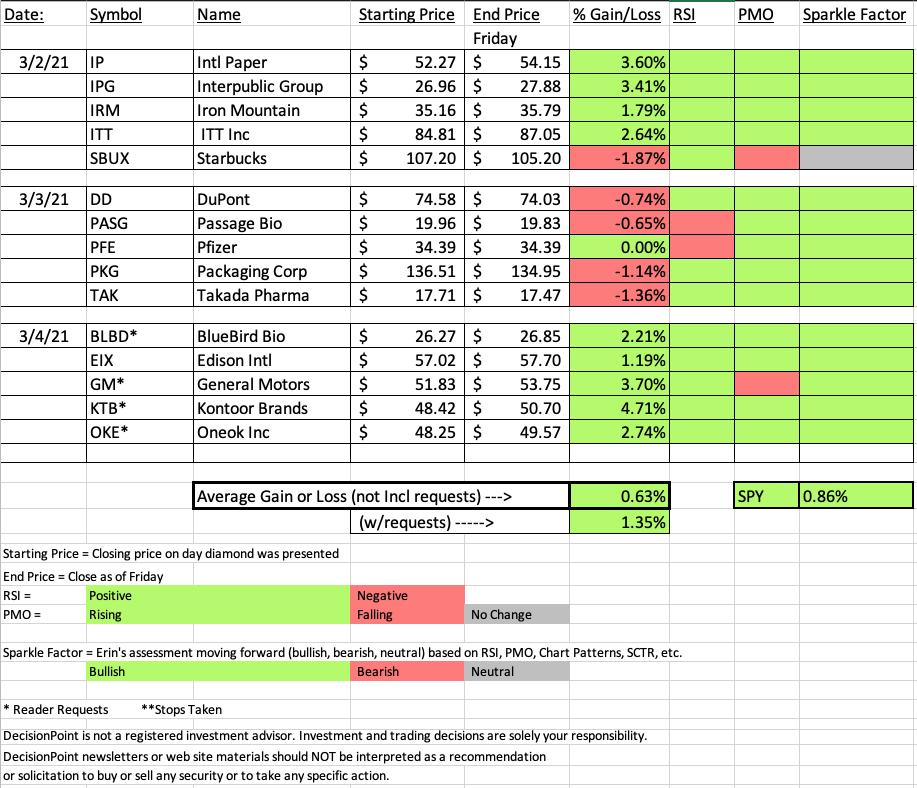

This morning's Diamond Mine trading room started off with the markets diving lower, but by the time we finished the market began to roar back. The spreadsheet now has plenty of green on it, meaning a successful week for our "diamonds in the rough".

The big loser was Starbucks (SBUX). The Restaurants & Bars industry group is beginning to underperform. It's one of the recovery areas that isn't outperforming.

The big winner for me was International Paper (IP). I definitely like it going forward. I like all the Diamonds going forward except SBUX, but even there I'm neutral.

The new Diamond Mine registration is below. Click here to register right now.

I did note that PASG hit its stop intraday yesterday, but it never closed above the stop level so it remained on the spreadsheet. It's only down 0.65% this week and the chart is looking good despite and because of that deep pullback.

Diamond Mine Information:

RECORDING LINK:

Topic: DecisionPoint Diamond Mine (3/5/2021) LIVE Trading Room

Start Time : Mar 5, 2021 08:55 AM

Meeting Recording:

Access Passcode: 2*cm7yhJ

REGISTRATION:

When: Mar 12, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (03/12/2021) LIVE Trading Room

Register in advance for this webinar:

https://zoom.us/webinar/register/WN_GiyUuel4S96KJMoO_mj_CQ

Please do not share these links! They are for Diamonds subscribers ONLY!

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

A few items about the spreadsheet: I decided it only fair to denote "reader requests" as I shouldn't get to take credit if they turn out great! I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Free DecisionPoint Trading Room on Mondays, Noon ET

*Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!*

=======================================

BELOW is a link to Monday's recording with David Keller:

Topic: DecisionPoint Trading Room

Start Time : Mar 1, 2021 09:00 AM

Meeting Recording:

Access Passcode: tdd*4nNS

For best results, copy and paste the access code to avoid typos.

