Reader requests came from a variety of sectors and industry groups. I picked the strongest charts based on my analysis process. It was interesting that the charts I favored were from a few industry groups we've looked at recently.

First is Renewable Energy. I'll be looking at Sunrun (RUN). I've presented it a number of times, so I'll include those links.

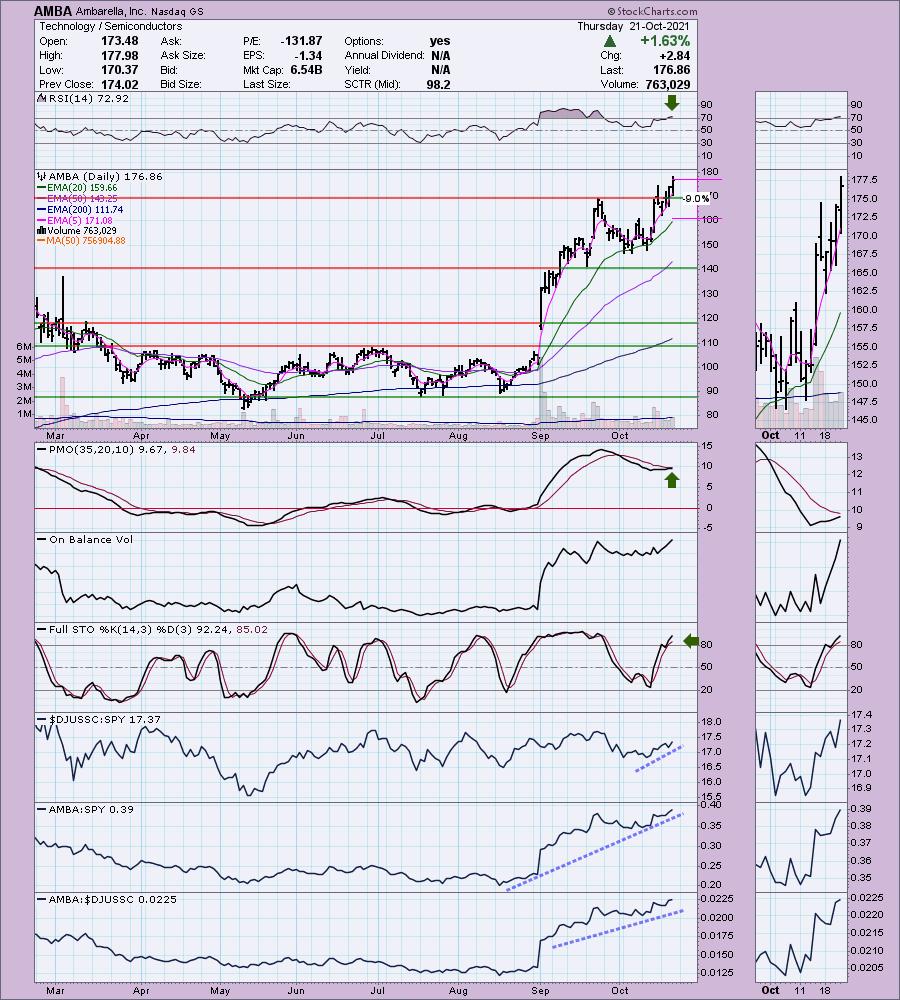

Another industry group? Semiconductors. I have one that was on my "Stocks to Review" that was requested, so I'll look at Ambarella (AMBA).

One of the others is from Furnishings in the Consumer Discretionary sector. The sector is booming right now in anticipation of strong holiday sales ahead.

