Our "Diamonds in the Rough" only had one to two days to ripen. In general we ended this short week with all but three positions up. I like every single one of these Diamonds moving forward, but as always I caution you on expanding your exposure right now. While I think we have another up day or two on the horizon, the intermediate-term picture is troubling. You can read more in today's DP Alert.

After reviewing all of the "Diamonds in the Rough" during today's Diamond Mine trading room, I like Discover Financial (DFS) best moving forward. It wasn't our "Darling" this week as it was only up 0.11%, but the chart looks great and it is in the Financial sector which is looking fairly bullish.

The actual "Darling" this week was Avangrid (AGR) as it was up +1.03% this week. This chart still looks excellent as well and would offer exposure in the runner-up Utilities sector. If I hadn't picked that sector last week, I would likely be presenting this week.

Hope everyone has a great Thanksgiving holiday! The next Diamonds report will be on Tuesday of next week.

RECORDING LINK Wednesday (11/24):

Topic: DP Diamond Mine (WEDNESDAY 11/24/2021) LIVE Trading Room

Start Time: Nov 24, 2021 08:59 AM

Meeting Recording Link.

Access Passcode: Turkey@24

REGISTRATION FOR Friday 12/3 Diamond Mine:

When: Dec 3, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (12/3/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (11/22) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Nov 22, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: November@22

For best results, copy and paste the access code to avoid typos.

