Not a great trading day so yesterday's "diamonds in the rough" felt the pain today. It's an excellent example of why we study overall market conditions and indicators in the DP Alert. The short term has not looked good for some time and I'm honestly just surprised it took so long to pullback in a meaningful way. The intermediate term has bullish implications, but there are some problems developing. Subscribe to the DP Alert, if you haven't already, to be prepared when the market looks soft or strong. Thank you to all readers who sent in requests this week! I had quite a few so don't feel bad if yours didn't get picked :-)

My pick today is from the Consumer Staples sector. Typically when the market shows weakness, Materials, Staples and Utilities in particular will outperform (usually) during bearish market conditions. Don't forget to register for tomorrow's subscriber-only "Diamond Mine" trading room! Even if you can't come, you'll be able to watch the recording.

Today's "Diamonds in the Rough" are: AIZ, FIZZ, KMB, OESX and QNST.

Diamond Mine Information:

Diamond Mine Information:

Here is Friday's (11/6/2020) recording link. Access Passcode: #g8G^J&3

Register in advance for the next "DecisionPoint Diamond Mine" trading room on Friday (11/13/2020) 12:00p ET:

Here is the registration link for Friday, 11/13/2020. Password: warmer

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 11/9 free trading room? Here is a link to the recording. Access Code: UxEj0^3e. For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Assurant Inc. (AIZ)

EARNINGS: 2/9/2021 (AMC)

Assurant, Inc. engages in the provision of risk management solutions. It operates through following segments: Global Housing, Global Lifestyle, and Global Preneed. The Global Housing segment provides lender-placed homeowners, multi-family housing, and mortgage solutions. The Global Lifestyle segment offers mobile device protection products, related & extended service products and related services for consumer electronics & appliances, vehicle protection services, and credit insurance. The Global Preneed segment provides pre-funded funeral insurance and annuity products. The company was founded on February 4, 2004 and is headquartered in New York, NY.

I've noticed the Life Insurance industry group has been making an appearance in my Diamond scans so I wasn't surprised to see this reader request performing well over all given its short-term rising trend. I like see price breakouts and pullbacks to the breakout point. I'm not so excited about pullbacks that bring price back below the breakout point, that's a fake out breakout. The PMO looks great as it rises out of near-term oversold territory. The RSI is positive and not overbought. Picking the stop was a little tricky. It's about 12% if you go to the support level at the September lows and that's just too much for me. So I decided to go with a stop that is just under $120 that matches the lows from August and the mid-October lows.

The weekly PMO is rising nicely and is not overbought. The RSI is positive. While upside potential may seem low, I don't see any reason why it wouldn't be able to break above that.

National Beverage Corp. (FIZZ)

EARNINGS: 12/3/2020 (BMO)

National Beverage Corp. engages in the development, manufacture, market, and sale of flavored beverage products. Its brands include Big Shot, Clear Fruit, Crystal Bay, Everfresh, Everfresh Premier Varietals, Faygo, LaCroix, LaCroix Cúrate, Mr.Pure, Nicola, Ohana, Ritz, Rip It, Rip It 2oz Shot, Ritz and Shasta. The company was founded by Nick A. Caporella in 1985 and is headquartered in Fort Lauderdale, FL.

Keurig/Dr. Pepper (KDP) has found its way on my scan results so this is another that fits in that category with promise. I opted out of KDP as I had better selections at the time. I like how FIZZ is shaping up. We have a short-term bullish double-bottom that technically executed yesterday. Today we saw excellent follow-through with price breaking above the September top. The PMO is just now turning higher and the RSI is positive and not overbought. The SCTR is above 75 in the "hot zone". If I had one wish, it would be that the OBV bottoms were rising and not falling at the coordinating double-bottom price lows. That would only be a "confirmation" and this isn't a negative divergence with the current configuration.

The weekly chart is quite favorable with a positive RSI, rising PMO that is not extremely overbought. Notice the positive OBV divergence that kicked off this incredible rally from the bear market low.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Kimberly Clark Corp. (KMB)

EARNINGS: 1/25/2021 (BMO)

Kimberly-Clark Corp. engages in the manufacture and marketing of products made from natural or synthetic fibers. It operates through the following segments: Personal Care, Consumer Tissue, and K-C Professional (KCP). The Personal Care segment offers disposable diapers, training and youth pants, swimpants, baby wipes, feminine and incontinence care products, and other related products. The Consumer Tissue segment produces and sells facial and bathroom tissue, paper towels, napkins, and related products for household use. The K-C Professional segment supplies workplace supporting products such as wipers, tissue, towels, apparel, soaps, and sanitizers. The firm's brands include Depend, Huggies, Kleenex, Kotex, and Scott. The company was founded by John A. Kimberly, Havilah Babcock, Charles B. Clark, and Frank C. Shattuck in 1872 and is headquartered in Irving, TX.