Darling:

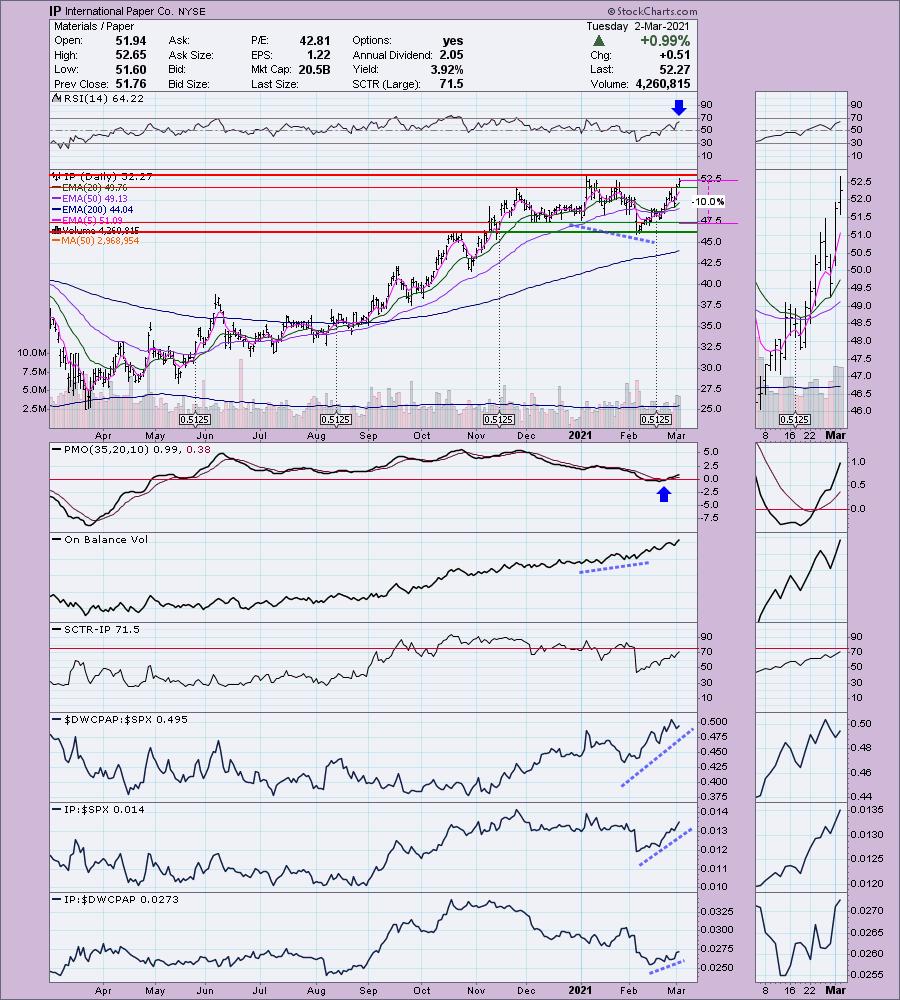

International Paper Co. (IP)

EARNINGS: 4/29/2021 (BMO)

International Paper Co. engages in the manufacture of paper and packaging products. It operates through the following segments: Industrial Packaging, Global Cellulose Fibers, and Printing Papers. The Industrial Packaging segment involves in the manufacturing of containerboards, which include linerboard, medium, whitetop, recycled linerboard, recycled medium, and saturating kraft. The Global Cellulose Fibers segment offers cellulose fibers product portfolio includes fluff, market, and specialty pulps. The Printing Papers segment includes manufacturing of the printing and writing papers. The company was founded by Hugh J. Chisholm in 1898 and is headquartered in Memphis, TN.

Here is the chart and commentary from 3/2:

"IP is unchanged in after hours trading. We don't have a breakout yet which is a bit of a concern, but the indicators are suggesting the breakout will occur. We have a fairly recent BUY signal on the PMO. I noticed a positive OBV divergence that led into the current rally. It is a clear out-performer and the Paper industry group is doing very well. The SCTR has been rising steadily implying internal strength as well as relative strength. The stop is rather deep, but it lines up nicely with support at the December lows."

