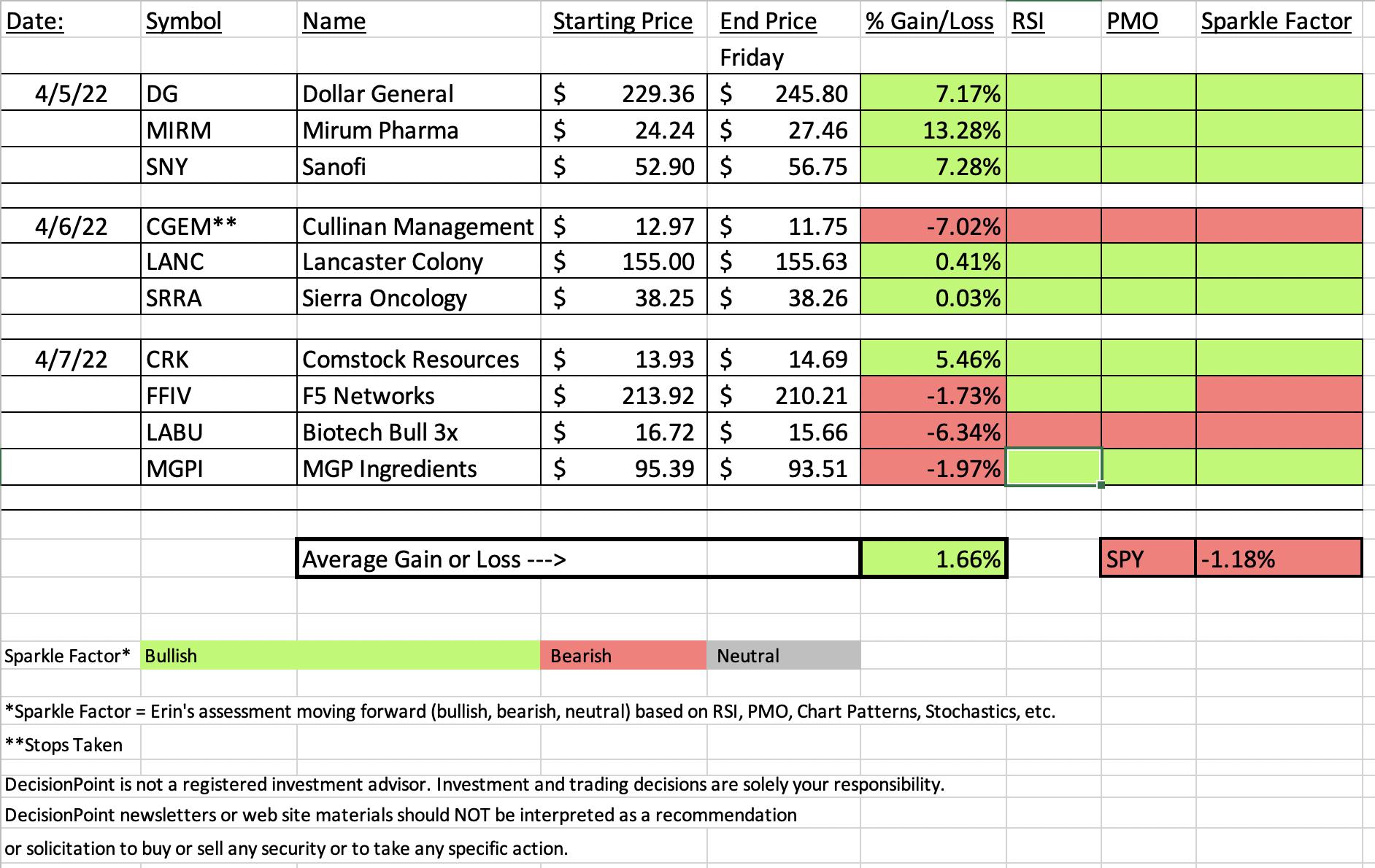

I was very pleased to see the performance of this week's "Diamonds in the Rough". This week "Diamonds in the Rough" finished +2.8% higher than the SPY. A stop did have to be taken on one of the positions and three of the ten don't look good moving forward.

This week's Dud is the stock that we did have to take that stop on. CGEM is a pharmaceutical and the others we picked did very well. This one was in a bear market configuration but had huge upside potential.

This week's Darling was also a pharmaceutical stock and it was up over +13% since Tuesday. MIRM is now showing overbought, but it looks very positive going forward.

In today's Diamond Mine we observed that Energy (XLE) looks very good going into next week. After consolidating it broke out today and indicators are looking very good. The industry group to watch is Integrated Oil & Gas, but I must say that all of the groups within Energy look very positive.

I was interviewed by Ike Iossif of MarketViewsTV this morning and I brought Exxon-Mobil (XOM) as my "Diamond of the Week". You'll have to review that chart!

You'll find the recording of today's Diamond Mine trading room below, as well as the link to register for next week's. Remember that these links are in every DP Diamonds Report. The recording link for the Free DP Trading Room is always listed below too.

Have a great weekend!