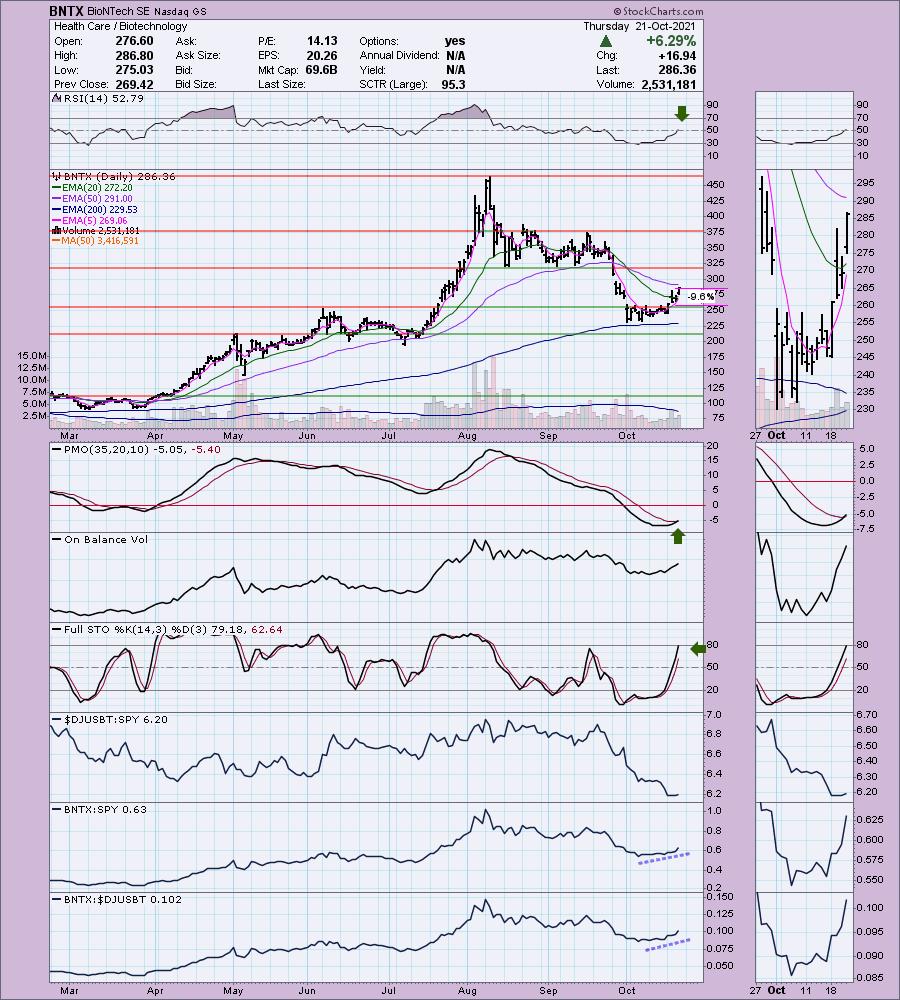

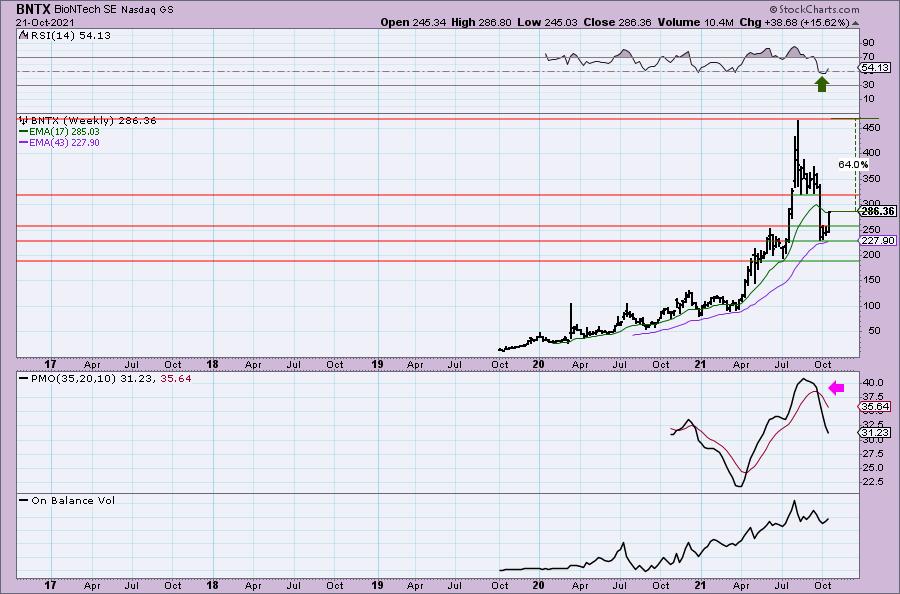

The other two are from Defense and Biotechnology. Biotechs aren't showing much strength now, but there are certainly pockets of strength and I liked the chart of BNTX. The Defense stock Aerovironment (AVAV) is looking strong on both the daily and weekly charts.

Don't forget to sign up for tomorrow's live Diamond Mine Trading Room! You can register here. The recording links will be in tomorrow's Diamonds Recap.

Today's "Diamonds in the Rough": AMBA, AVAV, BNTX, LOVE and RUN.

RECORDING LINK Friday (10/15):

Topic: DecisionPoint Diamond Mine (10/15/2021) LIVE Trading Room

Start Time : Oct 15, 2021 09:00 AM

Meeting Recording LINK.

