The market ran hot this week and that certainly helped "Diamonds in the Rough" to outperform. The SPY had a better week on average, but we are pleased with this week's performance. I only see two with uncertain futures. The rest I believe will continue to rally higher.

One thing to keep in mind is that the rally ran hot and it is likely ready for a pullback or digestion phase. This should offer better entries on Monday. For now, I like the market's chances of keeping this rally going longer, it's just time for it to pause to refresh.

I could've picked just about any sector this week as the one to watch with the exception of Energy which looks weak. I opted to go with an aggressive Consumer Discretionary sector (XLY) for this week's Sector to Watch.

The Industry Group to Watch was more difficult but ultimately I decided to stay within Discretionary and go with Recreational Services. There are other pockets of strength within, use the Industry Summary as your guide.

This week's "Darling" was MercadoLibre which was up 11.85% since being picked on Tuesday. The "Dud" was Cameco (CCJ) which edged out Timken Steel (TMST) by one one-hundredth of a point. Steel is now cooling as more aggressive plays get more attention.

We also explored Biotechs this morning in the Diamond Mine. I found three Biotechs that you might find interesting: BBIO, GILD and VRTX.

Have a great weekend!

Good Luck & Good Trading,

Erin

RECORDING LINK (11/3/2023):

Topic: DecisionPoint Diamond Mine (11/3/2023) LIVE Trading Room

Passcode: November#3

REGISTRATION for 11/10/2023:

When: Nov 10, 2023 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (11/10/2023) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

