The market advanced most of the day with Technology (XLK) and Consumer Discretionary (XLY) leading the way. Let me remind you how we all felt yesterday with the market falling and Technology and Consumer Discretionary leading it lower. I'm not saying that these sectors won't continue to see positive action, I just don't believe that this is a bottom for those sectors so in the meantime, here are some names from the defensive sectors to consider.

Utilities (XLU) continued to show strength as did some of the Consumer Staples (XLP) stocks. Interestingly, XLU and two other ETFs that follow that sector appeared on today's scans. I was already looking toward that sector last week. Playing defense is still a good idea and the defensive areas of the market are offering some excellent choices.

Today's "Diamonds in the Rough" are: D, EXC, MSEX, PRMW and STZ.

** Everyone needs a vacation and I am no exception. I've planned a mini vacation to local wine country mid-week 3/23 through 3/25. The DecisionPoint Alert will be published, but I'll be taking the week off for Diamonds with the exception of the 3/26 Diamond Mine. I need to fit wine tasting in somehow! To compensate you for that week, I am adding a week to the end of all Diamond and Bundle subscribers' terms when I return, because who knows, I may end up writing a report or two. **

Diamond Mine Registration Information:

Diamond Mine Registration Information:

When: Mar 19, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (03/19/2021) LIVE Trading Room

Register in advance for this webinar at this REGISTRATION LINK.

After registering, you will receive a confirmation email containing information about joining the webinar, including the password.

=======================================================================

Recording Link:

Topic: DecisionPoint Diamond Mine (3/5/2021) LIVE Trading Room

Start Time : Mar 5, 2021 08:55 AM

Meeting RECORDING LINK.

Access Passcode: 2*cm7yhJ

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Mar 8, 2021 09:00 AM PT

Free Trading Room RECORDING LINK.

Access Passcode: G@W.$M5B

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

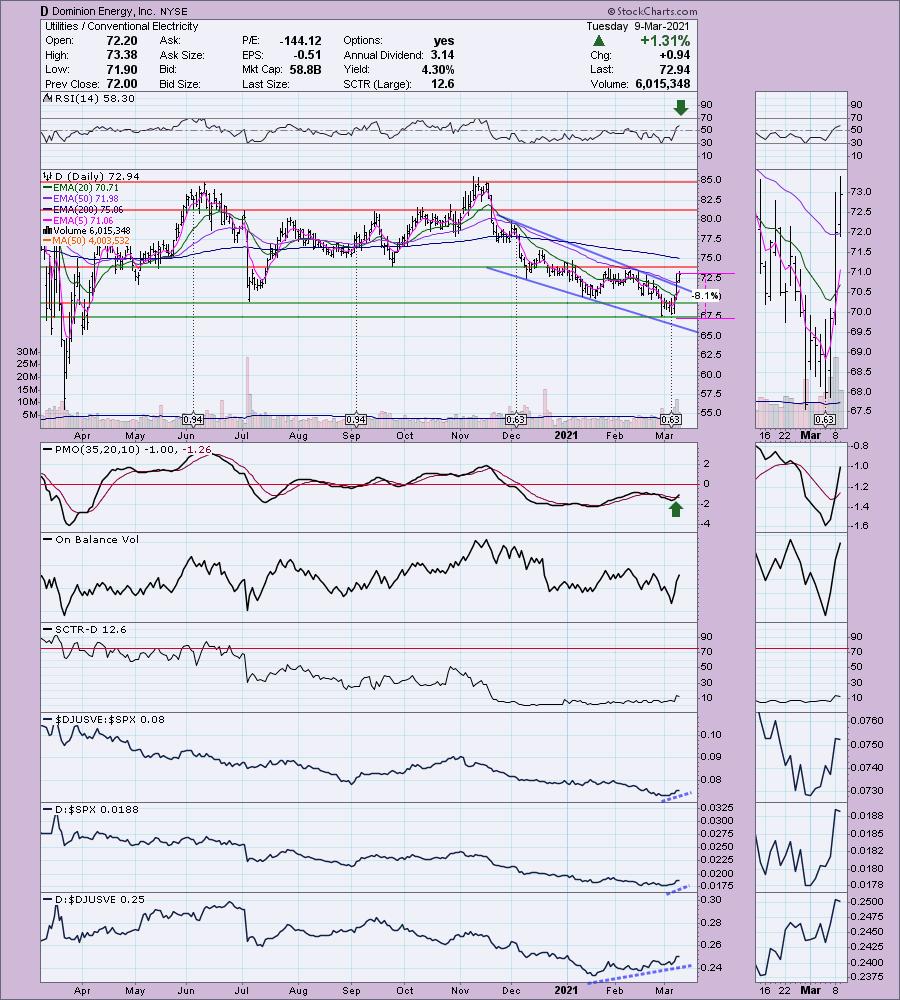

Dominion Energy, Inc. (D)

