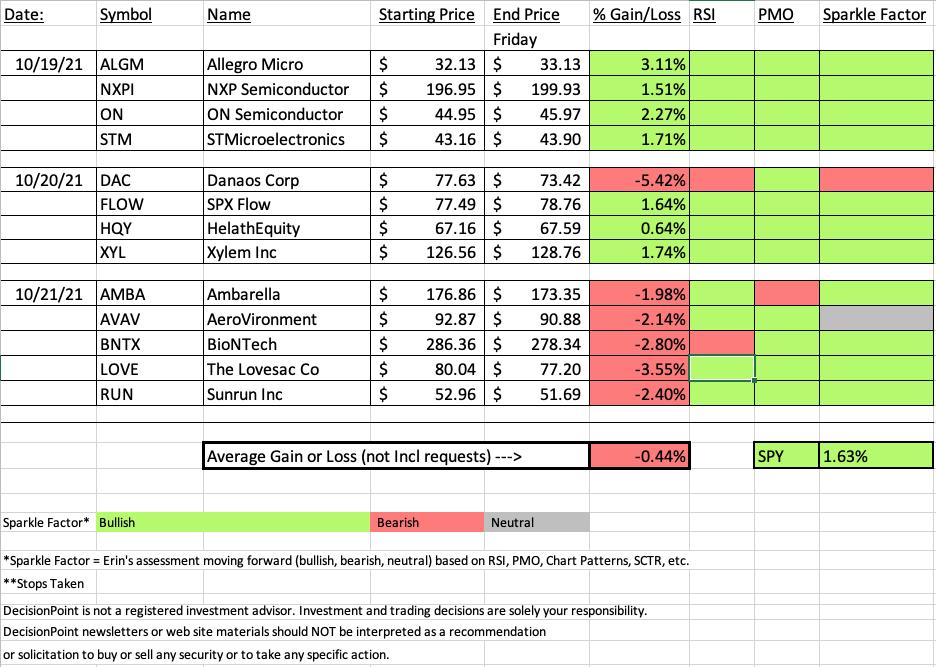

It was a pretty good week with "Diamonds in the Rough" from Tuesday and Wednesday performing well. Reader Requests yesterday turned out to be a bust and definitely were a drag on performance this week. This is not to say those requests were bad; we have to remember that those picks only get one day to look good on the spreadsheet. I also opted to choose them from the lists I was given, so I take responsibility which is why they are calculated into our percentage gain/loss on the week.

Semiconductors were certainly the bright spot this week. SOXX was up 1.7% on the week. I still like technology and this group should continue to outperform with Software.

The "Dud" this week was the Marine Transportation stock Danaos (DAC). Of course, I own it. However, not for long. I don't like how it is behaving. Based on the 5-minute candlestick I didn't sell it today and that turned out to be a good thing. On Monday I'll be watching for a good sell point. One did not come in today. It is the only stock this week that has a bearish Sparkle Factor, meaning I don't like it going forward.

The "Darling" this week was the Semiconductor stock Allegro Micro (ALGM) which was up +3.11% since Tuesday. All of the Tuesday tech stocks still look excellent.

The only other stock without a green (bullish) Sparkle Factor is AeroVironment (AVAV). I've marked it as "neutral" going forward, meaning it could go either way so you'll need to decide whether to hold it or sell it if you got in this week.

Hope everyone has a great weekend!

RECORDING LINK Friday (10/22):

Topic: DecisionPoint Diamond Mine (10/22/2021) LIVE Trading Room

Start Time : Oct 22, 2021 09:00 AM

Meeting Recording Link HERE.

Access Passcode: October@22

REGISTRATION FOR FRIDAY 10/29 Diamond Mine:

When: Oct 29, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/29/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (10/11) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Oct 18, 2021 09:00 AM

Meeting Recording LINK.

Access Passcode: October18!

For best results, copy and paste the access code to avoid typos.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

