The market is beginning to pull back in earnest and as a consequence, the scan results continue to be very thin. I had a total of 30 charts to look at today versus well over 100 charts on a normal day. This alone tells us to tread carefully.

I've added the extra week to all of your subscriptions. You should be able to view this using the "Manage Account" link when you click the person icon in the upper righthand corner.

Mother-in-law still taking up much of my time, but as noted yesterday, publishing will still occur but it may mean reports arriving later than usual like today. Rest assured you will always have your DP Diamonds reports and DP Alert reports before market open the next day.

Today's "Diamonds in the Rough": CGEM, LANC and SRRA.

Stocks to Review: FAST and UDR.

RECORDING LINK (3/18/2022):

Topic: DecisionPoint Diamond Mine (3/18/2022) LIVE Trading Room

Start Time: Mar 18, 2022 09:00 AM

MeetingRecording Link.

Access Passcode: March$18

REGISTRATION FOR Friday 4/8 Diamond Mine:

When: Apr 8, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (4/8/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (4/4) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Apr 4, 2022 08:59 AM

Meeting Recording Link.

Access Passcode: April#4th

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Cullinan Management Inc. (CGEM)

EARNINGS: 5/13/2022 (BMO)

Cullinan Oncology, Inc. is a biopharmaceutical company engaged in developing oncology and immuno-oncology therapies. The company was founded by Patrick R. Baeuerle on September 15, 2016 and is headquartered in Cambridge, MA.

Predefined Scans Triggered: P&F Low Pole.

CGEM is unchanged in after hours trading. This is probably the stock pick with the most risk as far as volatility. It is a somewhat low volume and low priced stock. Price hasn't broken above the 50-day EMA since last year so it is at strong resistance and needs to breakout. The RSI is positive and rising. The PMO just triggered a crossover BUY signal. Stochastics are accelerating higher in positive territory. We have a positive OBV divergence and relative strength is acceptable. The stop is set below the 20-day EMA.

There is a strong OBV positive divergence on the weekly chart as well. The weekly RSI is negative, but rising. The weekly PMO is rising. There isn't much PMO data to look at so we have to go with the fact it is rising right now. If it can reach the 2021 high that would be a 43% gain.

Lancaster Colony Corp. (LANC)

EARNINGS: 5/4/2022 (BMO)

Lancaster Colony Corp. engages in the manufacture and sale of specialty food products. It operates through the following segments: Retail and Foodservice. The Retail and Foodservice segments focus on the manufacture and sale of frozen breads, refrigerated dressings, dips and shelf-stable dressings, and croutons under the brand names New York BRAND Bakery, Sister Schubert's, Marzetti Frozen Pasta, and Flatout. The company was founded in 1961 and is headquartered in Westerville, OH.

Predefined Scans Triggered: None.

LANC is unchanged in after hours trading. This is another stock that needs to breakout, but I like that I can set a thin stop below the March low. There is a positive OBV divergence and the PMO just triggered a crossover BUY signal. The RSI just hit positive territory. Stochastics look pretty good, but have begun to decelerate a bit. Relative strength is positive.

LANC is at the bottom of the trading range established in late 2021. I don't care for the weekly RSI, but it is drifting slightly higher. The weekly PMO is about to reverse into a crossover BUY signal. If it can reach the 2018 high, that would be a nice 18.8% gain.

Sierra Oncology, Inc. (SRRA)

EARNINGS: 5/5/2022 (BMO)

Sierra Oncology, Inc. is a clinical stage drug development company of therapeutics for the treatment of cancer. The firm focuses on advancing targeted therapeutics for the treatment of patients with significant unmet medical needs in hematology and oncology. Its product Momelotinib, a selective and orally-bioavailable JAK1, JAK2 & ACVR1 inhibitor with a differentiated therapeutic profile in myelofibrosis encompassing robust constitutional symptom improvements. The company was founded in May 2003 and is headquartered in San Mateo, CA.

Predefined Scans Triggered: Stocks in a New Uptrend (Aroon), Improving Chaikin Money Flow, Moved Above Upper Keltner Channel, New 52-week Highs, Moved Above Upper Bollinger Band, Moved Above Upper Price Channel, P&F Ascending Triple Top Breakout and P&F Double Top Breakout.

SRRA is up +1.96% in after hours trading. I think this is the most predefined scan triggers I have ever seen since I began doing this. If that is any indication, this could be a good one. I like that it has already broken out to new 52-week highs. The RSI is positive and not overbought. The PMO is nearing a crossover BUY signal. Stochastics just reached above 80 and relative strength is quite strong. I set the stop at the bottom of today's trading range.

The weekly RSI is overbought, but has been most of 2022. The weekly PMO is rising on a crossover BUY signal. I went with a somewhat conservative upside target at $60.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

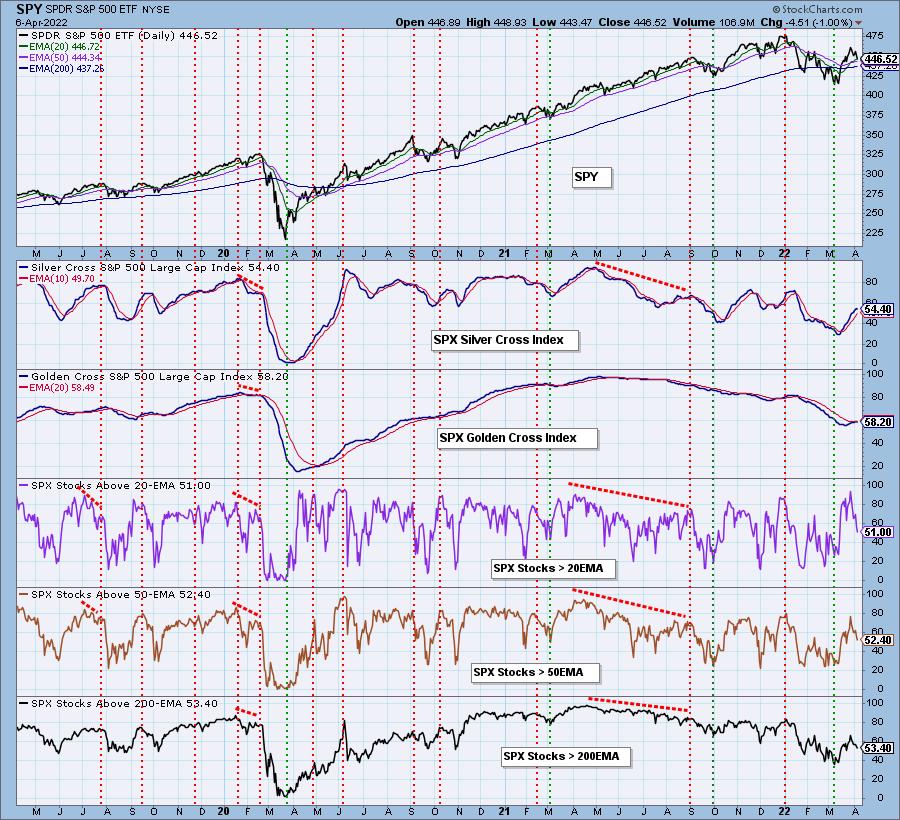

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% invested and 85% is in 'cash', meaning in money markets and readily available to trade with. I'm not comfortable with adding positions, particularly since the pickings are so slim.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Good Luck and Good Trading!

- Erin

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com