EARNINGS: 5/4/2021 (BMO)

Dominion Energy, Inc. engages in the provision of electricity and natural gas to homes, businesses, and wholesale customers. Its operations also include a regulated interstate natural gas transmission pipeline and underground storage system. It operates through following business segments: Dominion Energy Virginia, Gas Distribution, Dominion Energy South Carolina, Contracted Assets and Corporate and Other. The company was founded by William W. Berry in 1983 and is headquartered in Richmond, VA.

D is down slightly -0.05% in after hours trading. Last Friday D broke out from a bullish falling wedge and closed above its 50-EMA. Today saw a follow-on rally that had trading above the 50-EMA the majority of the day. The PMO just triggered a crossover BUY signal. The 5-EMA just crossed above the 20-EMA for a ST Trend Model BUY signal. The RSI is now in positive territory. This industry group is beginning to perk up and D has been an out-performer historical against its industry group. It is also a top holding in XLU which is looking very bullish. You can set a reasonable stop at about 8%.

I like the weekly chart with a newly rising weekly PMO and an RSI that is nearing positive territory above net neutral (50). My main concern is that overhead resistance is nearing at the 2017 high.

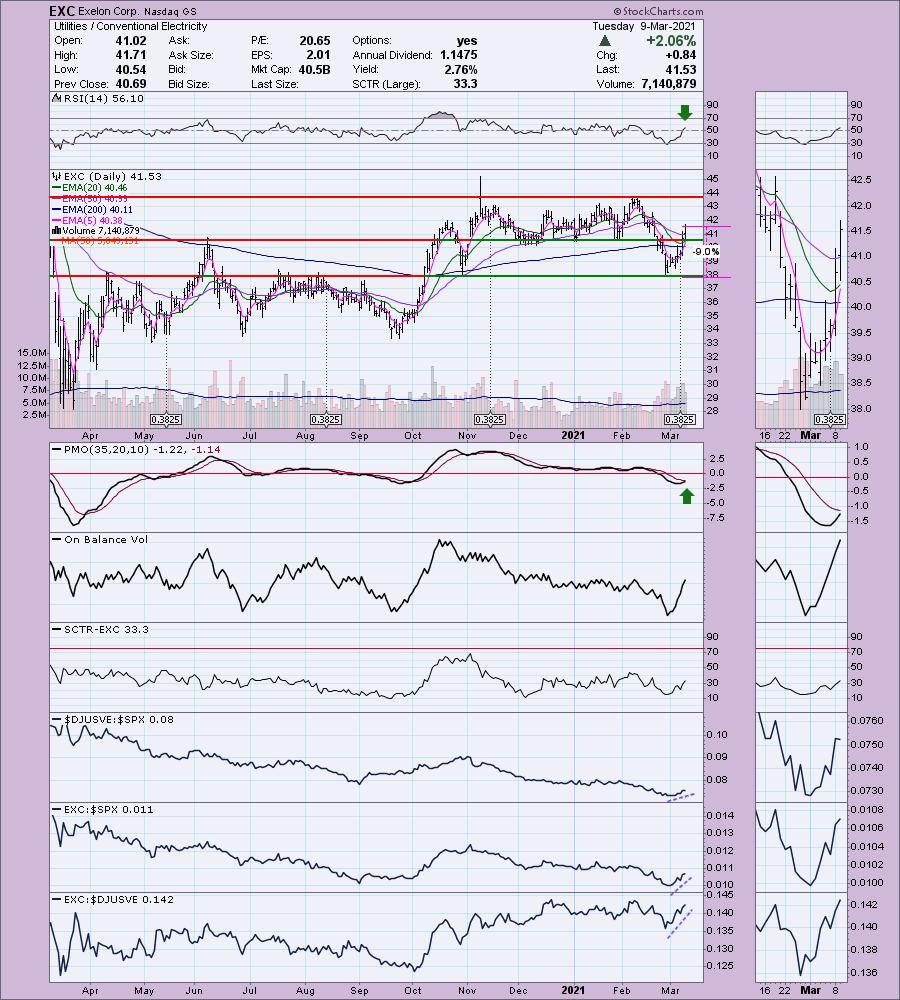

Exelon Corp. (EXC)