I covered KMB in the March 17th Diamonds Report (-4.12% loss) where I recommended it for a watch list and the April 7th Diamonds Report (+6.85%). KMB is a stock that I had as a "Buy and Hold" or "Long-Term Investment" before the bear market crash. It was a casualty of my moving completely to cash in March. It's about where it was when I sold it and it looks like it is time to grab it again. I like this one as a buy and hold because of its dividends and that it acts somewhat as a hedge given its membership in the Consumer Staples sector. Basically it has been my main exposure to that sector over the years. They were hit at earnings time and that caused the giant gap down. Generally it is best not to select a stock that didn't report good earnings the previous quarter, but the line up here is good for a short-term trade. The short-term double-bottom is what caught my on on the small "Candleglance" charts I used to find this pick. It has executed it with the small breakout above the confirmation line. Gap resistance could pose a problem at that September low, but if it can reach that level I suspect we could see a breakout. The RSI is negative on this bottom fish, but it is rising. The PMO is about to trigger a BUY signal in oversold territory.

The double-top has technically completed at the October low, but support here is murky and we are vulnerable to more downside. The RSI is negative and yes, that PMO is far from ideal. Keep this on a short leash to begin with. The monthly chart isn't all that good either as it has a similar look on the monthly PMO.

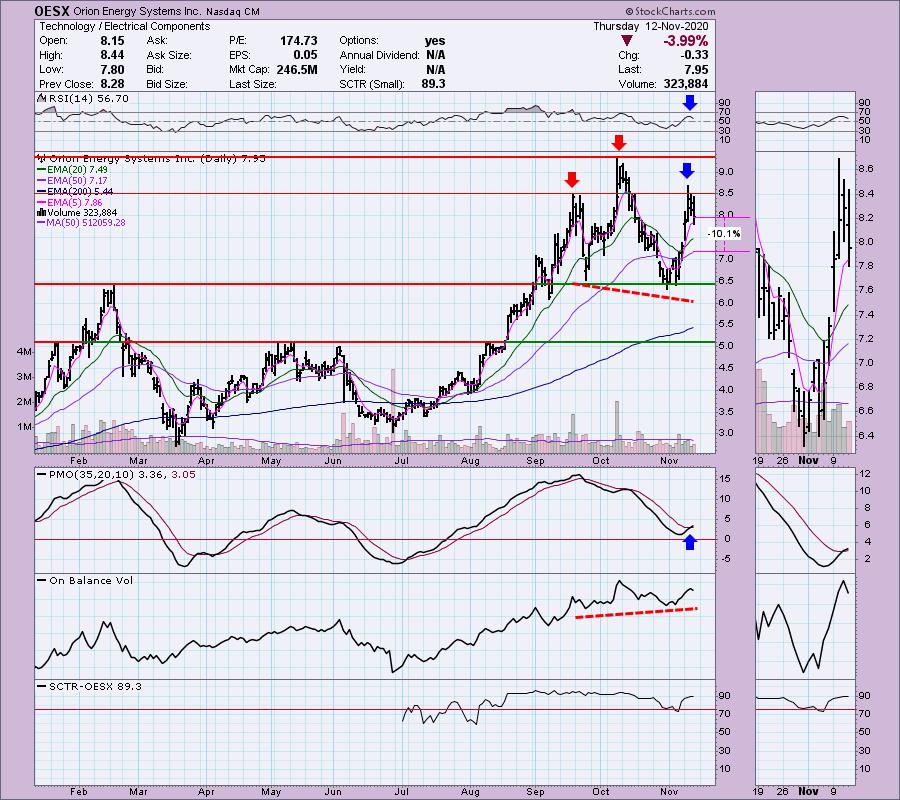

Orion Energy Systems Inc. (OESX)

EARNINGS: 2/4/2021 (BMO)

Orion Energy Systems, Inc. engages in the design, development, and trade of lighting systems, and retrofit lighting solutions. It operates through the following segments: U.S. Markets (USM); Orion Engineered Systems (OES), and Orion Distribution Services (ODS). The U.S. Markets segment produces, and sells commercial lighting, and energy management systems to the wholesale contractors. The Engineered Systems segment develops, and sells lighting products, and provides construction, and engineering services for commercial lighting, and energy management systems.The Distribution Services segment markets lighting products to agencies and distributors. The company was founded in April 1996 and is headquartered in Manitowoc, WI.

