My goodness! The stock symbols that arrived this week from readers were excellent! It was nearly impossible to narrow down the list. Forgive me if your request was not chosen! I'll look at any that you really want to see in tomorrow's Diamond Mine trading room, so email me if you cannot make it live and I'll add them to the list. I can't look at all of the requests tomorrow, so pick your favorite to email me.

The way I decided to whittle down the requests was to go to the weekly charts. I found five that have promising weekly charts as well as strong daily charts. I am not specifically picking one of my own, but I will tell you that two of them I saw this week in my scan results so it is almost like I picked them.

I've made my short list of stocks today out of the requests that I really had trouble picking from. You will want to review some of those charts.

Don't forget to register for tomorrow's Diamond Mine trading room right HERE or below!

Today's "Diamonds in the Rough" are: BSX, LIVN, PNR, RIO and TBI.

Stocks to Review ** (no order): GD, VMC, AVY, AMKR, ITGR, QCOM, IMVT and FUBO.

** The "Stocks to Review" are stocks that were on my short list for the day.

RECORDING LINK Friday (7/16):

Topic: DecisionPoint Diamond Mine (7/16/2021) LIVE Trading Room

Start Time : Jul 16, 2021 09:02 AM

Meeting Recording Link.

Access Passcode: July-16th

RECORDING LINK Friday (7/23):

Topic: DecisionPoint Diamond Mine (07/23/2021) LIVE Trading Room

Start Time : Jul 23, 2021 09:00 AM

Recording link for 7/23 Diamond Mine is HERE.

Access Passcode: July/23rd

REGISTRATION FOR FRIDAY 7/30 Diamond Mine:

When: Jul 30, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/30/2021) LIVE Trading Room

Register in advance for the 7/30 Diamond Mine HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Tom Bowley joins Erin in the DP Trading Room August 2nd!

It's a reunion for Tom and Erin! Remember MarketWatchers LIVE!? Tom will join me for an extended "10 in 10" as he shares his trading wisdom that combines technical analysis with fundamentals and earnings in particular! You can find him at EarningsBeats.com where he is the Chief Technical Analyst. Register HERE if you haven't already!

Free DP Trading Room (7/26) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Jul 26, 2021 08:59 AM

Meeting Recording Link.

