The leading sector today was Real Estate (XLRE). Consequently Real Estate stocks filled my scans today. This is FYI since the three stocks I picked today aren't from this sector. Prior "Diamonds in the Rough" from this month in the Real Estate sector are: CCI, O and PSA.

Yesterday's "Diamond in the Rough" REMX was one of the worst performers in our "ETF Tracker" ChartList (email me if you are a StockCharts.com member and would like to add the ChartList to your account). However, I think it only makes the chart more tasty. Uranium (URA) was one of the best performers in the ETF Tracker. I like Lithium on today's pullback as well (LIT and LAC).

We have a mixed bag today with at least two names you will immediately recognize.

Today's "Diamonds in the Rough" are: DKNG, EHC and TWTR.

"Stocks to Review" from my short list are: AAPL, ENSG, SWBI, VTR, and FUBO.

No Recording on 8/27 due to illness.

RECORDING LINK Friday (8/20):

Topic: DecisionPoint Diamond Mine (8/20/2021) LIVE Trading Room

Start Time : Aug 20, 2021 08:58 AM

Meeting Recording Link HERE.

Access Passcode: August/20th

REGISTRATION FOR FRIDAY 9/3 Diamond Mine:

When: Sep 3, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (09/03/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (8/30) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Aug 30, 2021 08:57 AM

Meeting Recording Link.

Access Passcode: August-30th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

DraftKings Inc (DKNG)

EARNINGS: 11/9/2021 (BMO)

DraftKings, Inc. operates as a digital sports entertainment and gaming company. It operates through the B2C and B2B segments. The B2C segment focuses in the providing users with DFS, Sportsbook and iGaming products. the B2B segment develops, designs and licenses f sports betting and casino gaming software for its sportsbook and casino gaming products. The company was founded by Jason D. Robins, Matthew Kalish and Paul Liberman on December 31, 2011 and is headquartered in Boston, MA.

DKNG is up +0.30% in after hours trading. Going into football season, I believe DKNG's seasonality and earnings will work in its favor. The chart is favorable with a big rally and subsequent consolidation. The RSI is positive and not yet overbought. It is continuing to move higher on the July PMO crossover BUY signal. Notice that when this rally began in July we had a positive OBV divergence. Currently the OBV is confirming the rally. The Gambling industry group saw some relative strength, but it is cooling somewhat. However, we can see that DKNG has been outperforming the SPX and the group, albeit moving mostly sideways of late. The stop is set at 7.4% below support at the June top.

The weekly chart is especially intriguing. We have a positive RSI and the weekly PMO is turning up and working its way toward a crossover BUY signal. There is a large double-bottom formation that executed last week. The minimum upside target of the double-bottom would put price at its all-time highs which gives us upside potential of over 24%.

Encompass Health Corp. (EHC)

EARNINGS: 10/28/2021 (AMC)

Encompass Health Corp. engages in the provision of post-acute healthcare services. It operates through the Inpatient Rehabilitation and Home Health and Hospice segments. The Inpatient Rehabilitation segment operates inpatient rehabilitation hospitals that provides rehabilitative treatment and care to patients who are recovering from stroke and other neurological disorders, cardiac and pulmonary conditions, brain and spinal cord injuries, complex orthopedic conditions and amputations. The Home Health and Hospice segment provides Medicare-certified home nursing, specialized home care and in-home services. The company was founded by Richard M. Scrushy on February 22, 1984 and is headquartered in Birmingham, AL.

EHC is down -0.49% in after hours trading. I covered EHC previously in the May 19th 2020 issue of DP Diamonds. The position hit its 6.9% stop the following June. Today it appears that EHC is bottoming at the bottom of the trading range on the 8-month daily chart. Today's breakout executes a bullish double-bottom pattern. The minimum upside target is around $82 where we see overhead resistance at the July high. The RSI has just entered positive territory and the PMO had a crossover BUY signal today. Relative strength is picking up for it and the group has rising relative strength bottoms. The stop is a meager 4.7% and this one has a yield of 1.41% as an added bonus.

The weekly chart isn't great but it is beginning to show improvement as the RSI is rising and near positive territory and the weekly PMO is decelerating. If price can reach the all-time high, that would be a 12% gain, but I'd look for a breakout.