Erin

RECORDING LINK (4/8/2022):

Topic: DecisionPoint Diamond Mine (4/8/2022) LIVE Trading Room

Start Time: Apr 8, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: April#8th

REGISTRATION FOR Friday 4/15 Diamond Mine:

You are invited to a Zoom webinar.

When: Apr 15, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (4/15/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (4/4/2022) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Apr 4, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: April#4th

For best results, copy and paste the access code to avoid typos.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Mirum Pharmaceuticals Inc. (MIRM)

EARNINGS: 5/5/2022 (AMC)

Mirum Pharmaceuticals, Inc. is a biopharmaceutical company. The firm focuses on the development and commercialization of a late-stage pipeline of novel therapies for debilitating liver diseases. Its products include Maralixibat and Volixibat. The company was founded by Niall O'Donnel, Michael Grey and Christopher Peetz in May 2018 and is headquartered in Foster City, CA.

Predefined Scans Triggered: New 52-week Highs and Stocks in a New Uptrend (Aroon).

Below are the commentary and chart from Tuesday 4/5:

"MIRM is unchanged in after hours trading. We had an "almost" breakout today. Price popped above overhead resistance but was pulled lower and closed beneath. The chart suggests it will breakout given the positive RSI and nearing PMO crossover BUY signal. Stochastics are rising strongly and should get above 80 soon. Relative performance is fairly good and it is improving. The stop is set below the 20-day EMA."

Here is today's chart:

Price continues to log new highs and today we have a bullish engulfing candlestick that suggests we will see more upside on Monday. The problem I see is an overbought RSI, but in February it spent some time in overbought territory and didn't sustain too much damage on the pullback to support at the September high. I expect higher prices next week.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

Cullinan Management Inc. (CGEM)

EARNINGS: 5/13/2022 (BMO)

Cullinan Oncology, Inc. is a biopharmaceutical company engaged in developing oncology and immuno-oncology therapies. The company was founded by Patrick R. Baeuerle on September 15, 2016 and is headquartered in Cambridge, MA.

Predefined Scans Triggered: P&F Low Pole.

Below are the commentary and chart from Wednesday (4/6):

"CGEM is unchanged in after hours trading. This is probably the stock pick with the most risk as far as volatility. It is a somewhat low volume and low priced stock. Price hasn't broken above the 50-day EMA since last year so it is at strong resistance and needs to breakout. The RSI is positive and rising. The PMO just triggered a crossover BUY signal. Stochastics are accelerating higher in positive territory. We have a positive OBV divergence and relative strength is acceptable. The stop is set below the 20-day EMA."

Here is today's chart:

Given that the 50-day EMA was so far below the 200-day EMA, we did start off somewhat handicapped on this one. I mentioned that this one needed to breakout to really be viable and it didn't. The chart went south very quickly after failing at resistance of 50-day EMA. The RSI dropped and the PMO has topped. Stochastics have topped but do remain above 80, so it could certainly turn around here; I just don't think it is likely.