EARNINGS: 5/6/2021 (BMO)

Exelon Corp. operates as a utility services holding company, which engages in the energy generation, power marketing, and energy delivery business. It operates through the following segments: Mid Atlantic, Midwest, New York, Electric Reliability Council of Texas (ERCOT) and other Power Regions. The Mid-Atlantic segment represents operations in the eastern half of PJM, which includes New Jersey, Maryland, Virginia, West Virginia, Delaware, the District of Columbia and parts of Pennsylvania and North Carolina. The Midwest segment operates in the western half of PJM, which includes portions of Illinois, Pennsylvania, Indiana, Ohio, Michigan, Kentucky and Tennessee, and the United States footprint of MISO, excluding MISO's Southern Region, which covers all or most of North Dakota, South Dakota, Nebraska, Minnesota, Iowa, Wisconsin, the remaining parts of Illinois, Indiana, Michigan and Ohio not covered by PJM, and parts of Montana, Missouri and Kentucky. The New York (NY) segment provides operations within ISO–NY, which covers the state of New York in its entirety. The ERCOT segment includes operations within Electric Reliability Council of Texas, covering most of the state of Texas. The Other Power Regions consists of the operations in New England, South, West, and Canada. The company was founded in February 1999 and is headquartered in Chicago, IL.

EXC is up +0.79% in after hours trading. This is another top holding within XLU that arrived in one of my scans. EXC broke out last Friday as well and today saw a strong continuation of that rally. The PMO is about to trigger a crossover BUY signal and the RSI has reached positive territory. Volume has been coming in--just look at the OBV. I would like to see price already testing overhead resistance at the February high given the excessive volume, but it seems well on its way there. Outperformance is clear. I've chosen a 9% stop level as it lines up nicely just under near-term support.

Upside potential is somewhat modest given what we've seen on many other stocks, but it's a gain I would be happy to take. The weekly PMO has begun to bottom and the RSI just hit positive territory.

Middlesex Water Co. (MSEX)

EARNINGS: 5/5/2021 (AMC)

Middlesex Water Co. owns and operates regulated water utility and wastewater systems. The firm's services include water production, treatment, & distribution, full service municipal contract operations, wastewater collection and treatment. It operates through two segments: Regulated and Non-Regulated. The Regulated segment serves residential, commercial, industrial and municipal customers. The Non-Regulated segment engages in business activities with developers, government entities and other customers. The company was founded in 1897 and is headquartered in Iselin, NJ.

MSEX is unchanged in after hours trading. It rallied strongly today and likely will pullback tomorrow giving us a better entry. The RSI just reached positive territory and the PMO is bottoming. I like today's breakout, the 5-EMA will likely give us a positive crossover the 20-EMA tomorrow unless price closes below the 20-EMA. This one has been outperforming the SPX. I don't count it outperforming its group since the group has been very weak, but it is starting to outperform with rising bottoms in the thumbnail. The stop is deep but if you'd like to lengthen it to about 11% it will put it below the February low support level. Or, you could choose to tighten it to support at the January low.

At first glance the weekly PMO is pretty ugly, but notice in the thumbnail that this week's rally is already preparing it for a whipsaw BUY signal. Upside potential is modest, but there is no reason it couldn't move higher than that if this rally continues.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