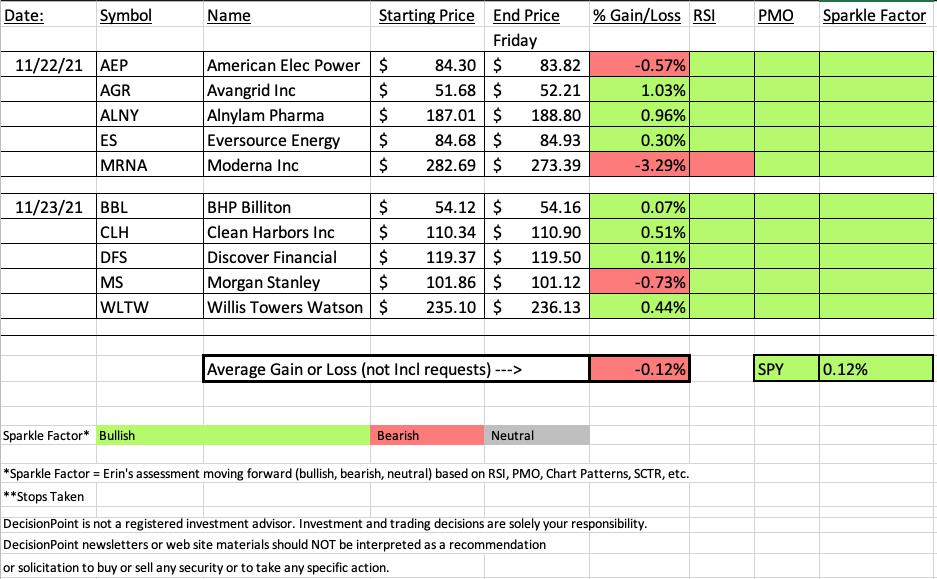

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

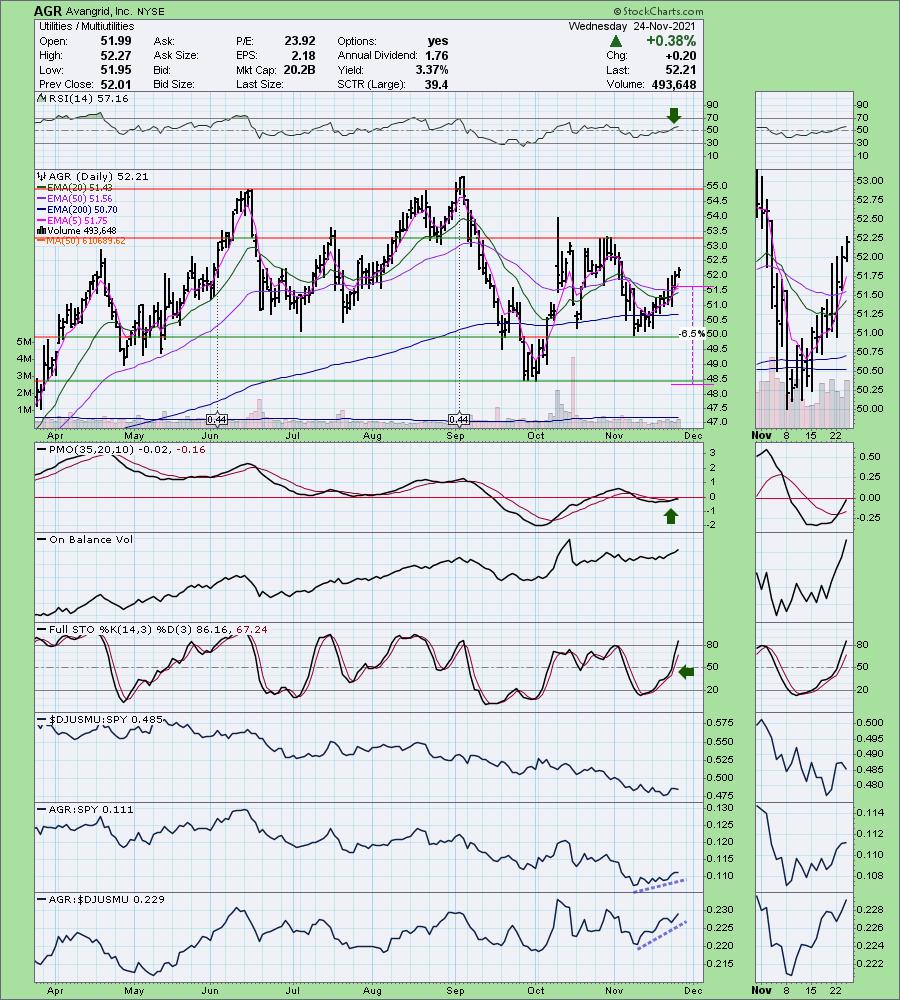

Avangrid, Inc. (AGR)

EARNINGS: 2/22/2022 (AMC)

Avangrid, Inc. engages in the energy transmission and gas distribution. It operates through the following segments: Networks, Renewables, and Other. The Networks segment includes energy transmission and distribution, electric transmission, and gas distribution activities. The Renewables segment relating to renewable energy, mainly wind energy generation and trading related with such activities. The Other segment covers miscellaneous corporate revenues including intersegment eliminations. The company was founded in 1852 and is headquartered in Orange, CT.

Predefined Scans Triggered: Bullish MACD Crossovers and Entered Ichimoku Cloud.

Below are the commentary and chart from Monday (11/22):

"AGR is down -0.81% in after hours trading, so we could see a nice entry tomorrow. I covered AGR in the June 15th 2021 Diamond Report. Sadly I picked it at the top so the 7.3% stop was eventually hit on the late September sell-off, but the position was never up by much. I don't think we're picking it at the top right now. It is in a nice rising trend and today closed above the 50-EMA. The RSI just hit positive territory and Stochastics are on their way to positive territory also. The PMO is nearing a crossover BUY signal. Despite the group underperforming, AGR has been outperforming the SPY as well as the group. It has a nice 3.41% yield and a stop below the September low at 6.5%."

Here is today's chart:

The chart continues to improve with the rally over the past two days since it was picked. The PMO should hit positive territory soon. The RSI remains positive and relative strength against the group and the SPY is just getting better. This could be a defensive position to consider.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