Access Passcode: October$15

REGISTRATION FOR FRIDAY 10/22 Diamond Mine:

When: Oct 22, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/22/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (10/18) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Oct 18, 2021 09:00 AM

Meeting Recording LINK

Access Passcode: October18!

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "Diamonds in the Rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

Ambarella, Inc. (AMBA)

EARNINGS: 11/22/2021 (AMC)

Ambarella, Inc. engages in the development and sale of video compression, image processing, and computer vision solutions. It offers processors and software that cater to end markets including security cameras, automotive cameras, industrial and robotic applications, and consumer applications. The company was founded by Feng Ming Wang and Leslie D. Kohn on January 15, 2004 and is headquartered in Santa Clara, CA.

Predefined Scans Triggered: New 52-week Highs, Moved Above Upper Price Channel, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

AMBA is up +0.14% in after hours trading. I haven't covered AMBA before, but I did own it years ago during its parabolic run in 2014. One of my best trades ever. No promises this time around! I like Semiconductors right now and this is an excellent choice. Price continues to log new all-time highs on this recent rally. The RSI and Stochastics are overbought, so a pause may be ahead to get price from being so overbought. The PMO looks great as it moves in for a crossover BUY signal. Relative performance speaks for itself. I set a 9% stop level based on the early October top.

The weekly chart looks very bullish except that the weekly RSI is overbought. That's forgivable given it can stay there for weeks at a time.

AeroVironment Inc. (AVAV)

EARNINGS: 12/7/2021 (AMC)

AeroVironment, Inc. engages in the design, development, production, support and operation of unmanned aircraft systems and electric transportation solutions. The company was founded by Paul B. MacCready, Jr. in July 1971 and is headquartered in Arlington, VA.

Predefined Scans Triggered: Elder Bar Turned Blue and P&F Double Top Breakout.

AVAV is unchanged in after hours trading. We have a nice basing pattern. Price is nearing overhead resistance, but it handled resistance at the 50-EMA will little trouble. The RSI is positive and not overbought. The PMO is rising on an oversold BUY signal. I'd like to see the PMO hit positive territory. Volume has been good. Stochastics are overbought, but positive. The group is underperforming right now but we can see that AVAV is beginning to outperform it and most importantly, the SPY. The stop is thinner mainly because AVAV is on a LT Trend Model "Death Cross" SELL signal. I liked it up with the late September high.

The weekly PMO is turning up and the weekly RSI is headed toward positive territory. We have a very bullish falling wedge on the weekly chart. A breakout here could mean a trip back up to all-time highs.

BioNTech SE (BNTX)

EARNINGS: 11/9/2021 (BMO)

BioNTech SE is a next-generation immunotherapy company, which treats cancer and other serious diseases. It exploits an array of discovery and therapeutic drug platforms for the development of novel biopharmaceuticals. The company's portfolio of infectious disease and oncology product candidates include FixVac, iNeST (Individualized Neoantigen Specific Immunotherapy), Intratumoral Immunotherapies, RiboMabs, RiboCytokines, CAR T Cell Platform, T Cell Receptor(TCR), Checkpoint Immunomodulator, Targeted Cancer Antibodies, and Small Molecule Immunomodulators. The company was founded by Christopher Huber, Ozlem Tureci and Ugur Sahin on June 2, 2008 and is headquartered in Mainz, Germany.

Predefined Scans Triggered: P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

BNTX is down -0.45% in after hours trading. Not a surprise given the huge 6%+ rally today. The chart looks very good. The RSI just hit positive territory and the PMO just triggered a crossover BUY signal today. Stochastics are positive and rising strongly. The Biotech group isn't performing well, but BNTX is starting to outperform the SPY which is most important.

The weekly RSI just rebounded back into positive territory. Unfortunately the weekly PMO is declining on a SELL signal. Currently price is sitting above the 17-week EMA which is positive. Upside potential is excellent if we get the breakouts necessary.

The Lovesac Company (LOVE)

EARNINGS: 12/9/2021 (BMO)

The Lovesac Co. is a technology driven, omni-channel company. It designs, manufactures, and sells furniture comprised of modular couches called sactionals and foam beanbag chairs called sacs. Its products include sactionals, sacs, and accessories. The company was founded by Shawn David Nelson in 1995 and is headquartered in Stamford, CT.

Predefined Scans Triggered:Moved Above Upper Keltner Channel, P&F Double Top Breakout and P&F Triple Top Breakout.