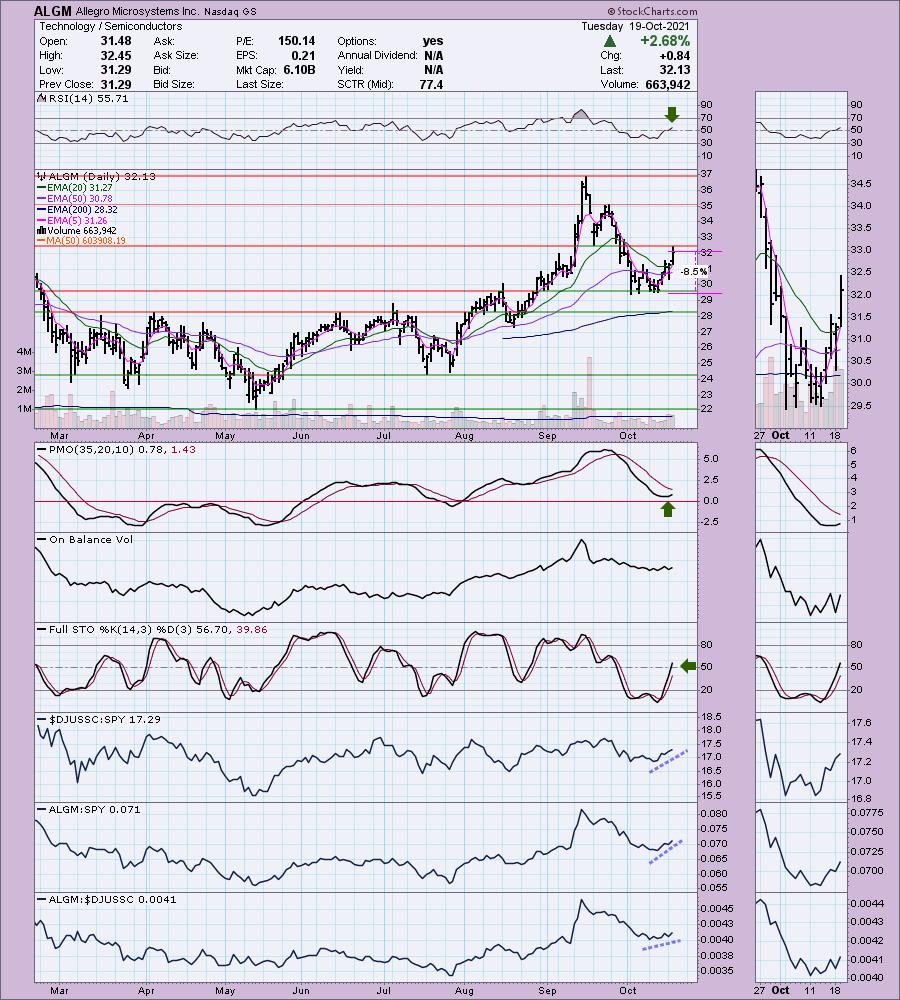

Darling:

Allegro Microsystems Inc. (ALGM)

EARNINGS: 10/28/2021 (BMO)

Allegro MicroSystems, Inc. develops semiconductor technology and application-specific algorithms. It provides current sensors, switches and latches, linear and angular position, and magnetic speed sensors. The firm designs, develops, fabless manufactures and markets of sensor ICs and application-specific analog power ICs enabling the emerging technologies in the automotive and industrial markets. The company was founded on March 30, 2013 and is headquartered in Manchester, NH.

Predefined Scans Triggered: P&F High Pole and Parabolic SAR Buy Signals.

Below are the commentary and chart from Tuesday (10/19):

"ALGM is unchanged in after hours trading. Price bounced off strong support earlier this month. There is a messy double-bottom here and price did break above the confirmation line today. It traded and closed above the 20-EMA, but it is now against resistance at that mid-September low. Given the positive RSI and rising PMO, I suspect we will see it break above this level. Stochastics are moving upward and are not overbought. Relative strength is beginning to improve for the Semiconductor industry group. ALGM is outperforming the SPY and is beginning to outperform its industry group. The stop is set below support at 8.5%."

Here is today's chart:

We have a new PMO crossover BUY signal to add another bullish characteristic to this already bullish chart. Stochastics are flattening but remain above 80. I would mind seeing more volume come in, but overall the chart remains positive.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Danaos Corp. (DAC)

EARNINGS: 11/8/2021 (AMC)

Danaos Corp. engages in the provision of marine and seaborne transportation services. It offers services by operating vessels in the containership sector of the shipping industry. The company was founded by Dimitris Coustas in1972 and is headquartered in Piraeus, Greece.

Predefined Scans Triggered: Bullish MACD Crossovers and P&F Double Top Breakout.

Below are the commentary and chart from Wednesday (10/20):

"DAC is down -0.04% in after hours trading. Price bounced off support at the May tops and has now vaulted both the 20/50-EMAs. The RSI just moved into positive territory and the PMO is turning up in oversold territory. Stochastics are rising strongly. You can see that relative performance is somewhat flat for the industry group, but it is beginning to trend higher this month. DAC is now outperforming both the group and the SPY. The stop is set just below the September intraday low at 6.8%."

Below is today's chart:

The PMO has flattened and could see a top soon. The RSI failed to stay in positive territory. Stochastics are turning down in neutral territory which could spell trouble. Relative performance is failing. I do own this one. My stop was nearly hit. The position is only down about 4.5% in my portfolio, but I'd like to access that money to buy a better looking chart.

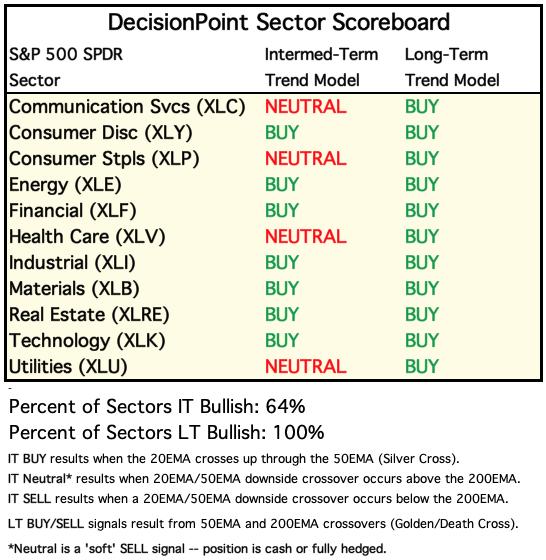

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

Short-term RRG: The sectors to watch based on the RRG would be XLRE, XLK and XLY. However, notice that XLU has turned around and is now moving in the bullish northeast direction. That implies new strength. Be careful with investments in XLC and XLP. XLE and XLF are weakening, but they are still fairly healthy.

