It's always fascinating to see which industry groups show strength in my various scans. Gold Miners which had been dominating them, actually were absent today--mainly because they are in overbought territory. The Diamond PMO Scan returned only one stock today and it was a broadline retailer. I found a companion retailer that is a solid large-cap company to add too. Quite a few Consumer Staples companies came up in my Bullish-EMA - Mid-Range SCTR scan--I picked my favorite. I have set up trailing stops for about 75% of my portfolio. I am expecting a consolidation period or possible decline in the near future and want to lock in my profits. A quick reminder, many companies are reporting earnings right now and I know that recent Diamonds are reporting this week. If you don't like to buy or hold before earnings, keep that in mind.

Before I get started though, I wanted to revisit the UNG chart that I wrote about on Friday and looked at yesterday. I suggested that after yesterday's 4.24% decline, my readers might have a better entry. I hope that a few of you got in yesterday after the 4.24% decline because today it was up over 4%. I'm up slightly on this position and I like this chart even more now.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

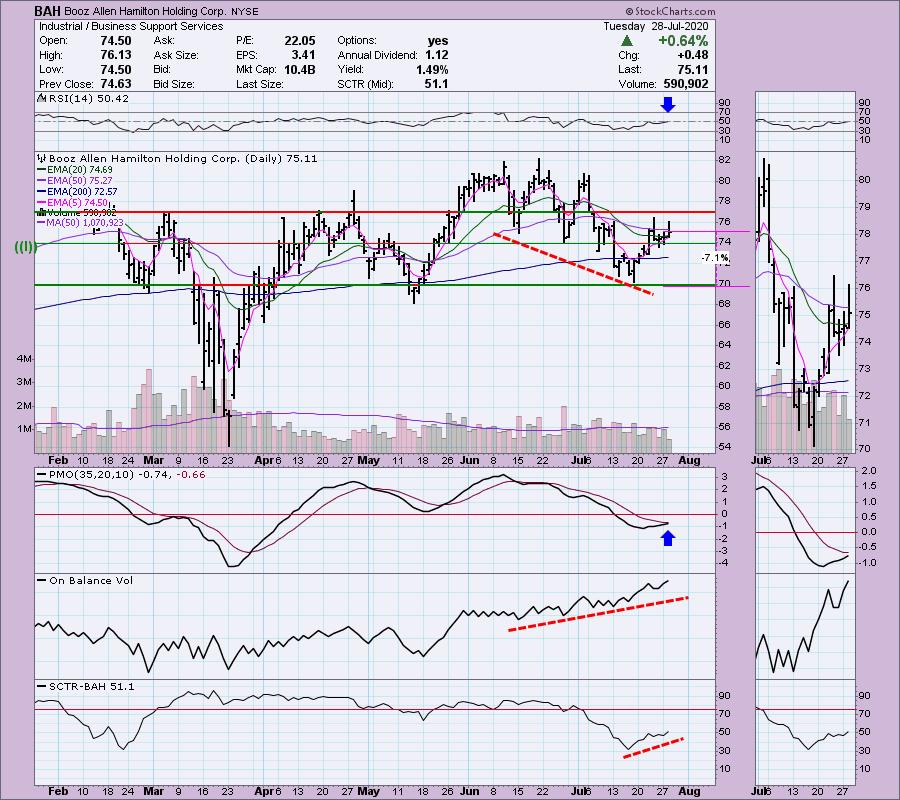

Booz Allen Hamilton Holding Corp (BAH) - Earnings: 7/31/2020 (BMO)

Booz Allen Hamilton Holding Corp. engages in the provision of management and technology consulting services. It offers analytics, digital solutions, engineering, and cyber expertise.

This one came up on "Carl's Scan" which picks up stocks that have been beaten down but are showing promise. I will highlight this one as more of a short-term investment. You'll see why when you look at the weekly chart. The RSI just went above net neutral (50). The PMO is very close to a crossover BUY signal. There is a beautiful positive divergence between the OBV bottoms and price lows. There is also the benefit that you can set a stop below major support around $70 without having to go double-digit on the stop level.