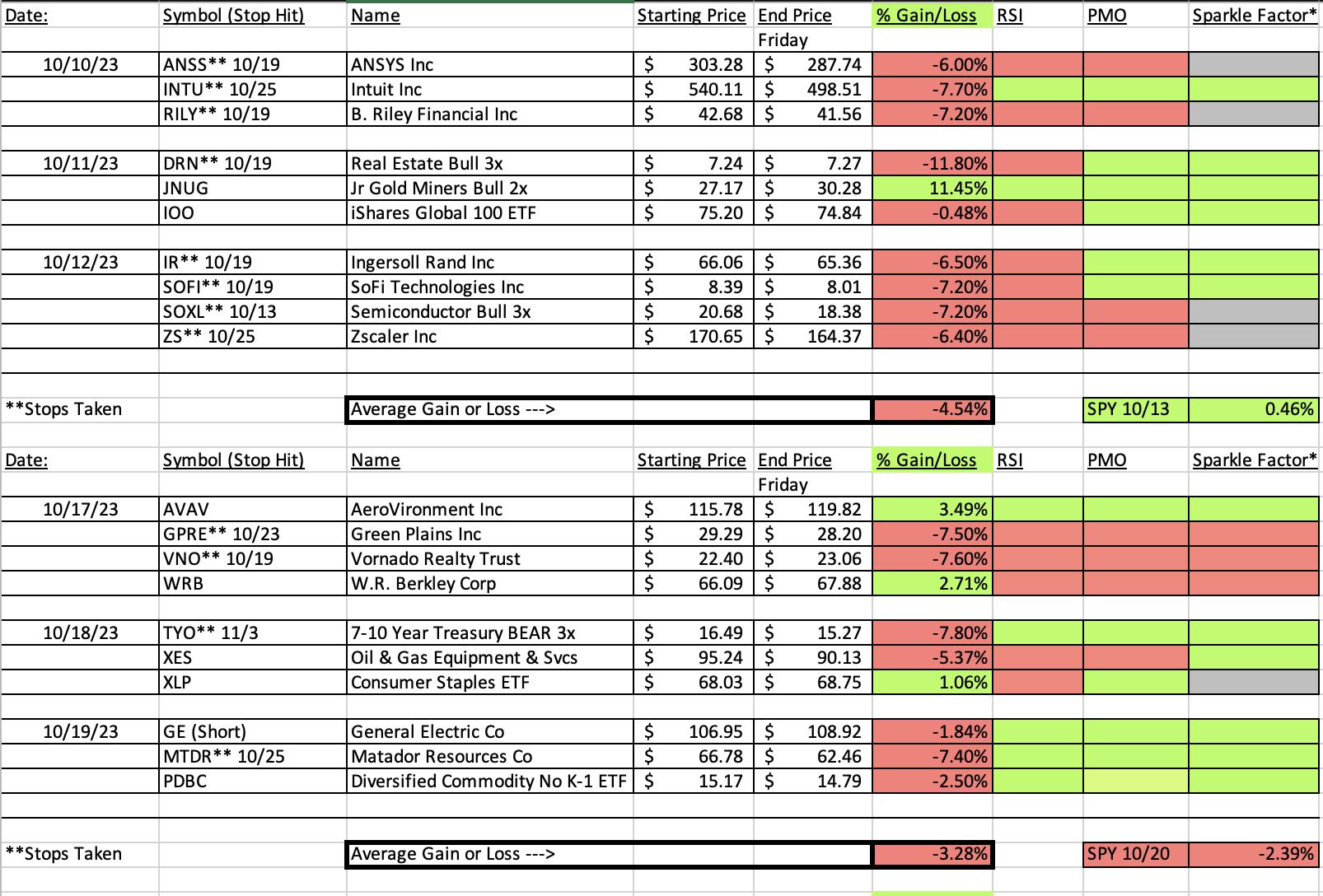

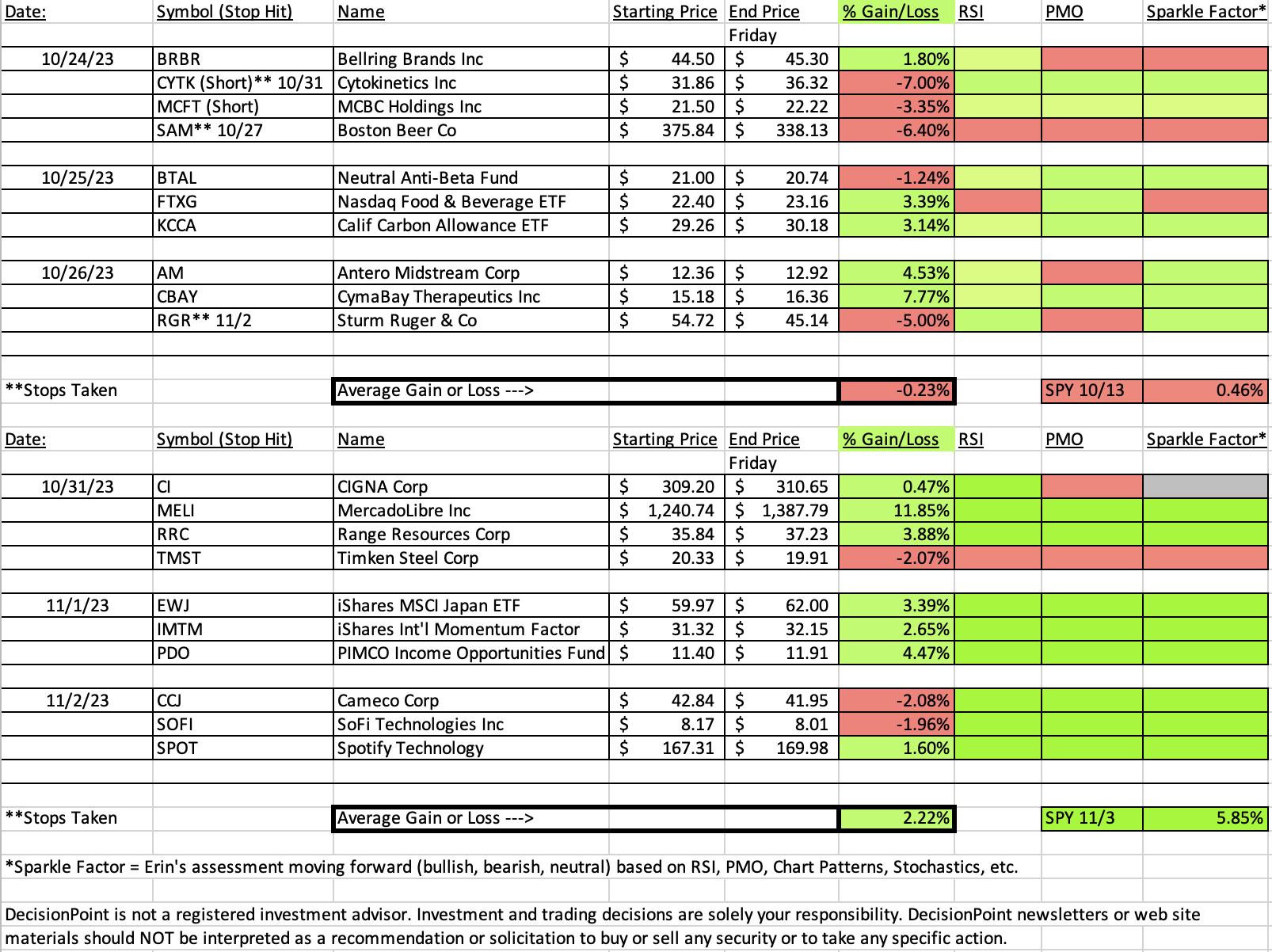

Our latest DecisionPoint Trading Room recording (10/30):