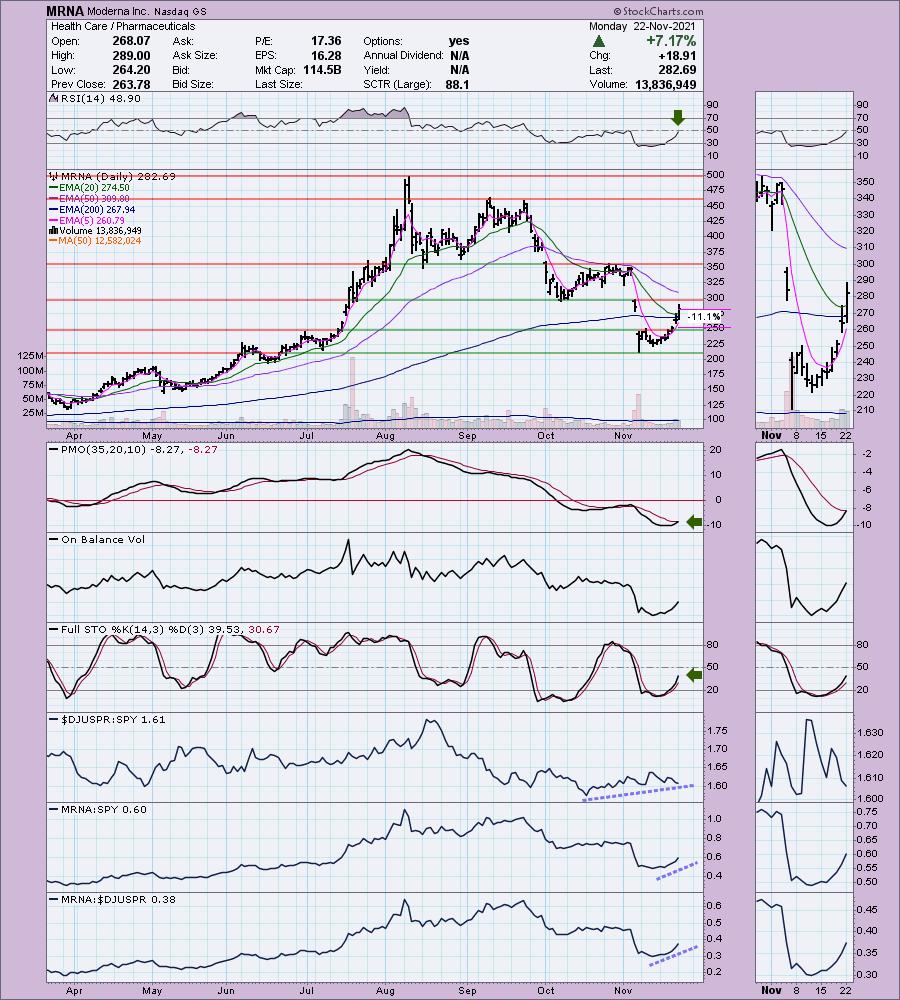

Dud:

Moderna Inc. (MRNA)

EARNINGS: 2/24/2022 (BMO)

Moderna, Inc. engages in the development of transformative medicines based on messenger ribonucleic acid (mRNA). Its product pipeline includes the following modalities: prophylactic vaccines, cancer vaccines, intratumoral immuno-oncology, localized regenerative therapeutics, systemic secreted therapeutics, and systemic intracellular therapeutics. The company was founded by Noubar B. Afeyan, Robert S. Langer, Jr., Derrick J. Rose and Kenneth R. Chien in 2010 and is headquartered in Cambridge, MA.

Predefined Scans Triggered: P&F Double Top Breakout.

Below are the commentary and chart from Monday (11/22):

"MRNA is up +0.36% in after hours trading. I covered MRNA on September 9th 2021 as a reader request that I liked. The timing was off on this one as the stop was hit on the late September decline. MRNA has been through the ringer. It is down almost 44% from the all-time high in August. This allows for plenty of upside potential. I talked about gaps earlier. MRNA just covered the second early November gap. It is coming up against gap resistance at the first November gap down, but the PMO is triggering a crossover BUY signal. The RSI is rising nicely and should hit positive territory above net neutral (50) soon. Stochastics are still in negative territory but are rising. The Pharma industry group is performing relatively well and MRNA is outperforming it as well as the SPY currently. This is a 'beat down' selection and price is well below the 50-EMA, so tread lightly. The stop had to be set deeply given today's 7%+ gain. You could make it tighter to match more closely with the 200-EMA."

Below is today's chart:

The chart hasn't really deteriorated that much. The RSI turned down in negative territory, but other than that I think there is still promise here. Gap resistance was broken and now price is pulling back to the 200-EMA. This is forming a tiny pennant on a flag pole. Generally closure of a gap results in follow-through. Stochastics are improving and the PMO is still rising. Today's 1%+ decline didn't bother the PMO or Stochastics at all. I would keep it on your watch list.