Access Passcode: July/26th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

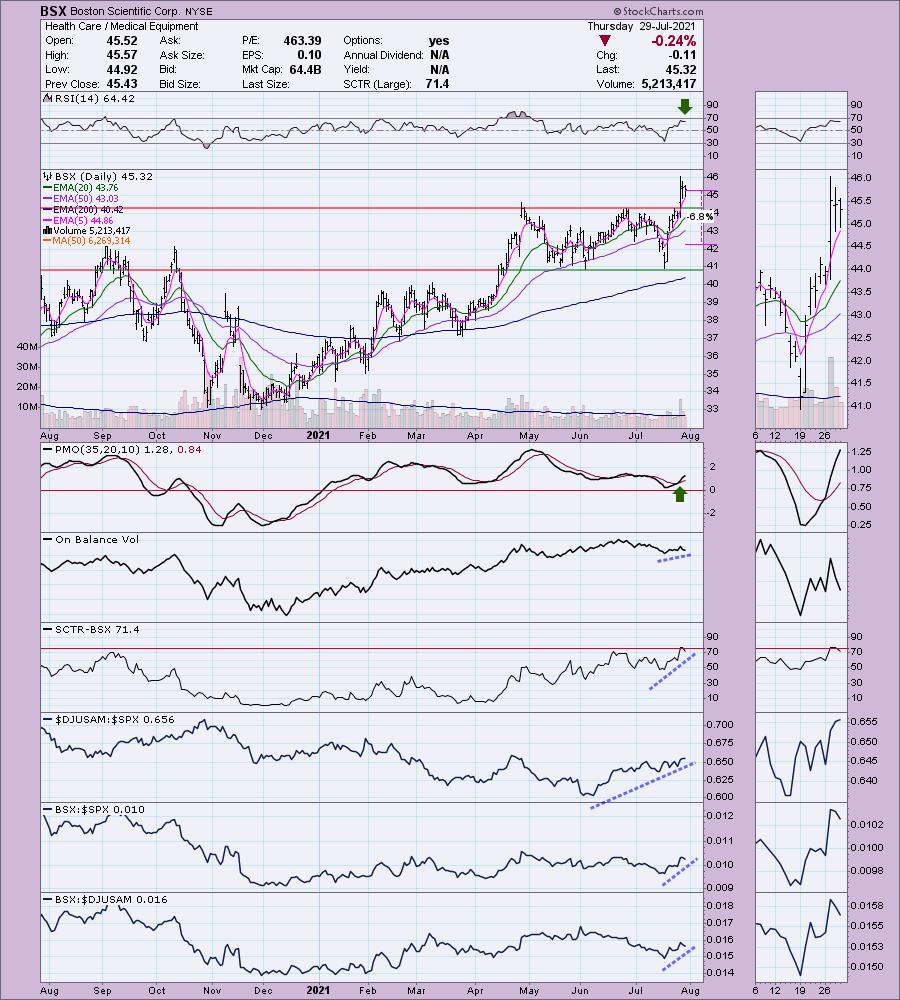

Boston Scientific Corp. (BSX)

EARNINGS: 10/27/2021 (BMO)

Boston Scientific Corp. engages in the development, manufacture and marketing of medical devices that are used in interventional medical specialties. It operates through the following segments: Rhythm and Neuro, Cardiovascular and MedSurg. The Rhythm and Neuro segment develops implantable devices that monitor the heart and deliver electricity to treat cardiac abnormalities. The Cardiovascular segment comprises of technologies or diagnosing and treating coronary artery disease and other cardiovascular disorders including structural heart conditions. The MedSurg segment focuses on Endoscopy, which provides devices to diagnose and treat a broad range of gastrointestinal and pulmonary conditions with innovative and invasive technologies. The company was founded by John E. Abele and Pete Michael Nicholas on June 29, 1979 and is headquartered in Marlborough, MA.

BSX is up +0.51% in after hours trading. This one has come up in my scan results a few times this week. It looks particularly good on the small pullback yesterday and today. The RSI is positive and not overbought. The PMO is on a near-term oversold crossover BUY signal. I always like to see a PMO turning up right above the zero line. The OBV is confirming the rally in the short-term, but there is a negative divergence between price tops and declining OBV tops. I'll forgive that given the strength of the breakout and strong relative performance. The stop is set below that late June trough.

The weekly PMO and RSI are excellent. I particularly like the PMO bottom above the signal line and the fact that it is not overbought. It is near all-time highs so consider a possible upside target at a 17% gain around $53.

LivaNova PLC (LIVN)

EARNINGS: 10/28/2021 (BMO) ** Reported Today **

Henry Schein, Inc. engages in the provision of health care products and services to medical, dental, and veterinary office-based practitioners. It operates through the Healthcare Distribution, and Technology and Value-Added Services segments. The Healthcare Distribution segment includes consumable products, small equipment, laboratory products, large equipment, equipment repair services, branded and generic pharmaceuticals, vaccines, surgical products, diagnostic tests, infection-control products and vitamins. The Technology & Value-Added Services segment offers financial services on a non-recourse basis, e-services practice, technology, network and hardware services. The company was founded by Henry Schein and Esther Schein in 1932 and is headquartered in Melville, NY.

LIVN is unchanged in after hours trading. They had an earnings surprise of 62.5%! It popped above and closed above resistance. This one came up in my scans yesterday, but I knew they were reporting and decided to avoid it. Apparently a big mistake in this case, but we know it can go either way. The RSI is positive and the PMO is on an oversold crossover BUY signal. It recently had a "Silver Cross" of the 20/50-EMAs which puts it on an IT Trend Model BUY signal. The OBV is confirming the rally and the SCTR is in the "hot zone" above 75 (meaning it is in the upper quartile of all mid-cap stocks for the IT and LT). We were right about Medical Supplies being the industry group to watch, the outperformance is impressive by the group. LIVN is a strong relative performer against the SPX and its industry group. The stop is set below the 50-EMA.

