You could tell it was a rough day in the market when my scans were mostly unproductive. Of the results I received, I was immediately able to take more than half out of the running. The stocks I did ferret out I only feel lukewarm about. It isn't a good time to be expanding your portfolio given new weakness and overbought conditions. I would be careful about adding positions and today's positions while bullish, aren't as strong as usual.

Good Luck & Good Trading,

Erin

Today's "Diamonds in the Rough": BMI, EVR, HEI and MATX.

Runner-ups: KT, LPLA, SITC, SKM and ANF.

RECORDING & DOWNLOAD LINK (2/9/2024):

Topic: DecisionPoint Diamond Mine (2/9/2024) LIVE Trading Room

Recording & Download Link HERE

Passcode: February#9

REGISTRATION for 2/16/2024:

When: Feb 16, 2024 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (2/16/2024) LIVE Trading Room

Register in advance for this webinar HERE

After registering, you will receive a confirmation email containing information about joining the webinar.

Here is the latest recording from February 12th. Click HERE to subscribe to the DecisionPoint YouTube Channel to be notified when new content is available.

Welcome to DecisionPoint Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Stop levels are all rounded down.

Badger Meter, Inc. (BMI)

EARNINGS: 04/18/2024 (BMO)

Badger Meter, Inc. engages in the provision of flow measurement, control products, and communications solutions that serve water utilities, municipalities, and commercial and industrial customers worldwide. Its products are classified into two categories: Municipal Water and Flow Instrumentation. Municipal water products include water meters and related technologies to municipal water utilities. Flow Instrumentation products include meters and valves sold worldwide to various industries for water and other fluids. The company was founded in 1905 and is headquartered in Milwaukee, WI.

Predefined Scans Triggered: Hollow Red Candles and P&F Double Top Breakout.

BMI is unchanged in after hours trading. It had a bad day but finished with a bullish hollow red candlestick. This means price closed above the open, just not higher than the day before. This looks like a breakout followed by a mechanical pullback. The RSI did move down with today's decline but it remains in positive territory. The PMO has given us a Crossover BUY Signal. Stochastics are rising in spite of the decline. Relative strength lines are rising as we want against the SPY. BMI is doing very well against the group. I've set the stop beneath support at 7.2% or $139.10.

It's not a great weekly chart. The weekly RSI is positive. The weekly PMO is still declining but is decelerating. The StockCharts Technical Rank (SCTR) is well outside the hot zone* above 70. Upside potential is somewhat limited based on overhead resistance, but a breakout isn't out of the question and this is still almost double our stop level.

*If a stock is in the "hot zone" above 70, it implies that it is stronger than 70% of its universe (large-, mid-, small-caps and ETFs) primarily in the intermediate to long terms.

Evercore Partners Inc. (EVR)

EARNINGS: 04/24/2024 (BMO)

Evercore, Inc. operates as a investment banking advisory company. It operates through the Investment Banking and Investment Management business segments. The Investment Banking segment includes the global advisory business of the company through which the firm delivers strategic corporate advisory, capital markets advisory, and institutional equities services. The Investment Management segment comprises wealth management and trust services through Evercore Wealth Management L.L.C. and investment management in Mexico through Evercore Casa de Bolsa, S.A. de C.V., as well as private equity through investments in entities that manage private equity funds. The company was founded by Roger C. Altman in 1995 and is headquartered in New York, NY.

Predefined Scans Triggered: Hollow Red Candles and P&F Double Top Breakout.

EVR is unchanged in after hours trading. Today saw a bullish hollow red candlestick after a strong breakout above prior highs. While I'm not a fan of the Financial sector right now this was one of the few charts that did show promise today. The RSI is positive and not overbought. The PMO is nearing a Crossover BUY Signal well above the zero line. Stochastics are above 80 and relative strength lines are going to the right way, up. The stop is set beneath support at 7.4% or $167.14.

The weekly chart confirms short-term strength. The only issue with the weekly chart is the overbought weekly RSI. However, we can see from history that it could hold that condition for many more weeks. The weekly PMO is rising on a BUY Signal and the SCTR is at the top of the hot zone. Consider a 17% upside target to around $211.19.

Heico Corp. (HEI)

EARNINGS: 02/26/2024 (AMC)

HEICO Corp. engages in the manufacturing of electronic equipment for the aviation, defense, space, medical, telecommunications, and electronics industries. It operates through the Flight Support Group and Electronic Technologies Group segments. The Flight Support Group segment designs, manufactures, repairs, overhauls, and distributes jet engine and aircraft component replacement parts. The Electronic Technologies Group segment focuses on designing and manufacturing electronic, data and microwave, and electro-optical products, including infrared simulation and test equipment, laser rangefinder receivers, electrical power supplies, back-up power supplies, power conversion products, underwater locator beacons, emergency locator transmission beacons, flight deck annunciators, panels and indicators, electromagnetic and radio frequency interference shielding and filters, high power capacitor charging power supplies, amplifiers, traveling wave tube amplifiers, photo detectors, amplifier modules, microwave power modules, flash lamp drivers, laser diode drivers, arc lamp power supplies, custom power supply designs, cable assemblies, high voltage power supplies, high voltage interconnection devices and wire, high voltage energy generators, high frequency power delivery systems, and memory products. The company was founded in 1957 and is headquartered in Hollywood, FL.

Predefined Scans Triggered: P&F Double Top Breakout.

