I ran through all of my scans and found one bullish chart and one possible short. At this point, until I have a better selection, consider "Diamonds in the Rough" as watch list material. Increasing your exposure is dangerous right now. With fewer stocks/ETFs to choose from it tells me our probability of success is very low.

I did add a third stock on the "buy side". The one bullish stock I picked from the scans was a Home Builder so I decided to investigate and found one I like.

Looking for shorts was also a challenge, believe it or not. The "Diamond Dog" scan is not producing many results. As I noted yesterday, many of the 'dogs' are near support or simply don't have enough downside potential to make them a worthwhile risk.

Today's market decline appears to be a follow-on to yesterday's downside 'exhaustion' climax, so there is a possibility we will see a bit of a bounce before week's end. Overall, I think we should prepare for a very rocky December. "Diamonds in the Rough" are going to be difficult to come by, but I will continue to scour for the best possibilities.

I implore my readers to send me some requests for tomorrow. The pickings are slim and I'm very interested to see if you have any names I've missed. If not, I'll hope that my scans begin to produce. There's not much out there.

Today's "Diamonds in the Rough": NVR, HOV and YY (Short).

RECORDING LINK Wednesday (11/24):

Topic: DP Diamond Mine (WEDNESDAY 11/24/2021) LIVE Trading Room

Start Time: Nov 24, 2021 08:59 AM

MeetingRecording Link.

Access Passcode: Turkey@24

REGISTRATION FOR Friday 12/3 Diamond Mine:

When: Dec 3, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (12/3/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (11/22) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Nov 22, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: November@22

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

NVR, Inc. (NVR)

EARNINGS: 1/27/2022 (BMO)

NVR, Inc. engages in the construction and sale of single-family detached homes, townhomes and condominium buildings. It operates through the following segments: Homebuilding and Mortgage Banking. The Homebuilding segment sells and builds homes under the trade names Ryan Homes, NVHomes, Fox Ridge Homes and Heartland Homes. The Mortgage Banking segment provides mortgage related services to company's homebuyers. The company was founded in 1980 and is headquartered in Reston, VA.

Predefined Scans Triggered: None.

NVR is up +0.01% in after hours trading. I listed NVR first today because it was the Home Builder that came up in my scans. After seeing NVR was positive, I decided to look more closely at the industry group to see if there were other options as well. The majority of them were on PMO SELL signals or had topping PMOs. However, NVR (scan result) and HOV (visual search) had very positive configurations of the PMO and more. NVR had a strong upside breakout today which helped the PMO bottom above its signal line (a very bullish setup). Stochastics are moving sideways in positive territory and have turned up again. The RSI is positive and relative strength shows a top performer within a group that has relative strength (although like I said, I didn't see many in the group looking that positive). The stop is set at the 50-EMA. Admittedly this is a pricey stock, but many brokerages offer fractional shares.

You can see a bullish ascending triangle on the weekly chart that executed on today's breakout move. The weekly RSI is positive and the weekly PMO is nearing a crossover BUY signal. Since it is at new all-time highs, consider an upside target of about 15% at $6215.25.

Hovnanian Enterprises, Inc. (HOV)

EARNINGS: 12/9/2021 (BMO) ** Reports Next Week **

Hovnanian Enterprises, Inc. is a homebuilding company, which engages in the design, construct, market, and sell single-family attached town homes and condominiums, urban infill, and planned residential developments. It operates through the following segments: Homebuilding Operation, Financial Services, and Corporate. The Homebuilding Operation segment consists of the following geographical segments: Northeast, Mid-Atlantic, Midwest, Southeast, Southwest, and West. The Financial Services segment offers mortgage loans and title services to the customers of homebuilding operations. The company was founded by Kevork S. Hovnanian in 1959 and is headquartered in Matawan, NJ.

Predefined Scans Triggered: Moved Above Upper Bollinger Band, Moved Above Ichimoku Cloud, Moved Above Upper Price Channel, Parabolic SAR Buy Signals and P&F Double Top Breakout.