As I said I used the weekly charts to pare down today's requests. The weekly RSI is positive and the weekly PMO just turned up on this week's outperformance. Upside potential is excellent.

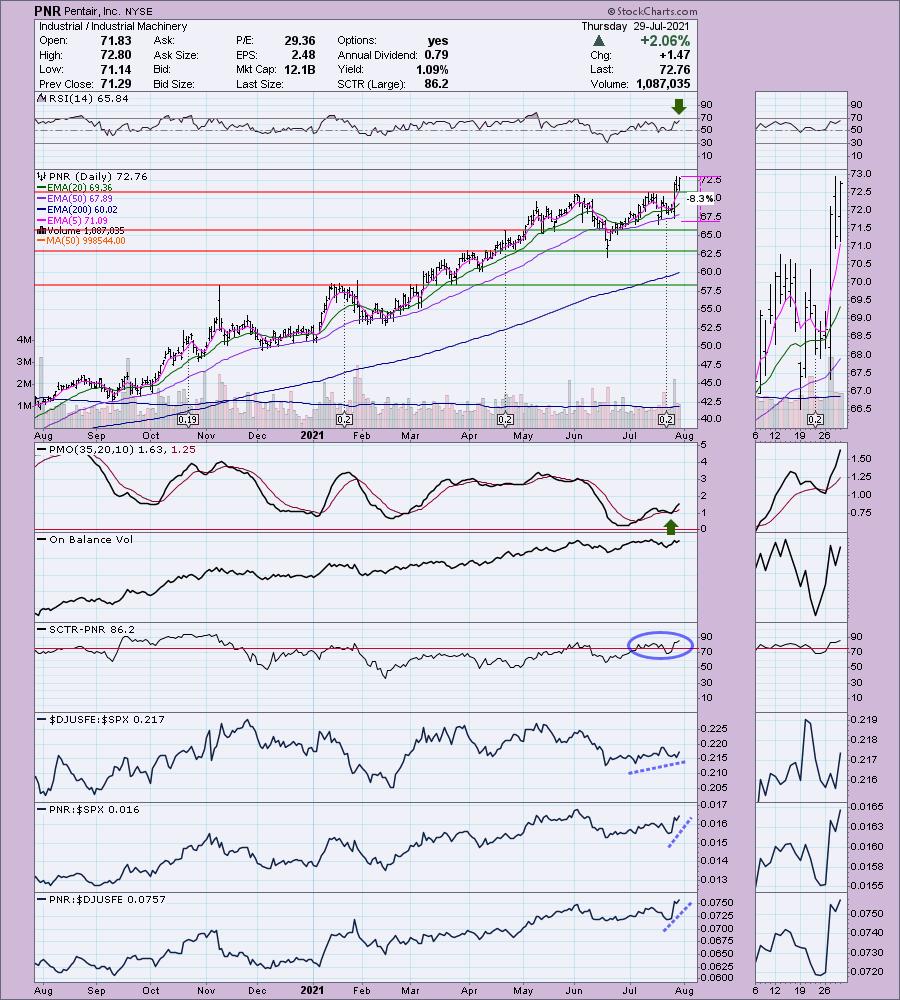

Pentair, Inc. (PNR)

EARNINGS: 10/19/2021 (BMO)

Pentair Plc engages in the provision of water solutions for residential, commercial, industrial, infrastructure, and agriculture applications. Its portfolio of solutions enables people, businesses, and industries to access clean, safe water, reduce water consumption, and recover and reuse it. The firm operates through the following business segments: Consumer Solutions and Industrial & Flow Technologies. The Consumer Solutions segment designs, manufactures and sells energy-efficient residential and commercial pool equipment and accessories, and commercial and residential water treatment products and systems. The Industrial & Flow Technologies segment manufactures and sells a variety of fluid treatment and pump products and systems, including pressure vessels, gas recovery solutions, membrane bioreactors, wastewater reuse systems and advanced membrane filtration, separation systems, water disposal pumps, water supply pumps, fluid transfer pumps, turbine pumps, solid handling pumps, and agricultural spray nozzles, while serving the global residential, commercial and industrial markets. The company was founded by Murray J. Harpole, Vern Stone, Vincent Follmer, Leroy Nelson, and Gary Ostrand on August 31, 1966 and is headquartered in London, the United Kingdom.