Here is today's chart:

We didn't have the breakout when I selected IP as a "diamond in the rough", but the chart and indicators were strongly suggesting it would breakout. It had a stellar day and looks like it will be successful moving forward. The SCTR just entered the "hot zone" above 75 today. This one should continue to run higher.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

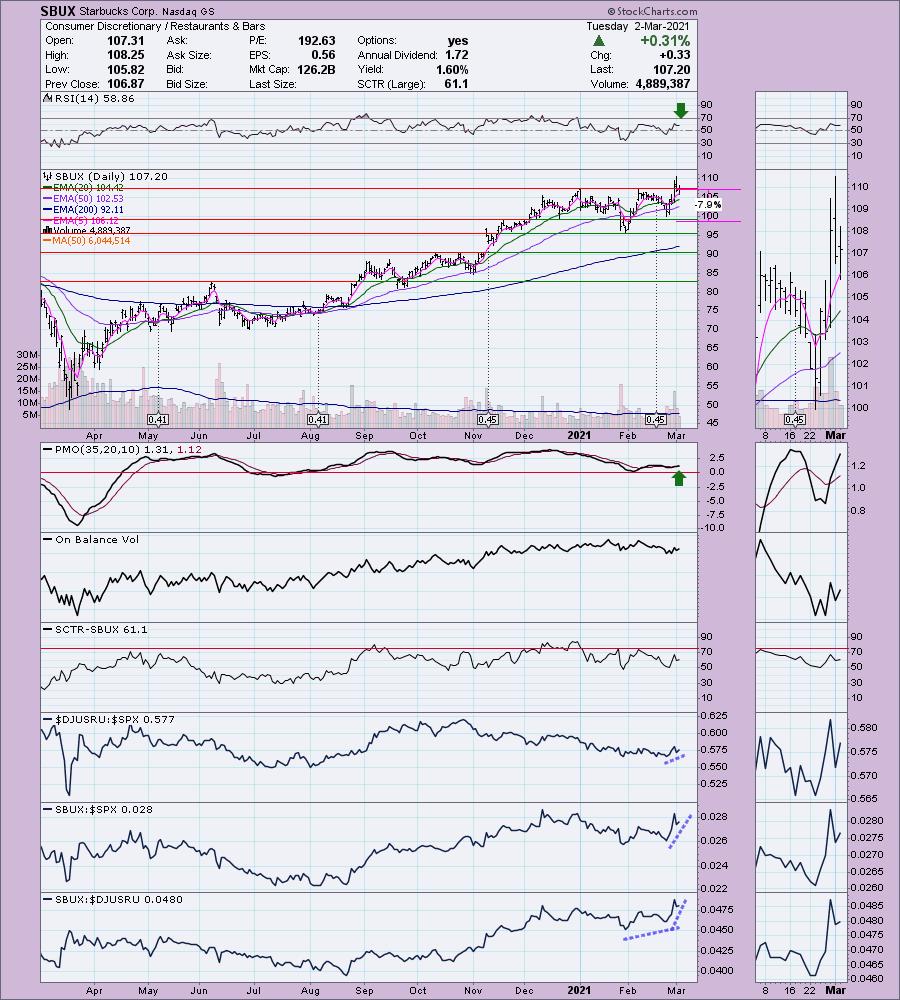

Starbucks Corp. (SBUX)

EARNINGS: 4/27/2021 (AMC)

Starbucks Corp. engages in the production, marketing, and retailing of specialty coffee. It operates through the following segments: Americas; China/Asia Pacific (CAP); Europe, Middle East, and Africa (EMEA); and Channel Development. The Americas, CAP, EMEA segments sells coffee and other beverages, complementary food, packaged coffees, single-serve coffee products, and a focused selection of merchandise through company-oriented stores, and licensed stores. The Channel Development segment include sales of packaged coffee, tea, and ready-to-drink beverages to customers outside of its company-operated and licensed stores. The company brands include Evolution Fresh, Teavana, Tazo Tea and Seattle's Best. Starbucks was founded by Jerry Baldwin and Howard D. Schultz on November 4, 1985 and is headquartered in Seattle, WA.