Clearly the weekly PMO is not pretty. This is why I would consider this a short-term investment with upside potential of 9.6%.

Lexington Corp Properties Trust (LXP) - Earnings: 8/6/2020 (BMO)

Lexington Realty Trust is a real estate investment trust, which engages in financing, acquisition, and ownership of portfolio of single-tenant commercial properties. It also provides investment advisory and asset management services.

I must say this one charmed me and that is why I have a limit order in on this one. I'm looking for a pullback for entry, but it isn't required. We have a nice breakout from a bullish ascending triangle or double-bottom pattern, whichever you prefer. The PMO already has a BUY signal. The OBV showed a nice positive divergence in mid-July off the second bottom. There is a short-term flag formation coming off that positive divergence. The RSI is in positive territory above 50. I also note the SCTR is showing improvement.

It's hard to map out upside potential as it is near all-time highs. The weekly PMO is rising and not overbought.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

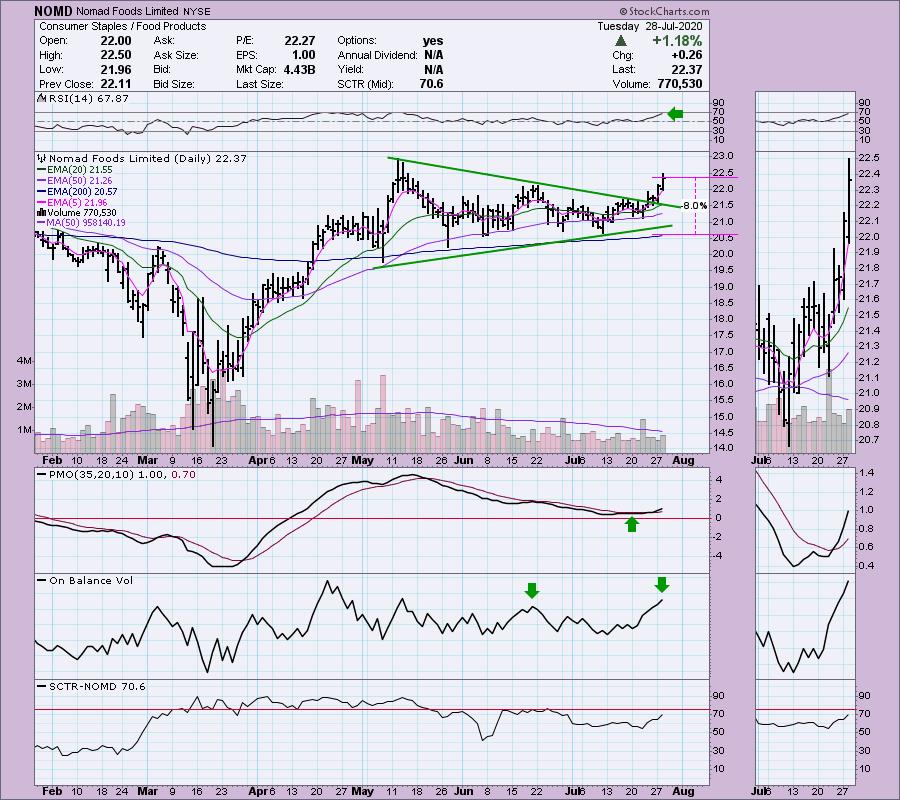

Nomad Foods Ltd (NOMD) - Earnings: 8/6/2020 (BMO)

Nomad Foods Ltd. operates as a holding company, which manufactures and sells frozen foods for human consumption. It offers its products under the brands LUTOSA, la Cocinera, Birds Eye, Iglo, and Findus.