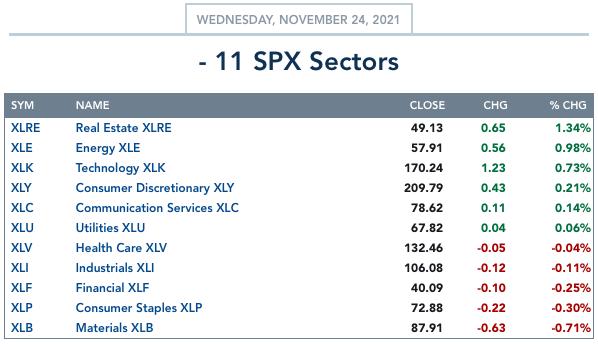

THIS WEEK's Sector Performance:

Since it is not technically the end of the week for trading, I don't have the weekly sector performance report. Below is today's results and performance.

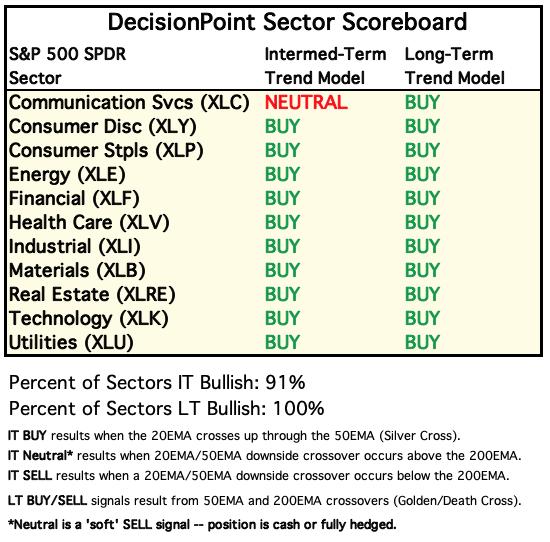

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

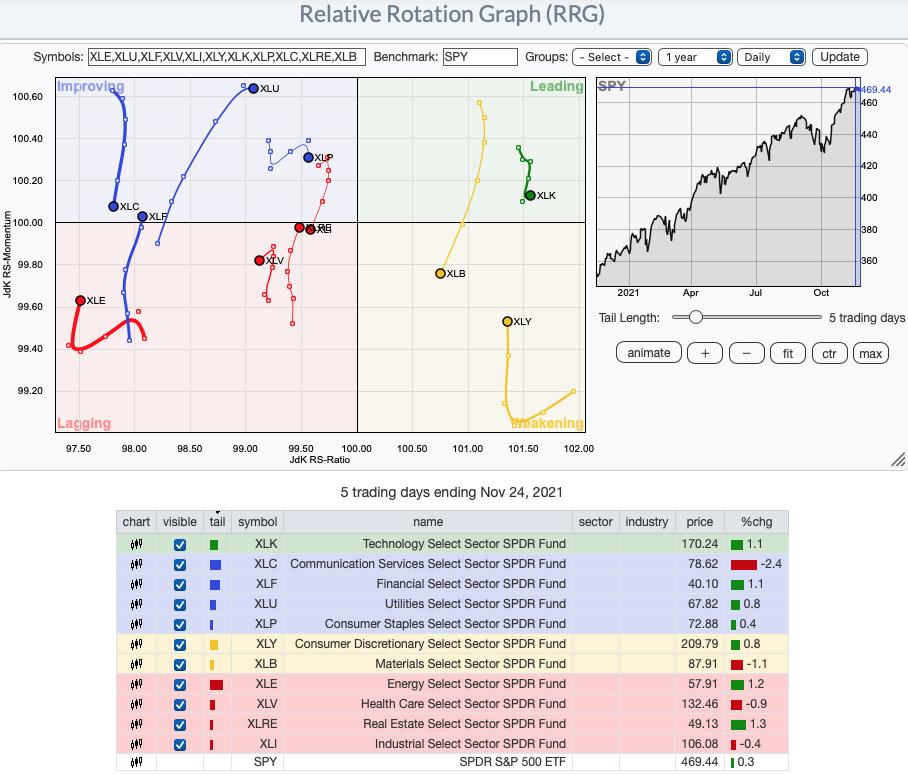

Short-term RRG: The sectors that I liked best when I reviewed their charts were XLU, XLF and XLRE. They are all traveling with a bullish northeast heading. However, the daily RRG also shows positive movement by XLF, XLY and XLE. XLC, XLI and XLV have the most bearish looking headings and positions. XLB is only in Weakening, but it also has a bearish southwest heading. XLK had been traveling south, but today has curled back up.