HOV is unchanged in after hours trading. This is one that I found perusing the industry group summary of stocks within Home Construction. It's been mostly range-bound since the summer, but is headed back to the top of the range again. It just broke above an already rising trend channel. The RSI is positive and rising. It is nearing an IT Trend Model "Silver Cross" BUY signal as the 20-EMA is nearing a positive crossover the 50-EMA. The PMO has just reached positive territory. Stochastics have turned up above net neutral (50). It is beginning to outperform and already strong group. The stop is set at the 50-EMA, but could be extended depending on your risk appetite.

The weekly chart is mixed. The weekly RSI just hit positive territory, but the weekly PMO is still in decline. This does look like a possible long-term bullish double-bottom in the making, but it's too early to bank on it. If it can reach the confirmation line of the double-bottom, that would be a 13% gain. If it can challenge all-time highs again, that's an over 48% gain.

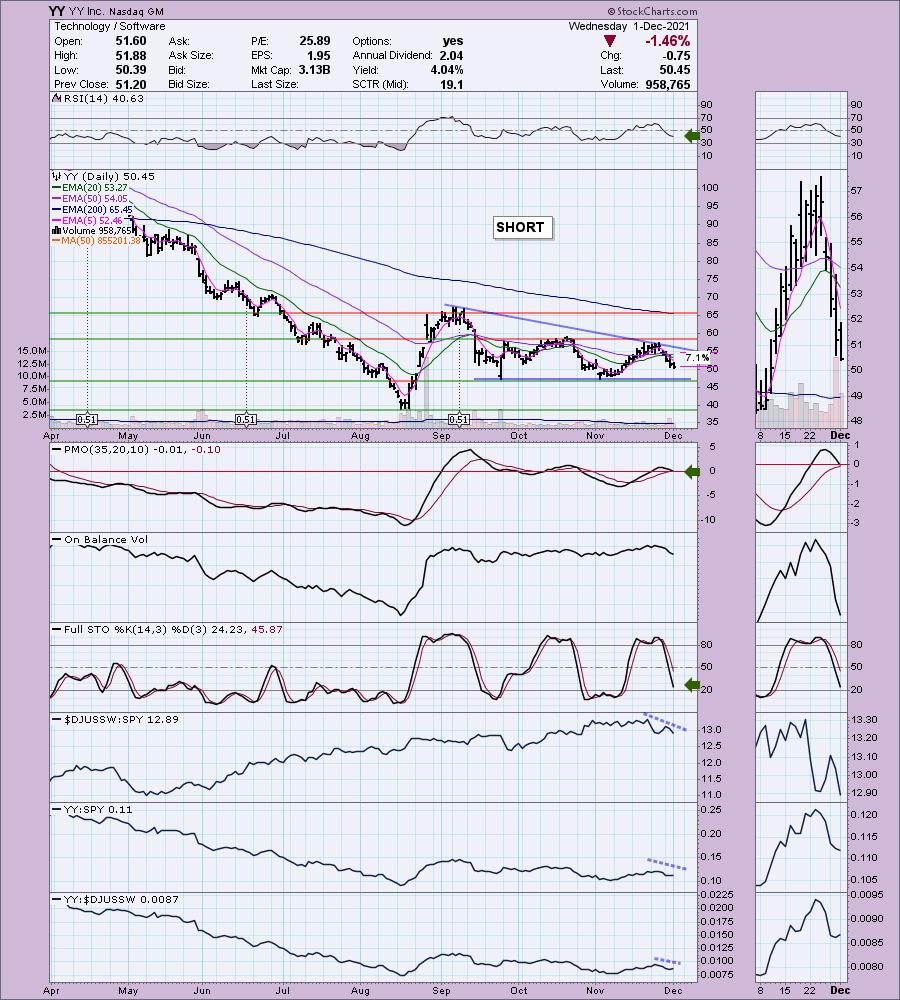

YY Inc. (YY) - Short

EARNINGS: 3/24/2022 (AMC)

JOYY, Inc. engages in managing a communication social platform, which enables users to join real-time online group activities through voice, text, and video. Its services include music and entertainment, online games, online dating, live game broadcasting, online education, and advertising. It operates through following segments: Live Streaming, Online Games, Membership and Others. The Live Streaming segment engages in the sales of in-channel virtual items used on live streaming platforms, including YY Live platform and Huya platform. The Online Games segment engages in the sales of in-game virtual items used for games. The Membership segment engages in the collection of membership subscription fees. The Others segment engages in the online education platform and online advertising and promotion. The company was founded by Xueling Li and Jun Lei in April 2005 and is headquartered in Singapore.