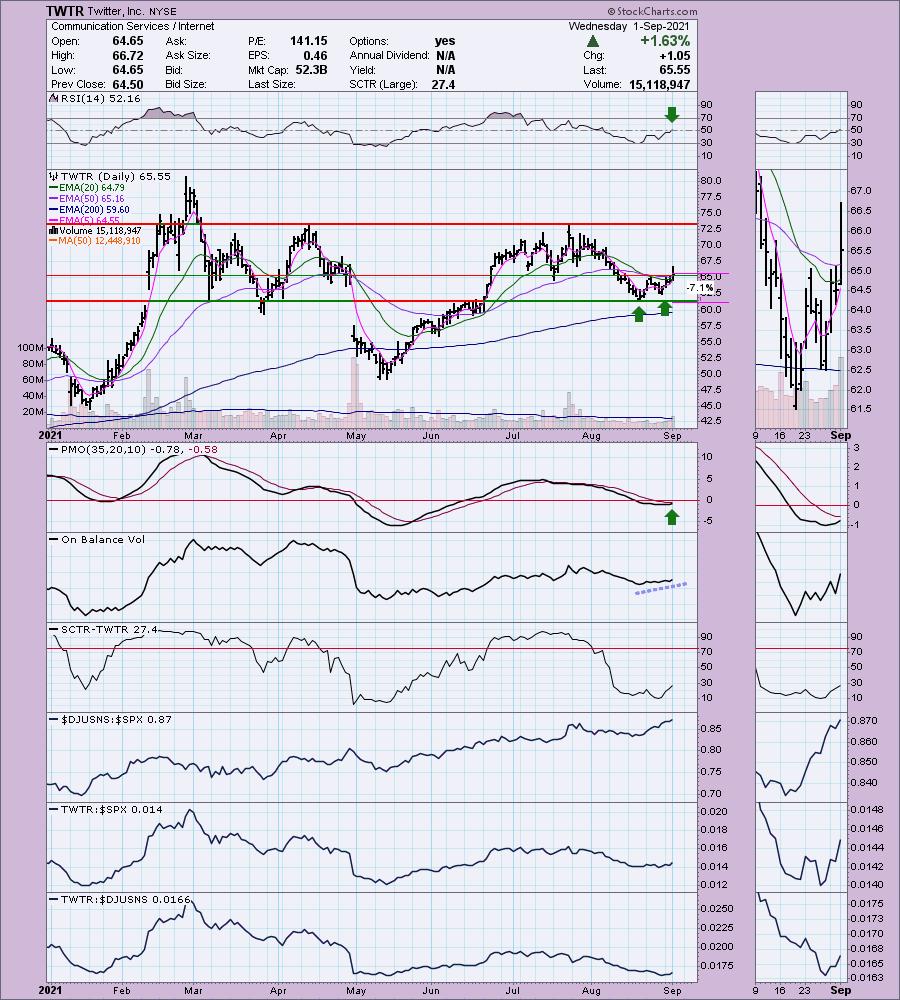

Twitter, Inc. (TWTR)

EARNINGS: 10/26/2021 (AMC)

Twitter, Inc. is a global platform for public self-expression and conversation in real time. It provides a network that connects users to people, information, ideas, opinions and news. The company's services include live commentary, live connections and live conversations. Its application provides social networking services and micro-blogging services through mobile devices and the Internet. The company can also be used as a marketing tool for businesses. Its products and services include Promoted Tweets, Promoted Accounts and Promoted Trends. Twitter was founded by Jack Dorsey, Christopher Isaac Stone, Noah E. Glass, Jeremy LaTrasse and Evan Williams on March 21, 2006 and is headquartered in San Francisco, CA.

TWTR is unchanged in after hours trading. I consider this one of the "FAANG+" stocks. The majority of these stocks have been leading the market higher. I almost included Apple (AAPL) today on the breakout, so be sure and look at the chart if you haven't already today. TWTR has a bullish double-bottom after a successful pullback to the 200-EMA. Today it broke above our key moving averages with gusto. This also executed a bullish double-bottom pattern. The RSI has just reached positive territory above net neutral (50) and the PMO is rising toward a crossover BUY signal. TWTR hasn't been the best performer in its outperforming industry group, but it is showing new relative strength. You can set a fairly conservative stop at 7%.

The weekly RSI is positive, but the PMO isn't looking very healthy yet. We should also take into consideration the possible bearish double-top that may be forming on the weekly chart. If it can reach its all-time high, that would be an over 24% gain.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

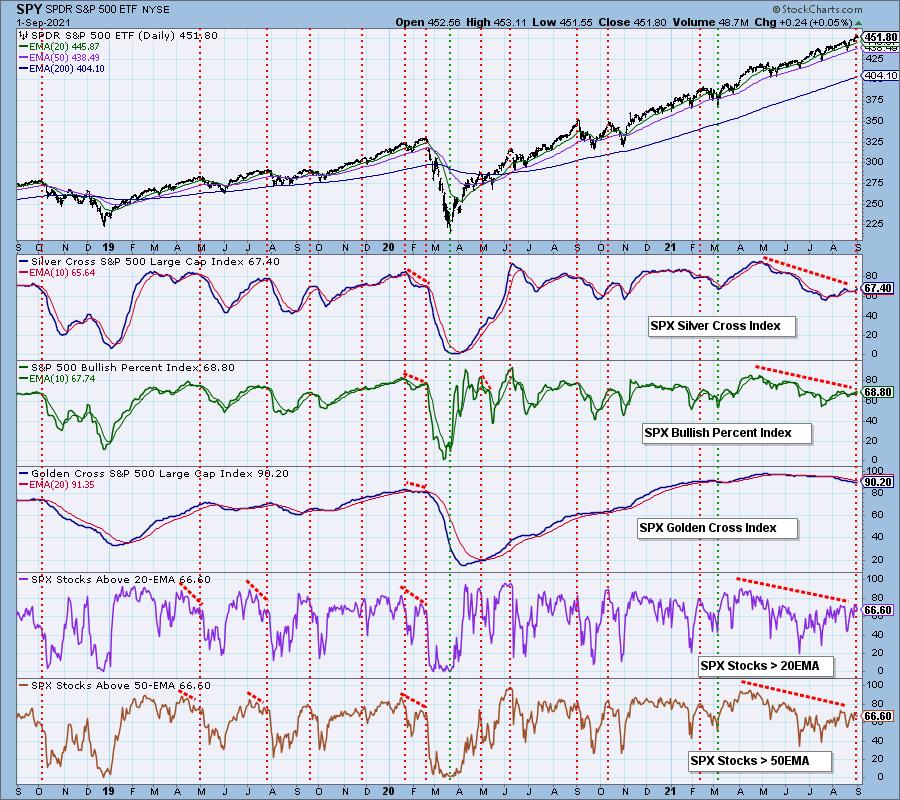

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm about 60% invested and 40% is in 'cash', meaning in money markets and readily available to trade with. I am considering adding TWTR and DKNG to my portfolio this week.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com