Intermediate-Term RRG: The weekly version shows that intermediate-term strength lies with with XLE, XLY, XLK, XLI and XLB. XLF is losing some steam but is still within Leading. XLU is beginning to move upward slightly and XLRE is heading northwest which is an improvement. Intermediate-term, I like XLK's position best given it hooked back around from Weakening and into Leading.

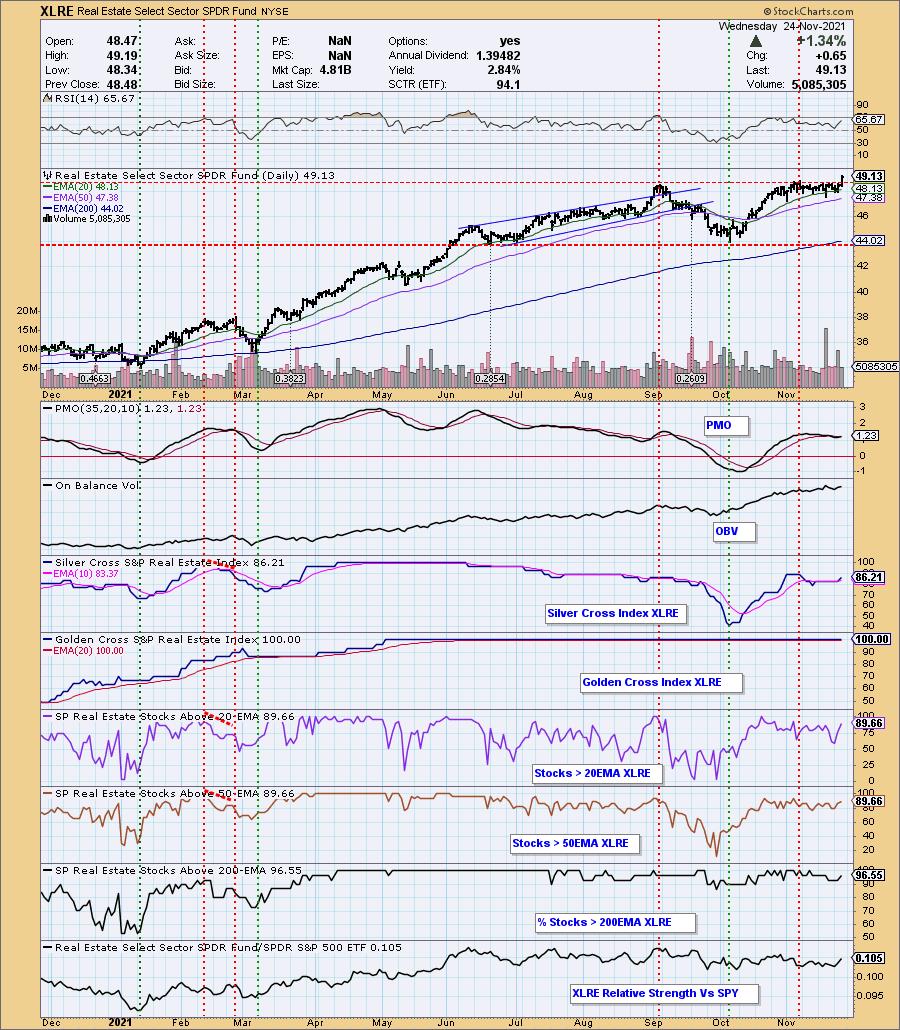

Sector to Watch: Real Estate (XLRE)

In today's Diamond Mine I stated that I needed to see the final participation numbers on XLU, XLRE and XLY to determine which I preferred. Today's upside breakout on XLRE combined with the whipsaw PMO BUY signal and improving participation made it an easy decision to choose XLRE. The SCI is rising and participation readings of stocks > 20/50-EMAs are higher than the SCI reading which tells us that the SCI will likely continue to rise. 100% of the sector stocks have bullish Golden Crosses (50-EMA > 200-EMA). %Stocks > 200-EMA is beginning to rise again. This is typically considered a defensive sector so I expect it to outperform should the market begin to decline as I expect.