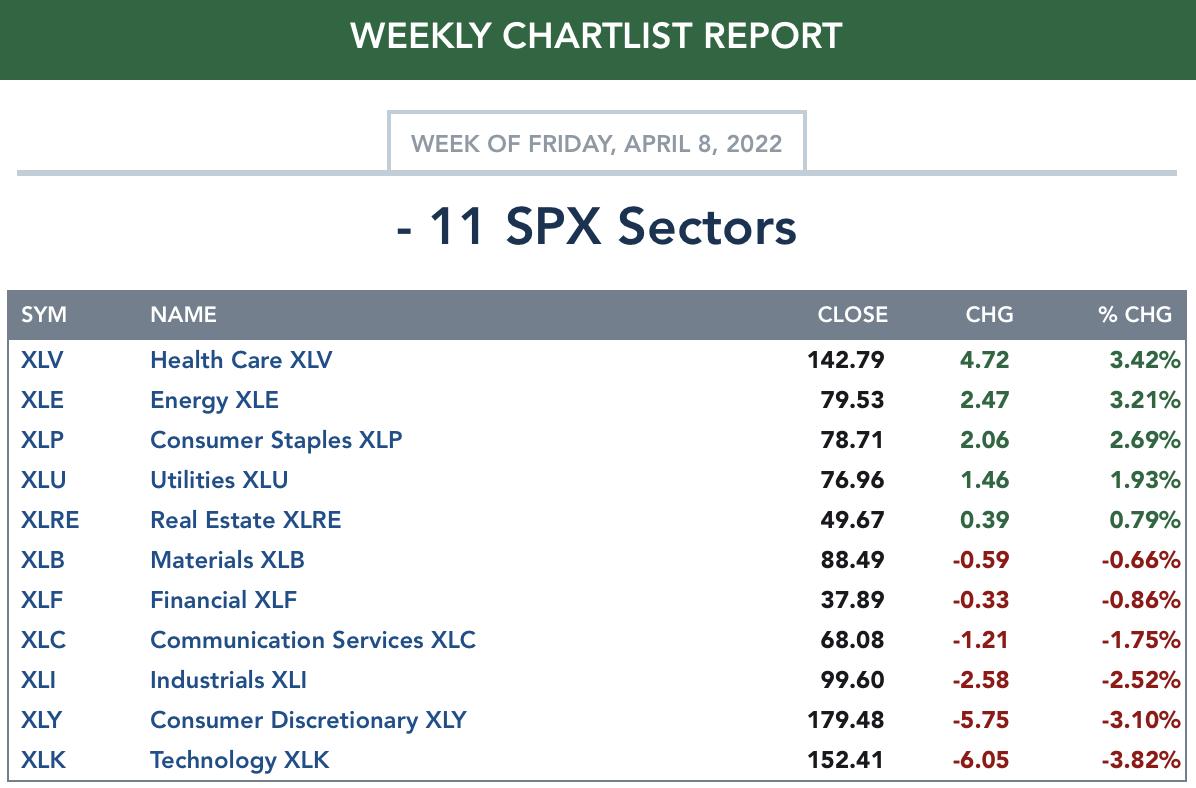

TODAY'S Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

Short-term (Daily) RRG:

What is most remarkable about the short-term RRG is that all of the best relative performers are defensive sectors, Utilities (XLU), Real Estate (XLRE), Healthcare (XLV) and Consumer Staples (XLP). When defensive areas of the market begin leading, that is generally a sign of future broad market decline.

Aggressive sectors, Technology (XLK), Consumer Discretionary (XLY) and Communication Services (XLC) are the most bearish. XLY is particularly bearish given it has entered the Weakening quadrant and XLC isn't as bearish given it still has an eastward heading and is in the Improving quadrant.

XLB was in Leading most of the week, but has reversed and is now in the Weakening quadrant. This could be due to the slight decline in Gold and Gold Miners that we saw this week.

XLF, XLE and XLI are the most bearish given their residence in the Lagging quadrant and bearish westward headings.

Intermediate-Term (Weekly) RRG:

Interestingly when we move the timeframe out, the picture is similar with a change in leadership. I still see Utilities (XLU), Healthcare (XLV) and Real Estate (XLRE) as being the most bullish given their headings are taking them further into the Leading quadrant but we can also add Materials (XLB) in this timeframe.

XLE looks much better on the intermediate term chart as it resides in the Leading quadrant and is very far from the center of the graph (that represents the benchmark SPY). It does have a southward heading and is showing some signs of intermediate-term weakness.

Most bearish are XLC, XLF and XLI, in that order. XLC just dropped back into the Lagging quadrant and has a bearish southwest heading that will take it further into Lagging. XLF has a bearish southwest heading, but it is only in the Weakening quadrant. XLI has a bearish southwest heading, but it is still in the Leading quadrant.

Aggressive sectors XLK and XLY have been Lagging for weeks, but they are showing slight improvement with a more northward heading.

That leaves XLP. It is hanging onto the Leading quadrant, but has a bearish southwest heading that will take it into "Weakening" soon. Still, "Weakening" is better than "Lagging".

RRG® charts show you the relative strength and momentum for a group of stocks. Stocks with strong relative strength and momentum appear in the green Leading quadrant. As relative momentum fades, they typically move into the yellow Weakening quadrant. If relative strength then fades, they move into the red Lagging quadrant. Finally, when momentum starts to pick up again, they shift into the blue Improving quadrant.

CLICK HERE for an animated version of the RRG charts.

Sector to Watch: Energy (XLE)

After consolidating for weeks, XLE is finally breaking out. Sure, it could be a takeout breakout, but the indicators are very favorable. The RSI is positive and not overbought, the PMO is rising toward a crossover BUY signal and Stochastics have turned up in positive territory. What's most impressive are the participation numbers. Every participation indicator is reading at 100%! This means that EVERY Energy stock not only has a "Silver Cross" and "Golden Cross" in effect, EVERY stock has price above the 20/50/200-day EMAs. Strength begets strength and that is what I'm counting on for this "Sector to Watch".

Industry Group to Watch: Integrated Oil & Gas ($DJUSMS)

Honestly I like all of the industry groups in the Energy sector. All of the group charts are showing breakouts. I like the upside breakout from the symmetrical triangle. They are continuation patterns and it is being confirmed with today's breakout. The RSI is positive and not overbought. The PMO is flat but ready to turn back up. Stochastics are rising and should reach above 80 next week. It is now beginning to outperform the SPY.

I don't usually do this, but since I had the interview this morning and had to bring a "Diamond of the Week", I'll present it here. We have a nifty breakout, a positive/rising RSI and a nearing PMO crossover BUY signal. It is beginning to outperform along with the industry group. I also can set a tight stop at -5.9% or I could stretch it a bit more to align with the late March low.

Go to our Sector ChartList on DecisionPoint.com to get an in-depth view of all the sectors.

Have a great weekend! The next Diamonds Report is TUESDAY (4/12).

- Erin

erin@decisionpoint.com

Full Disclosure: I'm 15% exposed to the market.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball. --Carl Swenlin

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2022 DecisionPoint.com