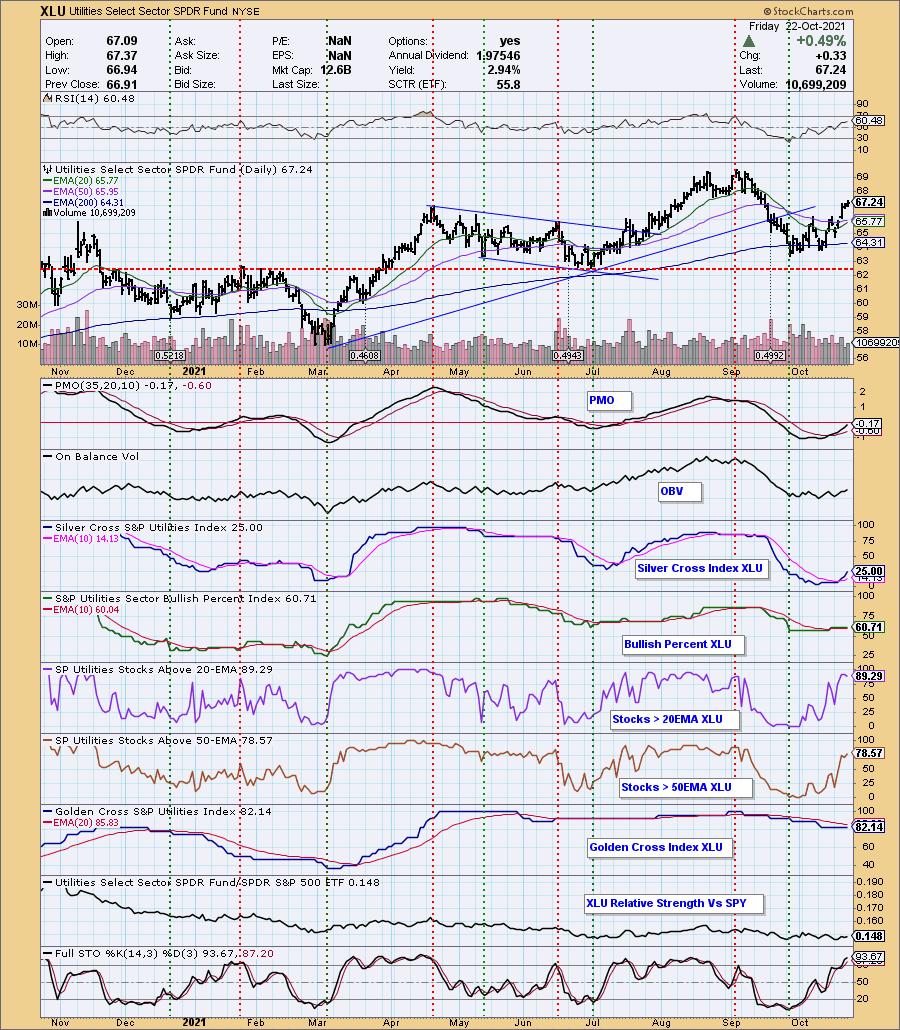

Sector to Watch: Utilities (XLU)

I've actually been avoiding this sector given rising energy costs. When I saw this chart, my concerns were allayed. Love the cup-shaped basing pattern that led XLU into this rally. The RSI is positive, the PMO is rising out of an oversold BUY signal. The SCI is what sold me here. Seeing it rising and noting participation is strong, the SCI should continue to rise. We may not be seeing relative strength right now, but Stochastics are looking bullish and XLU should give us an IT Trend Model "Silver Cross" BUY signal soon.

Industry Group to Watch: Water ($DJUSWU)

I didn't actually pick this industry group during the Diamond Mine today, but upon reviewing all four industry group charts in XLU, I liked the set-up best here. Price is still attempting to execute the double-bottom pattern. Price is above the 20/50-EMAs and we just got a ST Trend Model BUY signal as the 5-EMA just crossed above the 20-EMA. I like this group as it hasn't really broken out. Given the new PMO crossover BUY signal and rising Stochastics, I would look for good things to come from this group next week. (For the record, last week's industry group to watch was Specialty REITs. That group rallied strongly this week).

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! Next Diamonds Report is Tuesday 10/26.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 70% invested right now and 30% is in 'cash', meaning in money markets and readily available to trade with. I have moved primarily into energy and materials. I will be offloading a position or two next week that would bring my exposure to 60% or lower depending on how many and how much.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com