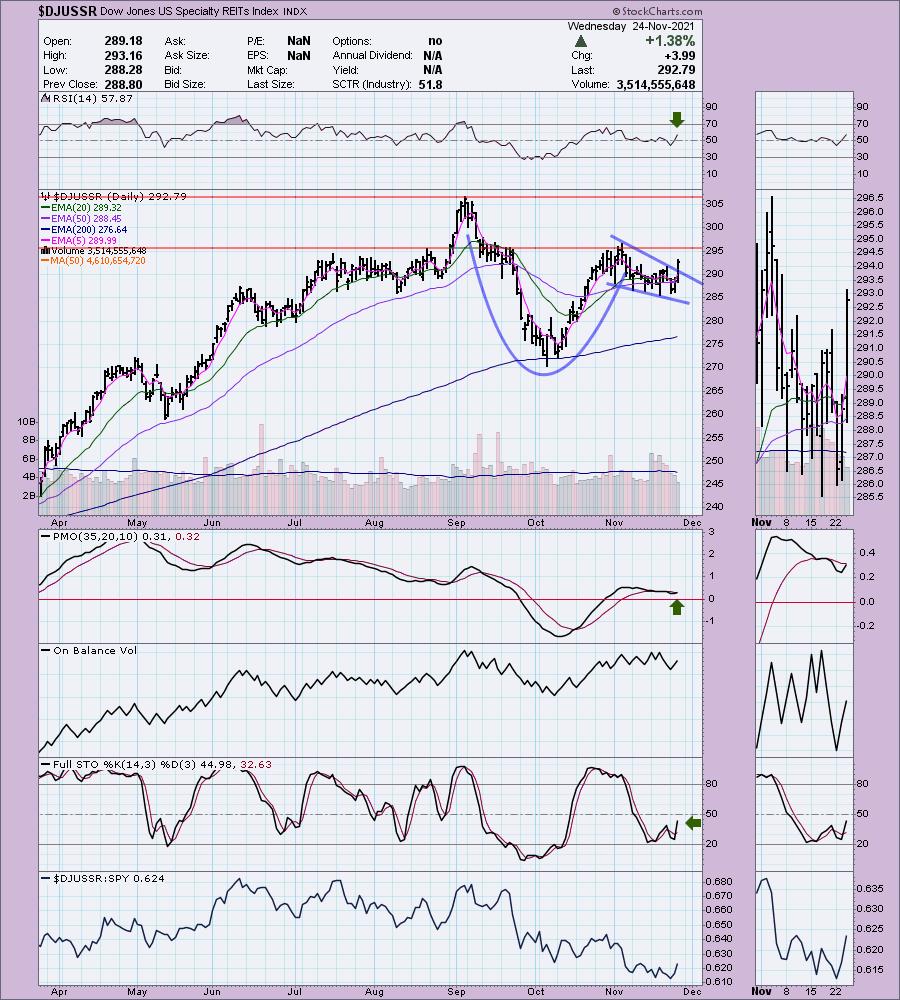

Industry Group to Watch: Specialty REITs ($DJUSSR)

This group had the second highest increase in its StockCharts Technical Rank (SCTR) of all industry groups. I really like the chart. We have a textbook cup with handle. The handle is a bullish falling wedge and today price cleanly broke out of the wedge. Granted overhead resistance is arriving soon, but between the pattern and the larger cup with handle, I don't expect it to have too much trouble. The RSI is positive and the PMO is about to trigger a crossover BUY signal. Stochastics have reversed although remain in negative territory below net neutral (50). Relative strength is beginning to rise.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! Remember, due to the Thanksgiving holiday next week, the next Diamonds Report is Tuesday 12/2.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 75% exposed to the market with trailing stops and hard stops on nearly every position.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com