Hormel (HRL) also came up in today's scans, but I liked NOMD better. Feel free to take peek at HRL though. We have a nice breakout from a symmetrical triangle continuation pattern. I think you can also make a case for a flagpole with a very large pennant (the triangle). The PMO have us a BUY signal last week. Volume is coming in as noted by the OBV making a higher high than the previous cardinal high. The RSI is getting a little overbought but not exceedingly so.

The weekly PMO is beginning to accelerate higher. Price is about 3.7% away from its all-time highs.

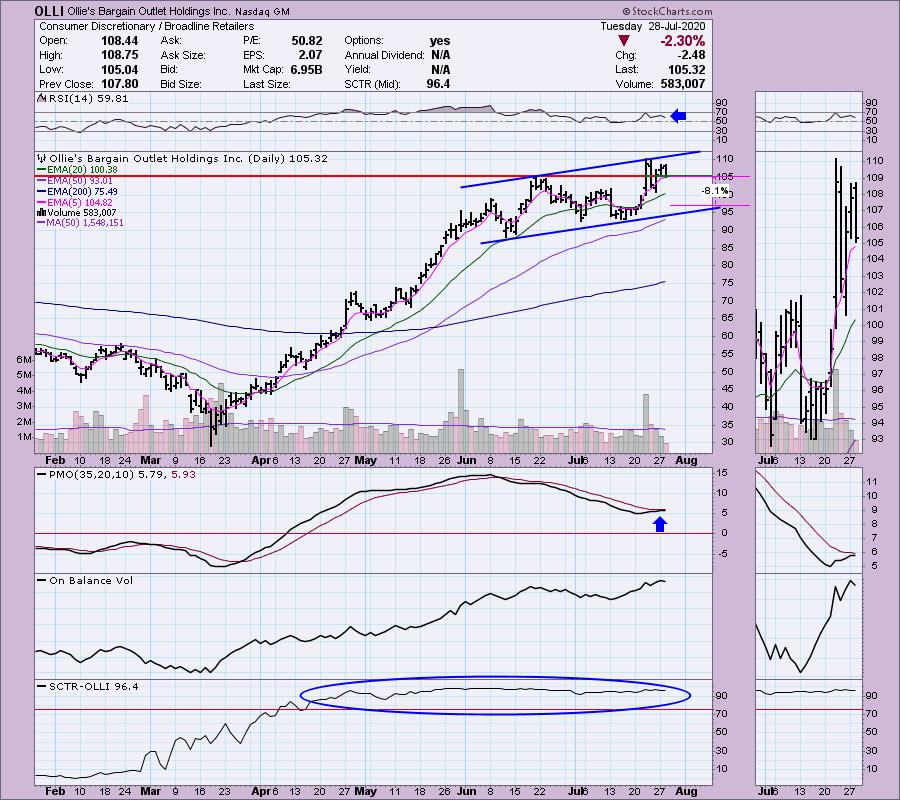

Ollie's Bargain Outlet Holdings Inc (OLLI) - Earnings: 8/27/2020 (AMC)

Ollie's Bargain Outlet Holdings, Inc. is a holding company, which engages in the retail of closeouts, excess inventory, and salvage merchandise. It offers overstocks, package changes, manufacturer refurbished goods, and irregulars. The company's products include housewares, food, books and stationery, bed and bath, floor coverings, electronics and toys.

After today's big decline back to the original breakout area, I think this is giving us a good entry along support at the June top. The RSI is positive. The PMO is nearing a BUY signal. It has decelerated, but it is still rising nonetheless. You could set a deeper stop, but it I saw it get down below $100, I'd consider dumping it and moving on to something else. The SCTR is very strong.

This sure looks like a flag that is executing (easier to see the flag in the thumbnail). The PMO is overbought, but rising strongly.