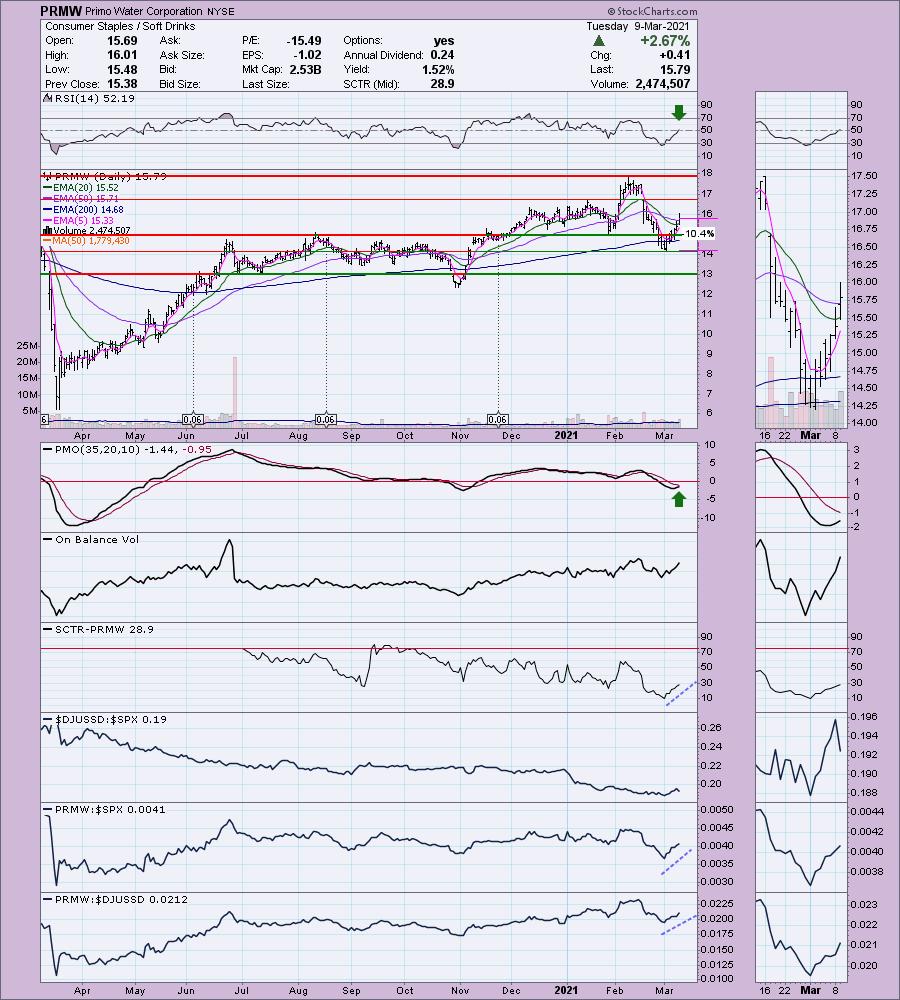

Primo Water Corporation (PRMW)

EARNINGS: 5/6/2021 (BMO)

Primo Water Corp. engages in the manufacture, process, and distribution of beverages. It operates through the following business segments: Route Based Services; Coffee, Tea, and Extract Solutions; and All Other. The Route Based Services segment includes Aquaterra and Eden businesses. The Coffee, Tea, and Extract Solutions segment relates to the S&D business. The All Other segment manufactures, repacks, and markets carbonated soft drinks in Europe. The All Other segment focuses on Aimia, Decantae, and RCI concentrate businesses, Columbus, Georgia manufacturing facility, and other miscellaneous expenses. The company was founded in 1955 and is headquartered in Tampa, FL.

PRMW is up +1.27% in after hours trading. The last two 'diamonds in the rough' are from Consumer Staples. Today price traded above the 20-EMA and finished with a close above the 50-EMA. Both the 5/20-EMAs are rising and should trigger ST and IT Trend Model BUY signals soon with a 5/20-EMA positive crossover (ST Trend Model BUY) and a positive 20/50-EMA crossover (IT Trend Model BUY). The RSI has just reached positive territory and the PMO is rising toward crossover BUY signal. The SCTR is improving. The industry group is performing about as well as the SPY, but we can see that PRMW is outperforming both.

The weekly chart shows a negative PMO on a SELL signal, but the RSI has recaptured positive territory above 50. If it can reach last month's high, that would be an almost 14% gain.

