The market is continuing lower as aggressive sectors continue lower. Today there was a clear theme in the scan results. The first was Consumer Discretionary (XLY) stocks and the second was Metals and Mining. I don't trust XLY. The scan results were not focused on any particular industry group within Discretionary and overall the XLY chart is not favorable. I opted not to include any Discretionary stocks because the sector is showing a clear lack of participation internally.

I am still seeing a lack of scan results in general, so I don't have any "Stocks to Review" today.

** IMPORTANT regarding Diamond Mine this week**

As usual I didn't realize I had Friday off until yesterday. Therefore, I have moved Friday's Diamond Mine to Thursday morning. There will only be six stocks to follow-up on (Tue/Wed picks). I'm keeping Reader Request Day on Thursday per usual, but I'm opting to skip the Recap this week in order to provide you the ten picks I promise. Email if you have questions.

Friday we discussed Energy as the sector to watch. It had a bad day yesterday, but Oil broke out strongly today. I believe positions in this sector should weather the storm in the intermediate term unless the wind changes direction.

Today's "Diamonds in the Rough": HESM, PAAS and SLV.

RECORDING LINK (4/8/2022):

Topic: DecisionPoint Diamond Mine (4/8/2022) LIVE Trading Room

Start Time: Apr 8, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: April#8th

REGISTRATION FOR **THURSDAY** 4/14 Diamond Mine:

When: Apr 14, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (4/14/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (4/11) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Apr 11, 2022 09:00 AM

Meeting Recording Link.

Access Passcode: April@11

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Hess Midstream Partners LP (HESM)

EARNINGS: 4/27/2022 (BMO)

Hess Midstream LP engages in the ownership, development, and acquisition of midstream assets to provide services to third-party crude oil and natural gas producers. It operates through the following segments: Gathering, Processing and Storage, and Terminaling and Export. The Gathering segment consists of natural gas and crude oil gathering and compression. The Processing and Storage segment includes the Tioga gas plant, equity investment in the Little Missouri (LM4) joint venture and mentor storage terminal. The Terminaling and Export segment consists of the Ramberg terminal facility, Tioga rail terminal, crude oil rail cars and Johnson's corner header system. The company was founded on January 1, 2014 and is headquartered in Houston, TX.

Predefined Scans Triggered: Moved Above Upper Bollinger Band and Moved Above Upper Price Channel.

HESM is up +0.06% in after hours trading. I covered HESM previously on February 24th 2022. The position is still open and is up a modest +6.81%. Note the very high yield! When I covered it yesterday on the DP Show, it hadn't confirmed the bullish double-bottom pattern; today it has. The minimum upside target is at $33.75, but I believe it is going to at least test the March high. The RSI is positive and the PMO has just triggered a new crossover BUY signal. Stochastics are above 80 and relative strength of the group and HESM is positive. The stop is set near the 50-day EMA. You could widen the stop, but I wouldn't want it if the double-bottom pattern is busted.

The weekly chart is strong. The weekly PMO has bottomed above its signal line and the weekly RSI is positive. It's less than 10% away from all-time highs so consider an upside target of 14% around $37.37.

Pan American Silver Corp. (PAAS)

EARNINGS: 5/11/2022 (AMC)

Pan American Silver Corp. engages in the exploration, development, extraction, processing, refining, and reclamation of mineral properties. It owns and operates silver mines located in Peru, Mexico, Argentina, and Bolivia. The firm operates through the following segments: Silver, Gold, and Other. The company was founded by Ross J. Beaty and John J. Wright in April 1994 and is headquartered in Vancouver, Canada.

Predefined Scans Triggered: P&F Bear Trap, P&F Double Top Breakout and P&F Triple Top Breakout.

PAAS is up +0.48% in after hours trading. I covered PAAS on July 16th 2020. After peaking at a gain of 21%, the position was eventually stopped out months later. Today price poked above overhead resistance at $29. Prior to this breakout, we had a flat top and rising bottoms that formed a bullish ascending triangle. We should expect higher prices. The RSI is positive and the PMO is nearing a crossover BUY signal. The PMO is on the overbought side, but I expect it to continue higher with price. Stochastics are now above 80 and relative strength against the SPY is very good. It is performing in line with its industry group which has been outperforming since January of this year. The stop is set beneath the September/October highs. It's yield is good.