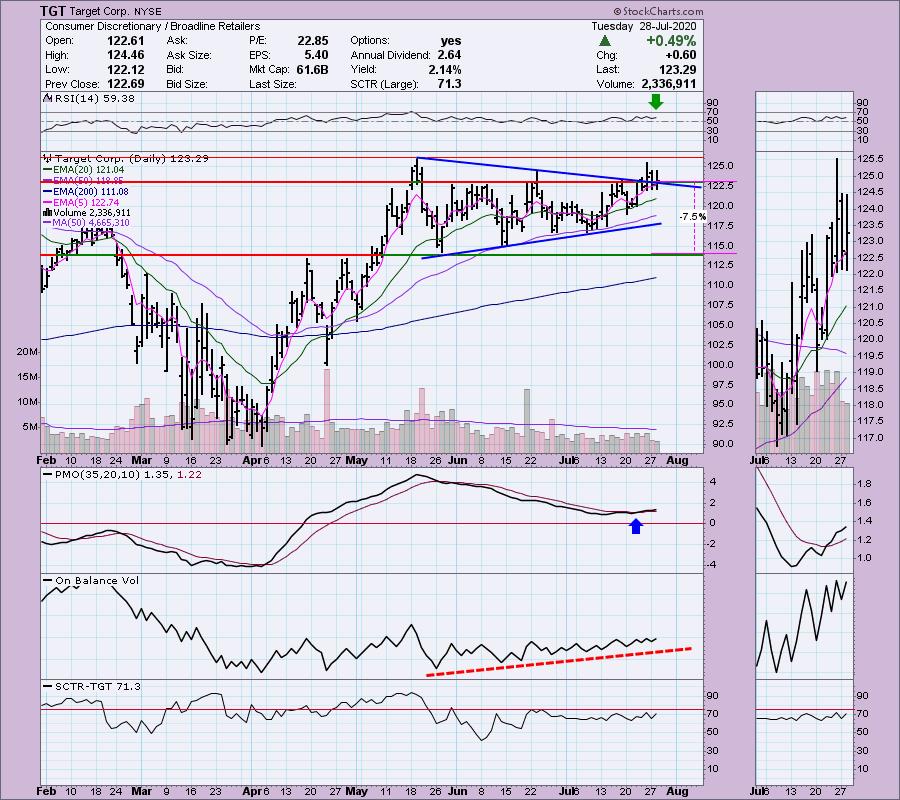

Target Corp (TGT) - Earnings: 8/19/2020 (BMO)

Target Corp. engages in owning and operating of general merchandise stores. It offers curated general merchandise and food assortments including perishables, dry grocery, dairy, and frozen items at discounted prices.

I think we all know Target. It has been in a holding pattern since May. It may continue that, but we did see an attempt at a breakout above the declining tops trendline. Price is currently holding above that trendline. The OBV is confirming the rising trend that forms the bottom of the triangle. The RSI is positive and not overbought. The PMO is finally on a BUY signal. The SCTR has some room for improvement, but it is still healthy.

I'm watching this as a possible bull flag on the weekly chart. The weekly PMO is on a BUY signal. It has flattened during this consolidation period. I am looking for an upside breakout.

Current Market Outlook:

Market Environment: It is important to consider the odds for success. The Silver Cross Index measures the percentage of stocks on IT Trend Model BUY signals (20-EMA > 50-EMA), while the Golden Cross Index measures the percentage of stocks on LT Trend Model BUY signals (50-EMA > 200-EMA). Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page. Here are the current percentages on the Silver and Golden Cross Indexes:

Diamond Index:

- Diamond Scan Results: 1

- Diamond Dog Scan Results: 40

- Diamond Bull/Bear Ratio: 0.03

Full Disclosure: I have limit orders in to add RGEN and LXP to my portfolio. I'm about 80% invested right now if those orders go through. 20% is in 'cash', meaning in money markets and readily available to trade with. While I'm 80% invested, 75% of my positions have trailing stops in place, so I've 'tightened up the ship" to prevent losing my profits.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

ANNOUNCEMENT:

The MoneyShow Las Vegas has been canceled "in person", but I will still be presenting during their video production. As soon as I have information, I will forward it! In the meantime, if you haven't already, click to get your free access pass!

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Thursdays 8:00a EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!