Here is the chart and commentary from 3/2:

"SBUX is up +0.09% in after hours trading. I covered SBUX back on May 25th 2020. I had set the stop at the earlier May 2020 lows at $70. It nearly triggered the stop, but eventually began climbing in July. It is up 36.4% since then. I liked the breakout from Thursday and Friday. We did get a pullback today, but it closed just on support. The PMO bottoms are rising with price bottoms and it just triggered a crossover BUY signal. I'm not thrilled with the OBV as it has a negative divergence with price currently. The SCTR is healthy, albeit not in the "hot zone" above 75. What impressed me was its outperformance against the SPX and its industry group. The RSI is positive and not overbought. I set a reasonable stop below the late February lows and below support."

Below is today's chart:

You can see why I gave it a "neutral" Sparkle Factor moving forward. It hasn't actually broken its declining trend and it is currently holding above support along the 50-EMA. Sure looks like we have a hammer candle/OHLC bar which suggests that SBUX my rebound. Those are the bullish characteristics, now for the bearish. The PMO has turned down and the RSI could be headed for negative territory. We have a clear negative divergence between OBV tops and price tops. Performance is beginning to wane, but it isn't bearish enough to sell if you have it.

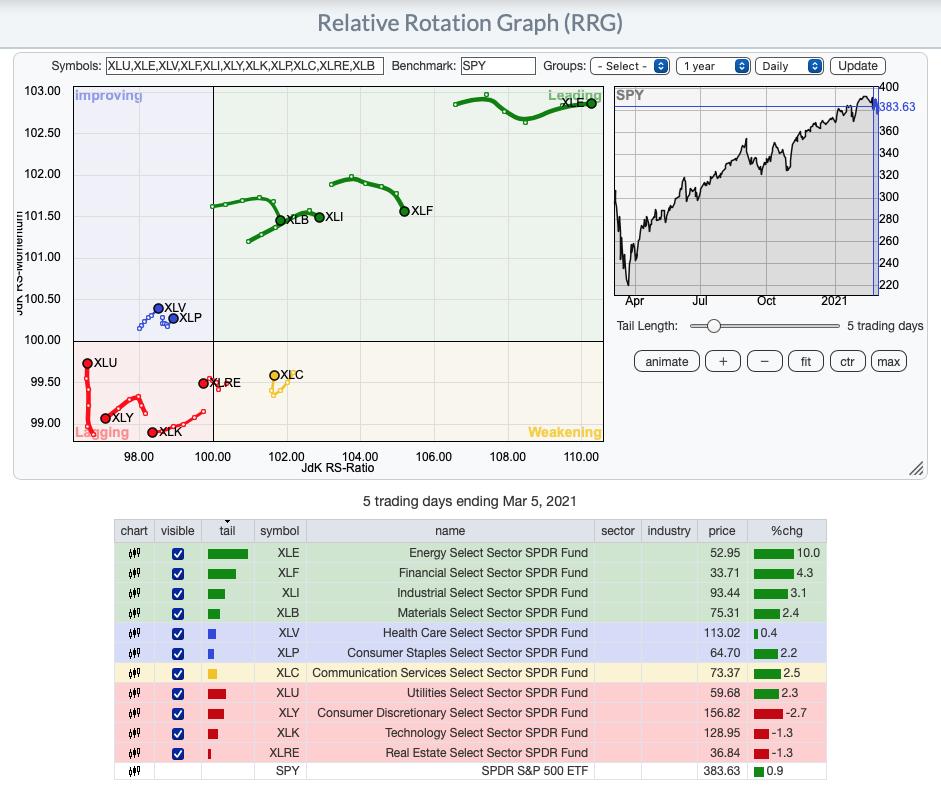

THIS WEEK's Sector Performance:

Click Here to view Carl's annotated Sector ChartList!

