. It operates through the following segments: Packaging, Paper, and Corporate and Other. The Packaging segment offers a variety of corrugated packaging products, such as conventional shipping containers. The Paper segment manufactures and sells a range of papers, including communication-based papers, and pressure sensitive papers. The Corporate and Other segment focuses on transportation assets, such as rail cars, and trucks. The company was founded in 1959 and is headquartered in Lake Forest, IL.

Predefined Scans Triggered: None.

PKG is up +0.15% in after hours trading. This looks like a textbook bullish double bottom pattern and it was confirmed with yesterday's breakout. Today it pulled back to the breakout point. The RSI is positive and not overbought. The PMO triggered a Crossover BUY Signal today. Stochastics did tip over but they remain above 80 signaling internal strength. The group is just beginning to outperform and PKG is outperforming the group and the SPY. The stop is set beneath support at 5.7% or $142.29.

I like the weekly chart given price bounced right off support at prior 2023 highs. The weekly RSI is positive and the weekly PMO is rising on a Crossover BUY Signal. The SCTR is in the hot zone. While this could be considered an intermediate-term investment, I wouldn't feel comfortable with that timeframe until we saw an upside breakout. I would consider an upside target of 17% or $176.55.

INTL FCStone Inc. (SNEX)

EARNINGS: 11/20/2023 (AMC)

StoneX Group, Inc. engages in the provision of brokerage and financial services. It operates through the following segments: Commercial Hedging, Global Payments, Securities, Physical Commodities, and Clearing and Execution Services. The Commercial Hedging segment offers risk management consulting services. The Global Payments segment includes global payment solutions for banks, commercial businesses, charities, non-governmental, and government organizations. The Securities segment consists of corporate finance advisory services and capital market solutions for middle market clients. The Physical Commodities segment consists of physical precious metals trading and the physical agricultural and energy commodity businesses. The Clearing and Execution Services segment refers to exchange-traded futures and options, foreign exchange prime brokerage, correspondent clearing, independent wealth management, and derivative voice brokerage. The company was founded by Diego J. Veitia in October 1987 and is headquartered in New York, NY.

Predefined Scans Triggered: Bearish Harami, Bullish MACD Crossovers, P&F Low Pole and Bullish 50/200-day MA Crossovers.

SNEX is unchanged in after hours trading. I like the cup shaped low and subsequent breakout above resistance. Today it pulled back toward the breakout point. The RSI is positive and not overbought. The PMO is flattening a bit on today's decline, but it is rising overall and should give us a Crossover BUY Signal soon. Stochastics are rising strongly and the group is beginning to outperform the market. SNEX is already outperforming the market. I've set the stop below support at 6.2% or $88.67.

What impressed me most on the weekly chart was the weekly PMO surging above the signal line. The weekly RSI is also in positive territory and not overbought. The SCTR isn't in the hot zone right now, but it is close enough. While enough is going right on this chart to consider this intermediate-term, as with the other, I'd like to see the breakout before I settle in to hold this one past a short-term timeframe. Upside potential is at least 13.2%, but a breakout would like see follow-through based on that PMO.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

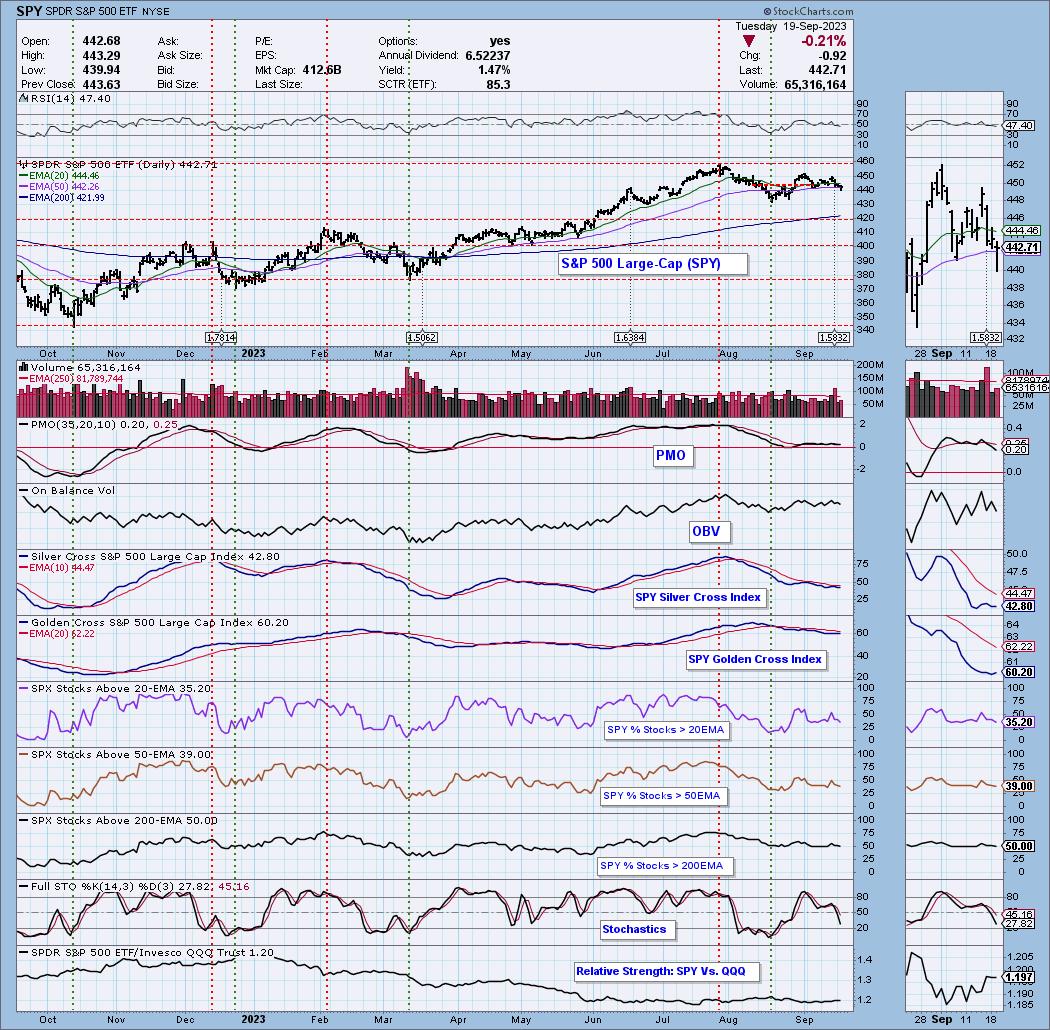

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 40% long, 2% short.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com