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

MercadoLibre Inc. (MELI)

EARNINGS: 11/01/2023 (AMC)

MercadoLibre, Inc. engages in the development of an online commerce platform with a focus on e-commerce and related services. It operates through the following geographical segments: Brazil, Argentina, Mexico, and Other Countries. The Other Countries segment refers to Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, Panama, Peru, Bolivia, Honduras, Nicaragua, El Salvador, Guatemala, Paraguay, Uruguay, and the United States of America. Its products provide a mechanism for buying, selling, and paying as well as collecting, generating leads, and comparing lists through e-commerce transactions. The company was founded by Marcos Eduardo Galperin on October 15, 1999 and is headquartered in Montevideo, Uruguay.

Predefined Scans Triggered: P&F Double Top Breakout.

Below are the commentary and chart from Tuesday 10/31:

"MELI is down -0.08% in after hours trading. I like the breakout from the declining trend. It managed to trade above the 50-day EMA today. The 20/50-day EMAs are above the 200-day EMA so it does have a slightly bullish bias. The RSI is positive and rising. There is a new PMO Crossover BUY Signal in oversold territory. Stochastics are rising in positive territory. The group is seeing outperformance and MELI is outperforming both the group and the SPY. I set the stop beneath that last low at 6.1% or $1165.05."

Here is today's chart:

Earnings worked in our favor on MELI. As I noted this morning in the trading room, I do try not to pick stocks that are going to report earnings. It won't always work in our favor. If you are able, it is generally advisable to not hold through earnings. The RSI is now overbought, but I expect it will stay there a bit longer. I'm looking for the rally to continue with a high likelihood of a digestion or pullback once the September top is reached. It may be a bit late to get in on this one.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Cameco Corp. (CCJ)

EARNINGS: 02/08/2024 (BMO)

Cameco Corp. engages in the provision of uranium. It operates through the Uranium and Fuel Services segments. The Uranium segment is involved in the exploration for, mining, milling, purchase, and sale of uranium concentrate. The Fuel Services segment deals with the refining, conversion, and fabrication of uranium concentrate and the purchase and sale of conversion services. The company was founded in 1988 and is headquartered in Saskatoon, Canada.

Predefined Scans Triggered: Moved Above Upper Keltner Channel, New 52-week Highs, Stocks in a New Uptrend (Aroon), Moved Above Upper Price Channel, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

Below are the commentary and chart from Thursday 11/2:

"CCJ is up +0.02% in after hours trading. Today saw a strong breakout rally. This did put the RSI into overbought territory so it is vulnerable to a pullback. The technicals suggest that would be temporary. The PMO is rising strongly on a Crossover BUY Signal. Stochastics just moved above 80. While the group is only performing in line with the SPY, CCJ is outperforming both the group and SPY. I set the stop arbitrarily at 7% around $39.84."

Here is today's chart:

CCJ has only had one day to mature and it happened to have a bad day. Support was compromised and this was a deep decline on a day that the market as whole rallied strongly. I think this takes the shine off yesterday's breakout. I still think you could hold this one, the main issue that there are likely better places to put your money to work right now.

THIS WEEK's Performance:

DecisionPoint Market Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated "Under the Hood" ChartList!

Sector to Watch: Consumer Discretionary (XLY)

Everything is going right on XLY. Primary would be the Silver Cross Index Bullish Shift across the signal line. Participation is expanding and isn't overbought yet. There is a new PMO Crossover BUY Signal. Price closed above the 50-day EMA. And finally, relative strength is improving against the SPY. We have a breakaway gap followed by a continuation gap. It looks very good going into next week.

Industry Group to Watch: Recreational Services ($DJUSST)

We have a nice rally off support at April tops. The RSI has just moved into positive territory. The PMO is accelerating higher on an oversold Crossover BUY Signal. Stochastics are rising in positive territory and relative strength is picking up. I think we'll see a move back to overhead resistance. A few stocks of interest in this area: CCL and RCL (I own it).

Go to our Under the Hood ChartList on DecisionPoint.com to get an in-depth view of all the sectors. On StockCharts.com you can find the Industry Summary.

Good Luck & Good Trading!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 55% long, 2% short. I own RCL.

Watch the latest episode of the DecisionPoint Trading Room with Carl & Erin Swenlin on Mondays 3:00p EST!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2023 DecisionPoint.com