CONCLUSION:

Today's higher close in the market was welcomed relief. However, I don't believe this is beginning of a new leg up. This is our opportunity to tighten up or switch to trailing stops on this strength. You may also want to consider closing some of your more aggressive positions and move into some of the value stocks available within Consumer Staples and Utilities. Below is the short-term sector RRG I've given it a "hot link" so if you click on the RRG image below it will take you to a live version. XLU is moving 'north', we want it to move northwest on a compass. We are seeing with both Healthcare (XLV) and Consumer Staples (XLP) moving northwest along with Energy (XLE).

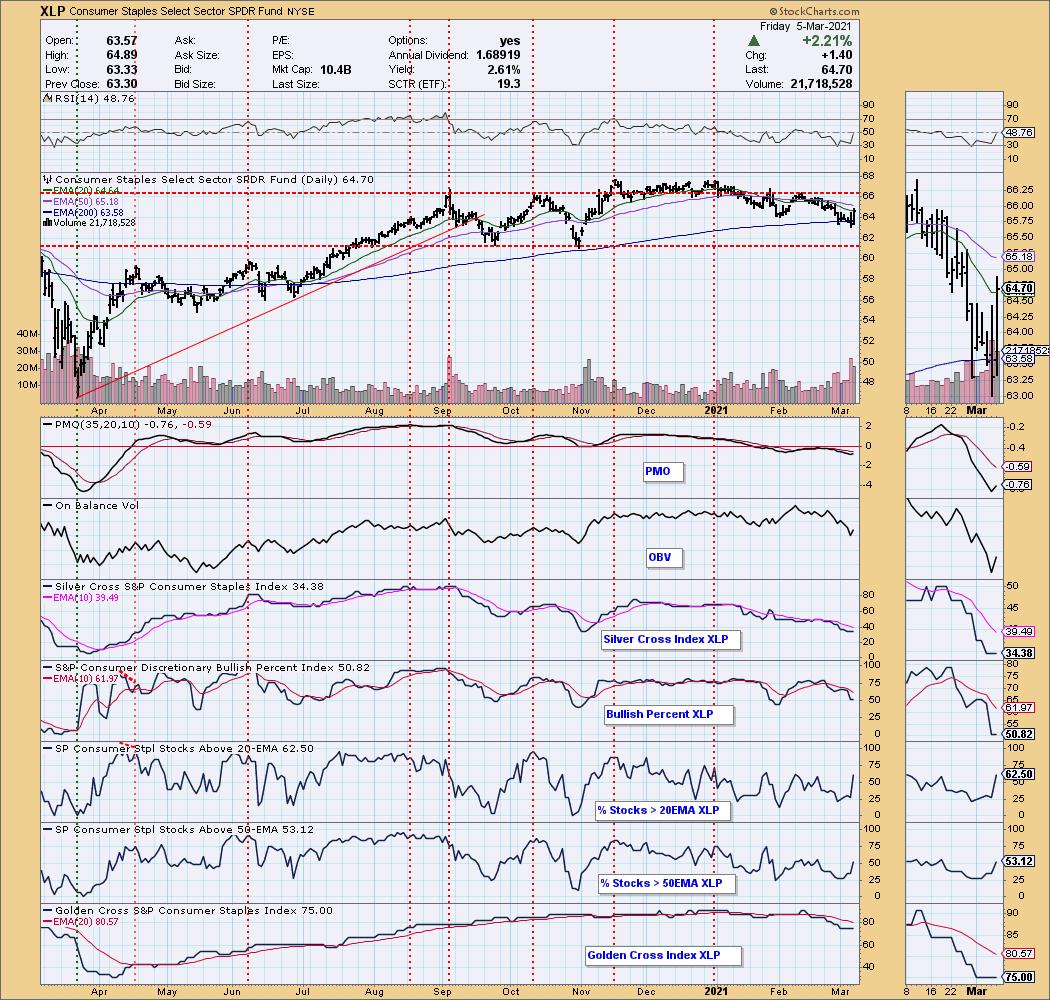

Sector to Watch: Consumer Staples (XLP)

I finally trust the XLP breakout. It closed above the 20-EMA on the breakout, something we have seen in some time. The BPI and SCI are in the process of turning back up. Participation is going up very quickly, so there is support in this sector to push it higher. The GCI has flattened and also looks ready to turn back up.