Predefined Scans Triggered: None.

YY is up +0.30% in after hours trading. There are a few reasons I opted to present this as a shorting opportunity. First, there is a bearish descending triangle formation that looks textbook. The EMAs are configured negatively with the fastest EMA on the bottom and the slowest on the top. The 20-EMA failed to cross above the 50-EMA. The PMO is about to trigger a SELL signal below the zero line. The RSI is negative and falling. Stochastics are pointed downward and are in negative territory. Relative strength has been trending lower overall for the group and the stock. The stop is set moving upward since this is a short. If it gets past the 50-EMA, it's probably wise to let it go.

There is a reverse flag formation with a pennant instead of flag. A pennant is essentially a symmetrical triangle. These are continuation patterns and since the prior trend was a decline, the expectation is a breakdown. The weekly RSI is negative and falling and the weekly PMO has turned down. If it falls to support, that's a 22% gain.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

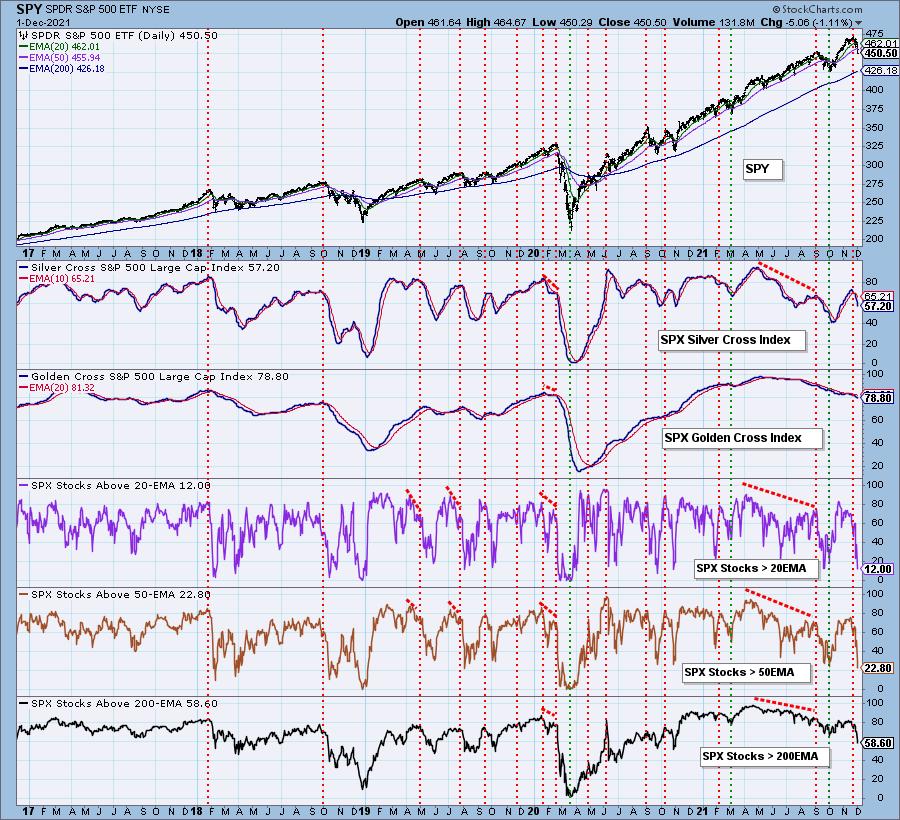

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 20% invested and 80% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com