We can see that PAAS broke from a bullish falling wedge and is now above resistance at late 2020/early 2021 lows. The weekly RSI is positive and I see that the 17-week EMA has crossed above the 43-week EMA. The weekly PMO is rising and now in positive territory. I also spot a positive OBV divergence that led into this rally as well. Upside potential is about 35%.

iShares Silver Trust (SLV)

EARNINGS: N/A

SLV tracks the silver spot price, less expenses and liabilities, using silver bullion held in London. For more information click here.

Predefined Scans Triggered: New CCI Buy Signals and P&F Double Top Breakout.

SLV is unchanged in after hours trading. I covered SLV on December 21st 2020 (position stopped out in mid-2021) and January 19th 2022 (Position stopped out). Price is about to breakout above resistance at the November top. The RSI has now entered positive territory and the PMO has turned back up. Volume is coming in strong. Stochastics are now above 80 and it is beginning to outperform the market. A thin stop of 5.7% could even be tightened more if you want less risk.

* FULL DISCLOSURE: I own SLV.

The weekly chart looks excellent. Price broke above resistance at the first quarter 2021 low and then pulled back and bounced back up. The weekly RSI is positive and the weekly PMO is on an oversold BUY signal and is rising in positive territory. Upside target is at the 2021 high.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

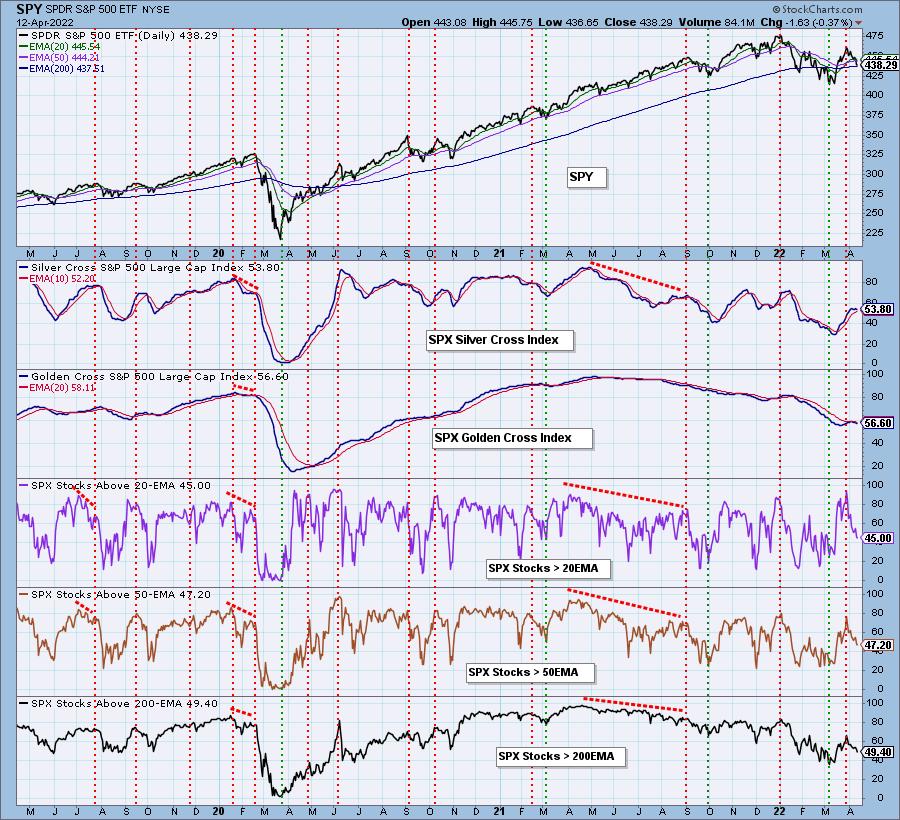

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% invested and 85% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Good Luck and Good Trading!

- Erin

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com