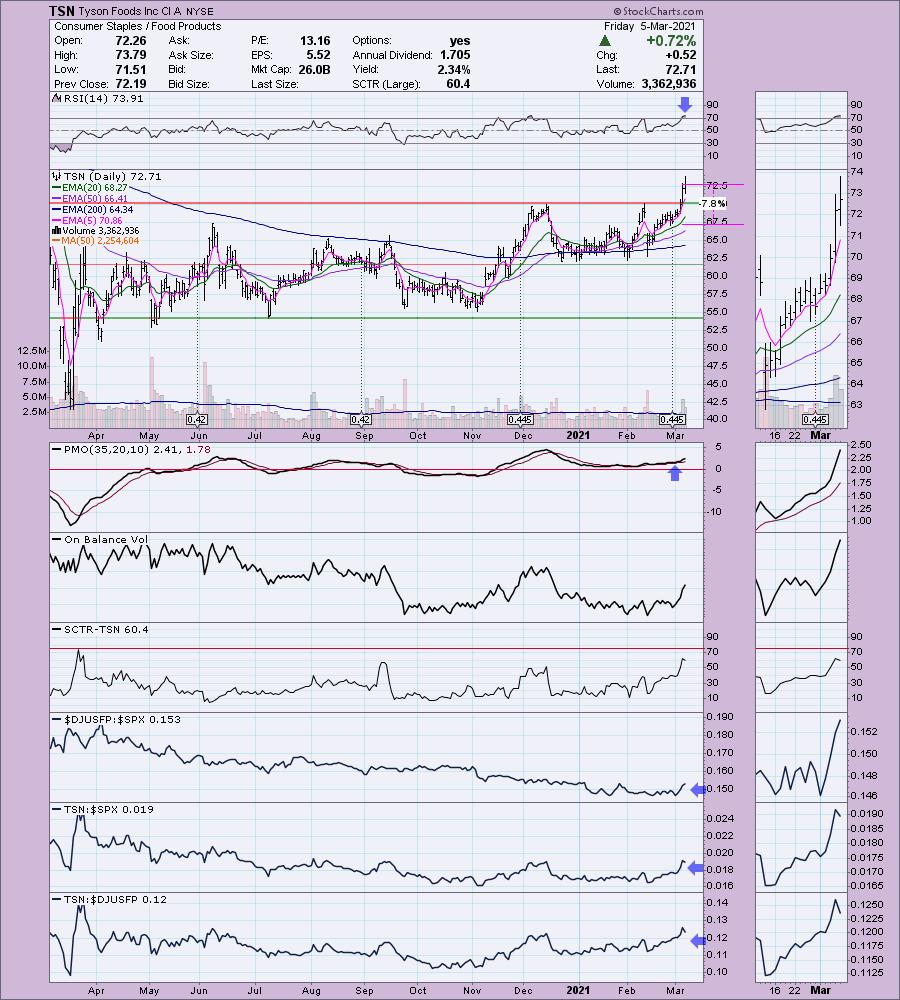

Industry Group to Watch: Food Products ($DJUSFP)

The most successful industry group within XLP is actually Tires, but CTB and GT are the reason. They've been soaring while their brethren have been less successful. My preference is Food Products. It's really looking great and after today's breakout, it looks even better. We should get a jump on this group next week before they get overbought.

My current choice within this sector is Tyson Foods Inc (TSN). Here's a quick look at the chart. Easy to set a stop at support which is just about 5%, I've annotated 7.8% for reference as well.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting!

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 80% invested right now and 20% is in 'cash', meaning in money markets and readily available to trade with. I will not be adding to my portfolio unless stocks within the defensive sectors are looking positive enough to swap out a more aggressive position for a more defensive position.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)