PNR is unchanged in after hours trading. I covered this one on March 10th 2021. The stop was never hit so the position is up 21.4% and gaining. The chart looks good again with a breakout above resistance. It pulled back toward the breakout area and rebounded back today. The RSI is positive, the PMO is on a crossover BUY signal. The OBV could use a higher high to prevent a negative divergence, but it is pretty close so I'll forgive it. The SCTR has been hovering around the "hot zone" for about a month. The group is outperforming and on this big rally, PNR is strongly outperforming the group and the SPX. The stop is set under the 50-EMA.

The weekly chart is favorable, but there is an overbought RSI (however, look at the last quarter, it was overbought for weeks with no problem). The PMO has ticked back up. It is at all-time highs, so consider an upside target of 18% around $86.

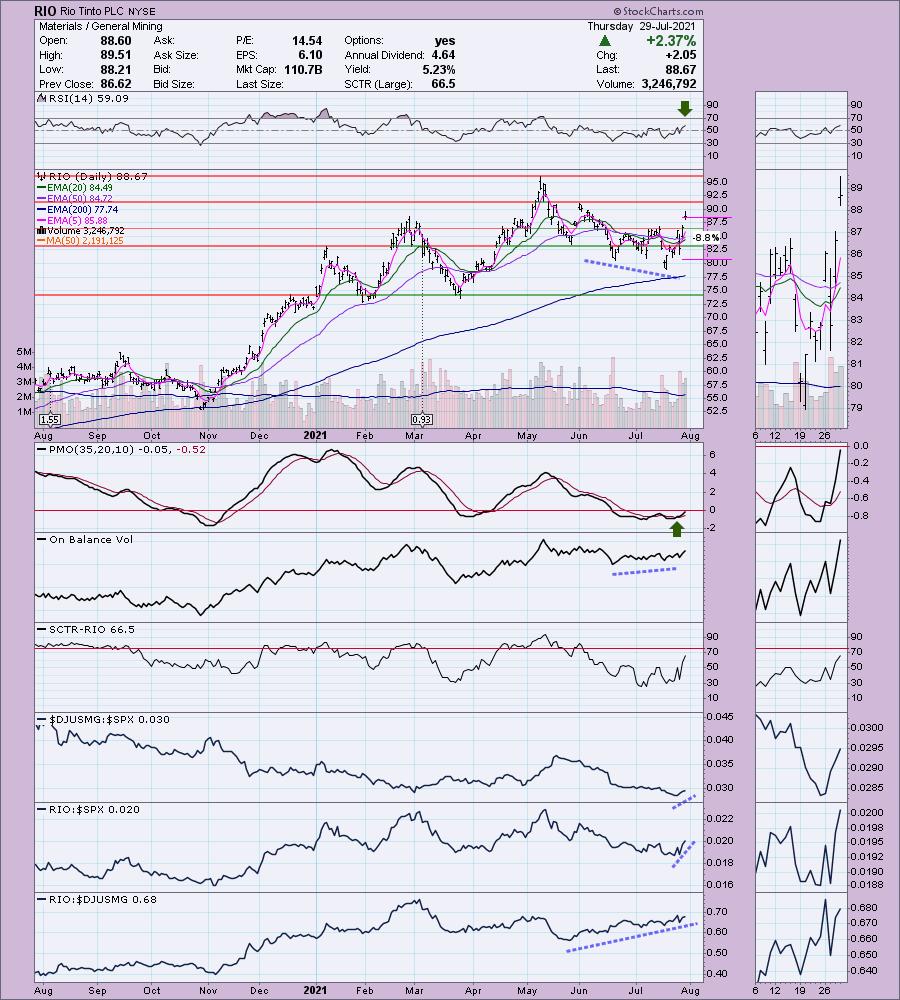

Rio Tinto PLC (RIO)