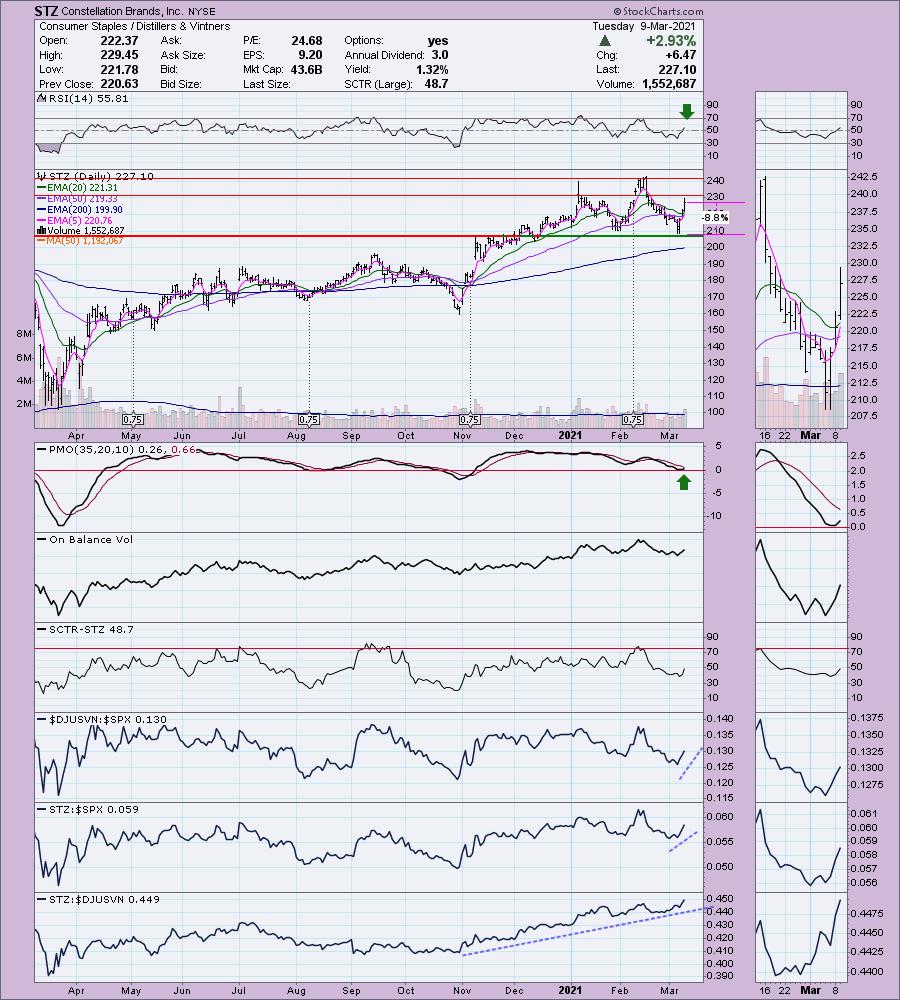

Constellation Brands, Inc. (STZ)

EARNINGS: 4/8/2021 (BMO)

Constellation Brands, Inc. engages in the production, marketing and distribution of beer, wine and spirits. It operates through the following segments: Beer, Wine and Spirits, and Corporate Operations and Other and Canopy. The Beer segment includes imported and craft beer brands. The Wine and Spirits segment sells wine brands across all categories-table wine, sparkling wine and dessert wine-and across all price points. The Corporate Operations and Other segment comprises of costs of executive management, corporate development, corporate finance, human resources, internal audit, investor relations, legal, public relations and information technology. The Canopy segment consists of canopy equity method Investments. The company was founded by Marvin Sands in 1945 and is headquartered in Victor, NY.

STZ is unchanged in after hours trading. This was a tough one believe it or not. I had three beverage stocks arrive in my scans and this was one of them. However, the other two looked pretty good too (HEINY and SAM). I opted to go with STZ based on its outperformance within its industry group which has awakened (I realize it is a different industry group than HEINY and SAM). The RSI just hit positive territory and the PMO has turned up above the zero line in near-term oversold territory. In the thumbnail, I note a slight positive divergence between OBV bottoms and price bottoms. It should see a ST Trend Model BUY signal tomorrow with a 5/20-EMA positive crossover. The stop level is reasonable when set at important support.

The weekly PMO is bottoming above its signal line which is especially bullish. The RSI is positive.

Full Disclosure: I'm about 75% invested and 25% is in 'cash', meaning in money markets and readily available to trade with. I have a limit order in for EXC and BLBD for tomorrow. If they don't execute before I wake up, I'll be using my 5-minute candlestick chart to time my entry. I remain in UNG and thankfully solar rebounded today. I'm contemplating adding to those solar positions.

Current Market Outlook:

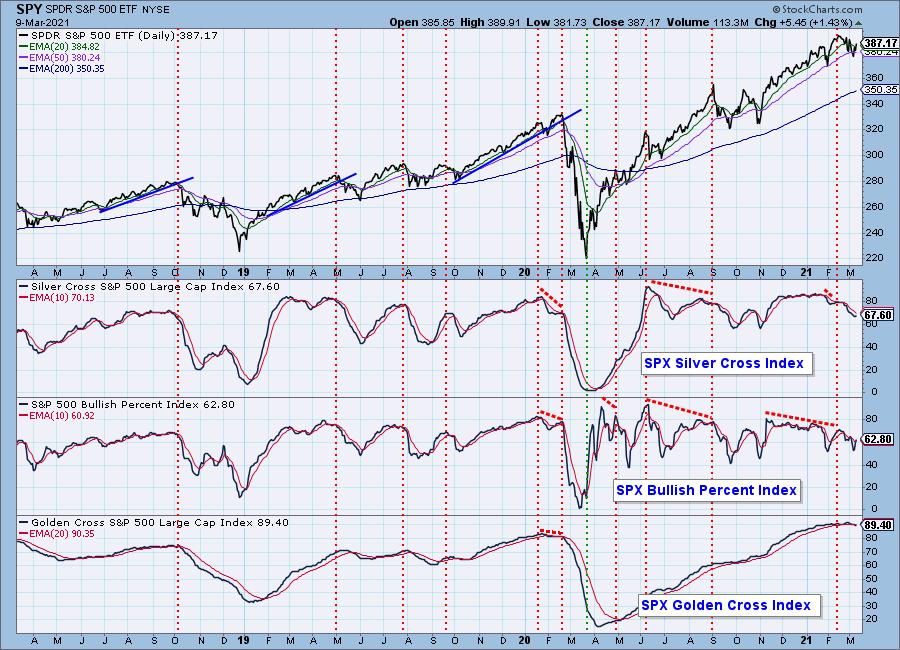

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

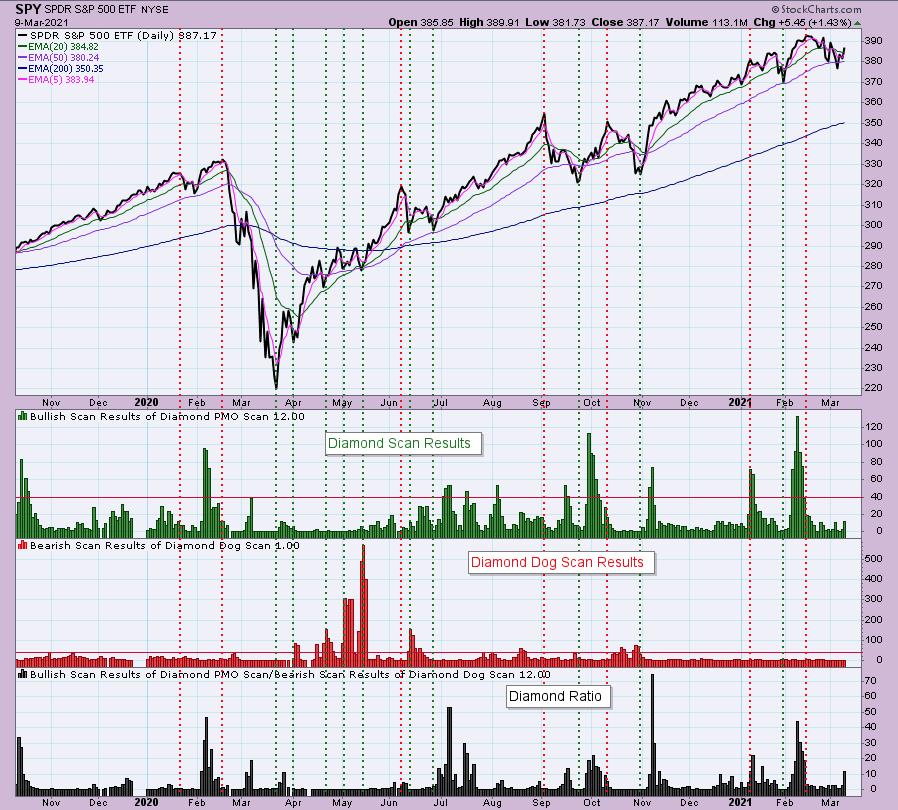

Diamond Index:

The Diamond Index chart looks at the number of scan results from my bullish Diamond PMO Scan and the number of scan results from the inverse Diamond Dog Scan. The Diamond Ratio divides the bullish results by the bearish results.

I only have data going back to October 2019 so I won't make any sweeping conclusions about the Diamond Index chart. I have marked cardinal tops with red dotted vertical lines and cardinal price bottoms with green dotted vertical lines. I believe that when the Diamond Dog results spike, it usually comes at a price bottom, or marks a strong continuation of the rising trend.

Unfortunately, the Diamond PMO Scan result numbers aren't providing much insight. The Diamond Ratio has promise, but again I don't see a clear correlation to the market tops/bottoms right now. I need to study and manipulate the data some more. Keep you posted!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!