This one was actually requested by two different subscribers so I had to include it! There are mixed messages here. Let's start with the positives. The RSI is positive and not overbought and the PMO has just triggered a BUY signal. Certainly the EMAs are configured positively with the fastest on top and slowest on the bottom. There is a positive OBV divergence that began the rally. My concern is this rally may've played out. This could be the start of a nearly textbook head and shoulders pattern: higher volume associated with the left shoulder and less at the right shoulder, and pop of volume at the 'head'. Given the favorable PMO and RSI, I would not have a problem giving this one a try with a stop set at the 50-EMA.

The weekly PMO is turning up above the signal line which is especially bullish and we have a positive RSI. Upside potential is good from right here. Note that OESX is up 8.76% on the week, so it may slow a bit. Just keep an eye on that possible head and shoulders on the daily chart.

QuinStreet Inc. (QNST)

EARNINGS: 2/3/2021 (AMC)

QuinStreet, Inc. engages in the provision of media management services. It operates through the United States and International geographical segments. Its platform offers performance marketing products based from number of clicks, inquiries, calls, applications, and full customer acquisitions. The company was founded by Douglas Valenti on April 16, 1999 and is headquartered in Foster City, CA.

This one actually is mostly neutral. The RSI is positive and not overbought, basically sitting in neutral territory. The PMO is trying to bottom, but over is flat and neutral. The OBV is currently confirming the short-term rising trend with rising OBV bottoms coordinating with rising price bottoms and the SCTR is healthy. Price action has been mostly sideways and after a failed breakout price is back inside that trading range. That puts price at the top of that range and vulnerable to a pullback. However, you could set a stop that would trigger on a breakdown from that rising trend around $15.80 or a 10% stop just below the October low.

Very bullish weekly chart with a positive and not overbought RSI, along with a rising PMO that is not overbought. The OBV is confirming this excellent rally from the bear market low.

Full Disclosure: I'm about 45% invested and 55% is in 'cash', meaning in money markets and readily available to trade with. I may begin divesting based on short-term weakness in the market as a whole.

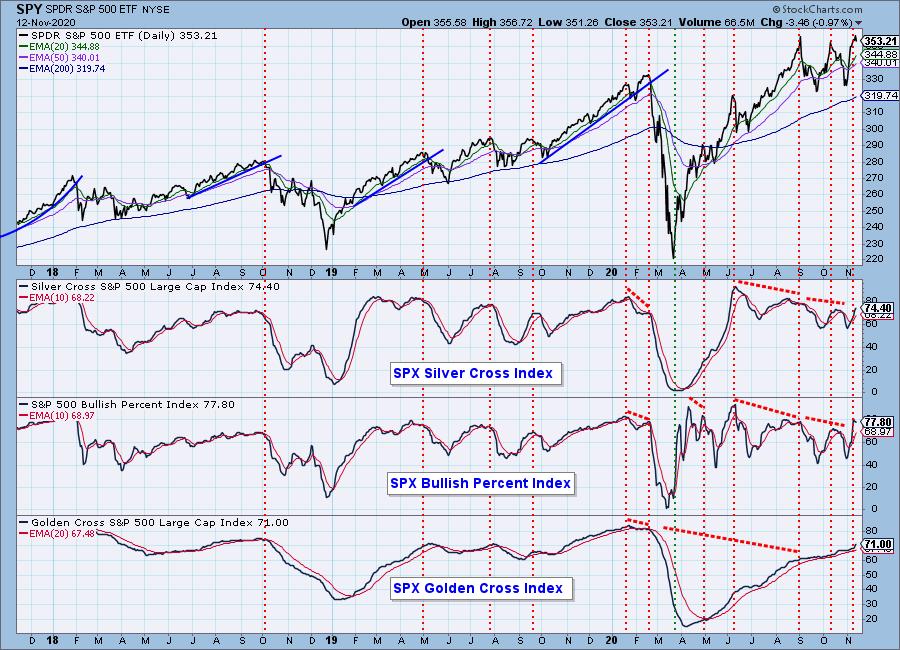

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 10

- Diamond Dog Scan Results: 3

- Diamond Bull/Bear Ratio: 3.33

I'm in the process of trying to plot the Diamond Index, but with time at a premium, it is on the back burner.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!