LOVE is up +1.20% in after hours trading. The Consumer Discretionary sector has really heated up as I mentioned in the opening. We'll see how it looks tomorrow in the Diamond Mine but it could turn out to be the sector to watch next week. The RSI is positive, although getting overbought. The PMO has whipsawed back into a BUY signal which is very positive. Notice that the OBV made a new high with price. That's a confirmation. Stochastics are positive and moving higher. Relative performance is good across the board. The stop is set just below the early October high.

This is one of the more positive weekly charts today. The PMO is going in for a crossover BUY signal and the weekly RSI is positive and not overbought. Upside potential is great even if it just gets to all-time highs.

Sunrun Inc. (RUN)

EARNINGS: 11/4/2021 (AMC)

SunRun, Inc. engages in the design, development, installation, sale, ownership and maintenance of residential solar energy systems. It sells solar service offerings and install solar energy systems for homeowners through its direct-to-consumer channel. The firm also offers plans such as monthly lease, full amount lease, purchase system, and monthly loan. The company was founded by Edward H. Fenster, Robert N. Kreamer and Lynn M. Jurich in January 2007 and is headquartered in San Francisco, CA.

Predefined Scans Triggered: Moved Above Upper Keltner Channel, Moved Above Upper Price Channel and P&F Double Top Breakout.

RUN is down -0.11% in after hours trading. I've covered RUN twice before. First on November 19th 2020 (the position flew up 70% and then retraced and hit the stop level in March) and second on February 11th 2021 (the rally that led to the pick stalled and the stop was hit fairly quickly).

You can see why I have issues trusting rallies in Renewable Energy. It hasn't stopped me from entered a position in this group, but I always keep my finger on the trigger with it. We have a beautiful double-bottom that executed on the breakout above the confirmation line at the September high. This rally began with a beautiful positive OBV divergence. The PMO is rising on an oversold BUY signal and is not overbought. The RSI is positive and not yet overbought. Stochastics are overbought but rising and oscillating above 80. Relative performance of the group has been noticeable and RUN is performing well against both the group and the SPY. The stop is set just below the confirmation line of the double-bottom.

The weekly chart looks excellent. The weekly RSI just hit positive territory and the PMO has turned up. Upside potential is very tasty.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

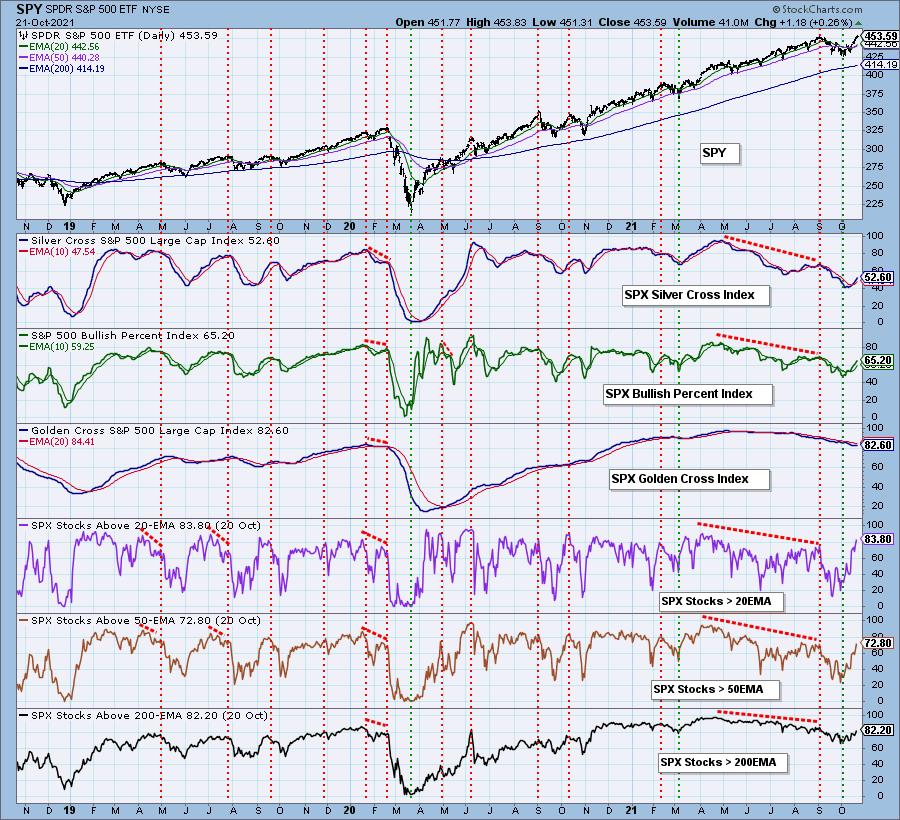

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm back to 85% invested and 15% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com