HEI is unchanged in after hours trading. I spy a bull flag that is originating from a prior bull flag. Today saw a high volume rally. The RSI is positive and not overbought. The PMO is rising on a Crossover BUY Signal above the zero line. Stochastics have reversed higher on the rally and are almost above 80 again. Relative strength is rising against the SPY for both the group and the stock. The stop can be set somewhat thinly at 5.5% or $177.67.

I like the weekly chart, it suggests this could be more than a short-term trade. The weekly RSI is positive and not overbought. The weekly PMO is rising on a Crossover BUY Signal above the zero line and the SCTR is nearly in the hot zone. Consider a 17% upside target to around $219.98.

Matson, Inc. (MATX)

EARNINGS: 02/20/2024 (AMC)

Matson, Inc. is a holding company, which engages in the provision of logistics and transportation services. It operates through the Ocean Transportation and Logistics segments. The Ocean Transportation segment offers ocean freight transportation, container stevedoring, refrigerated cargo services, inland transportation, and other terminal services. The Logistics segment includes domestic and international rail intermodal services, regional highway brokerage, specialized hauling, expedited freight operations, supply chain management, storage, and distribution services. The company was founded in 1882 by William Matson and is headquartered in Honolulu, HI.

Predefined Scans Triggered: Hollow Red Candles.

MATX is unchanged in after hours trading. I would have preferred a breakout then a pullback as this could turn into a bearish double top. It may be a good idea to see how this one trades before jumping in right away for that reason. The PMO is what sold me on it as a "Diamond in the Rough"; it is nearing a Crossover BUY Signal well above the zero line which signals pure strength. Stochastics are above 80 and relative strength lines are all rising. The stop has been set around the 50-day EMA at 7.3% or $111.40.

It shouldn't be a surprise that price held up at this level as it marks all-time highs. The weekly RSI is currently overbought, but other than that we have a rising weekly PMO that isn't overbought and a SCTR in the hot zone. Consider a 17% upside target to around $140.61.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

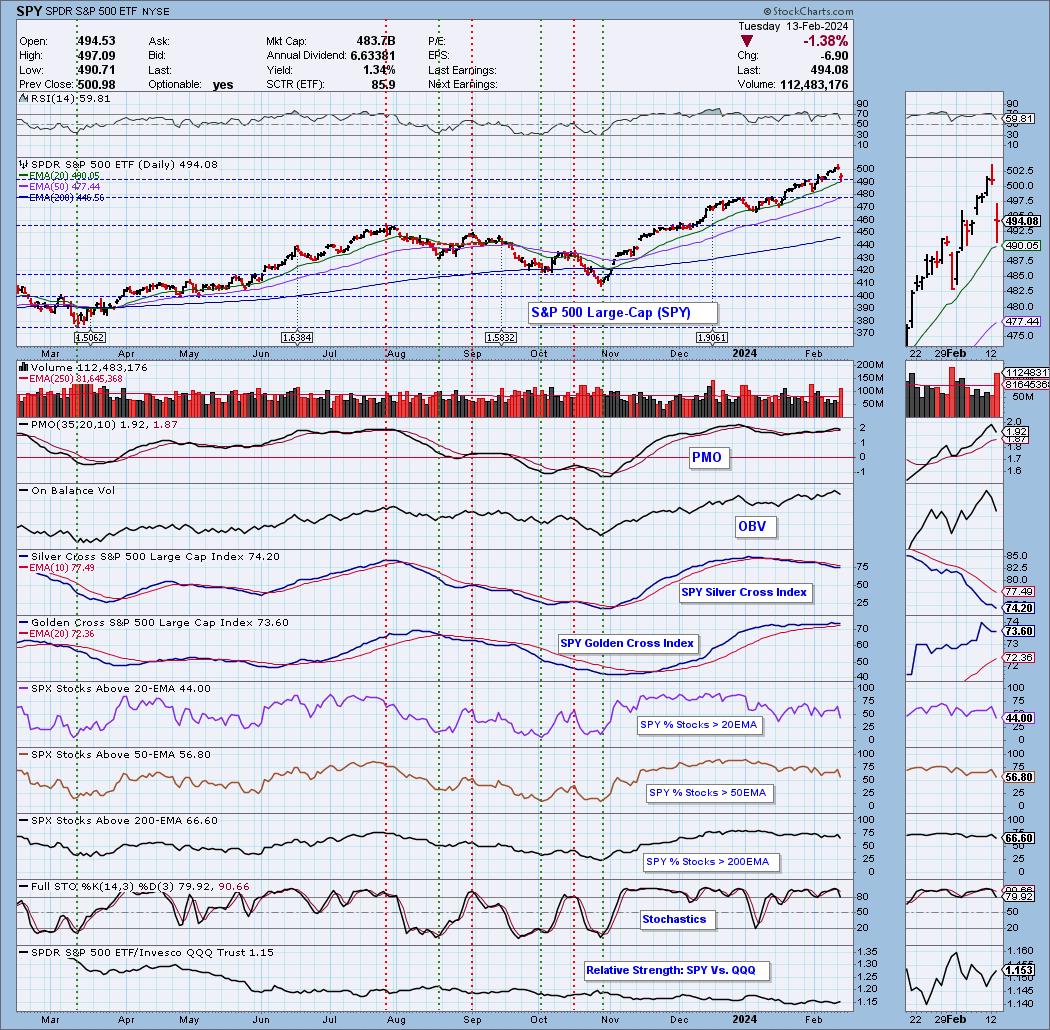

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 70% long, 0% short.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Watch the latest episode of DecisionPoint Trading Room with Carl & Erin Swenlin Mondays on the DecisionPoint YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com