EARNINGS: 2/16/2022 (BMO) ** Reported Earnings Today **

Rio Tinto Plc engages in the exploration, mining, and processing of mineral resources. It operates through the following business segments: Iron Ore, Aluminium, Copper and Diamonds, Energy and Minerals, and Other Operations. The Iron Ore segment supplies global seaborne iron ore trade. The Aluminium segment produces bauxite, alumina and primary aluminum. The Copper and Diamonds segment offers gold, silver, molybdenum and other by-products. The Energy and Minerals includes businesses with products such as uranium, borates, salt and titanium dioxide feedstock together with coal operations. The Other Operations segment covers the the curtailed Gove alumina refinery and Rio Tinto Marine operations. Rio Tinto was founded in 1873 and is headquartered in London, the United Kingdom.

RIO is up +0.11% in after hours trading. Earnings were up 6% and they raised their dividends. I like the recent breakout and the overall improvement in the General Mining industry group. I'm starting to eye some Gold Miners again (AGI I own, look at ARMK, RGOLD and FNV). The only thing that concerns me about this chart is the possibility this will turn into an island reversal, meaning a gap down could end this one. However, given the improving participation among Miners, this one could be interesting on a pullback. The RSI is positive, there is a beautiful OBV positive divergence and a new PMO crossover BUY signal arriving in oversold territory. The SCTR is improving quickly and you can see the group's relative performance improving and RIO is a winner in this group as well as against the SPX. The stop is set below the June closing low.

This breakout looks good on the weekly chart. The weekly RSI is positive and the weekly PMO is turning back up. Given it is near all-time highs, I'd set an upside target at about 18% near $105.

True Blue Inc. (TBI)

EARNINGS: 10/25/2021 (AMC)

TrueBlue, Inc. engages in the provision of staffing, recruitment process outsourcing and managed service provider solutions. It operates through the following segments: PeopleReady, PeopleManagement and PeopleScout. The PeopleReady segment offers staffing solutions for blue-collar, contingent on-demand and skilled labor to a broad range of industries that include retail, manufacturing, warehousing, logistics, energy, construction, hospitality and others. The PeopleManagement segment supplies contingent labor and outsourced industrial workforce solutions. The PeopleScout segment covers the provision of permanent employee recruitment process outsourcing for its customers for all major industries and jobs. The company was founded by John Ross Coghlan and Glenn Welstad in 1989 and is headquartered in Tacoma, WA.

TBI is unchanged in after hours trading. The RSI is positive and the PMO just gave us a crossover BUY signal. This rally has been strong and it comes off a positive OBV divergence. The SCTR has been strong since May. We are about to see an IT Trend Model "Silver Cross" BUY signal and the 5-EMA has already crossed above the 20-EMA for a ST Trend Model BUY signal. The group is performing spectacularly against the SPX and TBI is a winner against the SPX and the group. The stop is set just above support at the May low. If you set it just below that level, you're looking at 10%+ stop which is a little too deep.

The weekly chart is favorable with a positive RSI and a weekly PMO that is beginning to turn up. Admittedly it is nearing the top of its multiyear trading range, but it seems primed for a breakout this time. Since it is near all-time highs, consider an upside target of about 20% or at the $33.80 level.

"Under the Hood" Indicators

My webinar last week on "Under the Hood" Indicators at the Synergy Traders event was a success. I was able to get links to the recordings for BOTH days. You'll find my presentation in the second link. I was the last presenter.

Day 1 of Synergy Traders "Favorite Indicators" educational webinar event LINK.

Day 2 of Synergy Traders "Favorite Indicators" educational webinar event with Erin's webinar LINK.

"Simple Indicators to Improve Stock Selection & Timing"

I have another free seminar coming up on August 3rd, 2021 with Festival of Traders! My presentation will be at 6:40p ET. If you can't make it, register and you'll receive the recording! Your support is always appreciated! More details to follow.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 40% invested and 60% is in 'cash', meaning in money markets and readily available to trade with. I'm considering expanding my exposure to 50%, keep you posted.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com