Last Friday our "Sector to Watch" was Energy (XLE). This week, so far, it's been the only sector in the "green", up about +3.4% while the other sectors are down the past two days. XLE has excellent participation percentages.

While the "Industry Group to Watch" on Friday was Exploration & Production, Integrated Oil & Gas is edging it out in performance. The best part is that this group has plenty of upside potential. Pipelines are also looking very good!

You'll note that all but two of the "Stocks to Review" are Energy stocks.

I have pared back my exposure to 45%. I already have a strong Energy stock, but all of the symbols mentioned as "Diamonds in the Rough" and "Stocks to Review" are very tempting. Maybe I'll add one from Integrated Oil & Gas since my stock is in Exploration & Production. All three "Diamonds in the Rough" are possible adds.

Good Luck & Good Trading!

Erin

Today's "Diamonds in the Rough": HEP, IMO and MRO.

"Runners-up": SLB, HAL, XOM, PBF (I own it), CVI, VLO, CCRN, PRVA, CQP, TTE and OXY.

RECORDING LINK (8/19/2022):

Topic: DecisionPoint Diamond Mine (8/19/2022) LIVE Trading Room

Start Time: Aug 19, 2022 09:00 AM PT

Meeting Recording Link

Passcode: August*19

REGISTRATION FOR Friday 8/26 Diamond Mine:

When: Aug 26, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (8/26/2022) LIVE Trading Room

Register in advance for this webinar HERE

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Last Monday's Recording:

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Holly Energy Partners LP (HEP)

EARNINGS: N/A

Holly Energy Partners LP engages in the business of operating a system of petroleum product and crude pipelines, storage tanks, distribution terminals, loading rack facilities and refinery processing units. It operates through Pipelines & Terminals and Refinery Processing Unit segments. The company was founded in 2004 and is headquartered in Dallas, TX.

Predefined Scans Triggered: Moved Above Upper Bollinger Band and Moved Above Upper Price Channel.

HEP is unchanged in after hours trading. I covered it on January 6th 2022 (position closed). It is a Limited Partnership (LP) which means you will have to file an IRS K-1 form. Some don't like to do this so wanted to highlight it.

I loved this chart right away. The price breakout today was terrific; it had already broken out of the symmetrical triangle. The RSI is positive and not overbought. The PMO bottomed above its signal line and continues higher. Best part? It is far from overbought. If I had a complaint, it would be the low volume on today's big breakout move. Stochastics are above 80 and still rising. Relative strength is excellent across the board. The stop is set at 8% below support around $16.73. The yield is outstanding, but is lower than last year's.

HEP has essentially been in a trading range for about a year. It is getting close to the top of it. That could pose a problem. However indicators are strong. The weekly RSI just hit positive territory and the weekly PMO is generating a crossover BUY signal. The SCTR is in the "hot zone" above 70, meaning it is in the top 30% of mid-cap stocks based on a John Murphy calculation that takes into account all three time periods. It is weighted toward intermediate to long terms. If it can reach the top of its prior range from 2018-19, that would be an almost 30% gain.

Imperial Oil Ltd. (IMO)

EARNINGS: 10/28/2022 (BMO)

Imperial Oil Ltd. engages in the provision of integrated oil business. It operates through the following business segments: Upstream, Downstream, Chemical, and Corporate and Other. The Upstream segment includes the exploration and production of crude oil, natural gas, synthetic oil, and bitumen. The Downstream segment focuses on refining crude oil into petroleum products. The Chemical segment manufactures and markets hydrocarbon-based chemicals and chemical products. The Corporate and Other segment covers assets and liabilities that do not specifically relate to business segments. The company was founded on September 8, 1880 and is headquartered in Calgary, Canada.

Predefined Scans Triggered: Moved Above Upper Keltner Channel, Moved Above Upper Bollinger Band, Moved Above Ichimoku Cloud, Moved Above Upper Price Channel and P&F Double Top Breakout.

IMO is up +1.38% in after hours trading. This was actually requested last Thursday, I just didn't pick it. Today the large double-bottom pattern was confirmed on a strong breakout. The RSI is positive and rising/not overbought. The PMO is now in positive territory and has plenty of headroom. The OBV is confirming this rally. Stochastic are rising above 80. It has excellent relative strength against an already strong group. The stop is set below the 50-day EMA at 7.9% or around $46.16.

The weekly chart is coming back to life. The weekly RSI is positive and the weekly PMO is beginning to turn back up. The SCTR tells us this one is in the top 10% of all large-cap stocks. If the double-bottom gets to its minimum upside target, it would put price right at June highs. That would be about a 15.7% gain.

Marathon Oil (MRO)

EARNINGS: 11/2/2022 (AMC)

Marathon Oil Corp. engages in the exploration, production, and marketing of liquid hydrocarbons and natural gas. It operates through the following two segments: United States (U. S.) and International. The U. S. segment engages in oil and gas exploration, development and production activities in the U.S. The International segment engages in oil and gas development and production across international locations primarily in Equatorial Guinea and the United Kingdom. The company was founded in 1887 and is headquartered in Houston, TX.

Predefined Scans Triggered: Moved Above Upper Price Channel and P&F Double Top Breakout.

MRO is up +0.43% in after hours trading. I covered it on April 14th 2022 (position closed). Here is another double-bottom confirmation breakout. What I like about these is that they aren't overbought. The RSI is positive and the PMO only just reached above the zero line. The OBV is confirming the rally. Stochastics did tip over, but they were running out of headroom. As long as they remain above 80, we should be good. This is another strong relative performer against the group. The stop is set at 7.9% around $23.28.

The weekly chart continues to mature. The weekly RSI is now in positive territory and rising. The weekly PMO has decelerated, but hasn't quite bottomed yet. We expect it will. The SCTR is very strong at 93.1%.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

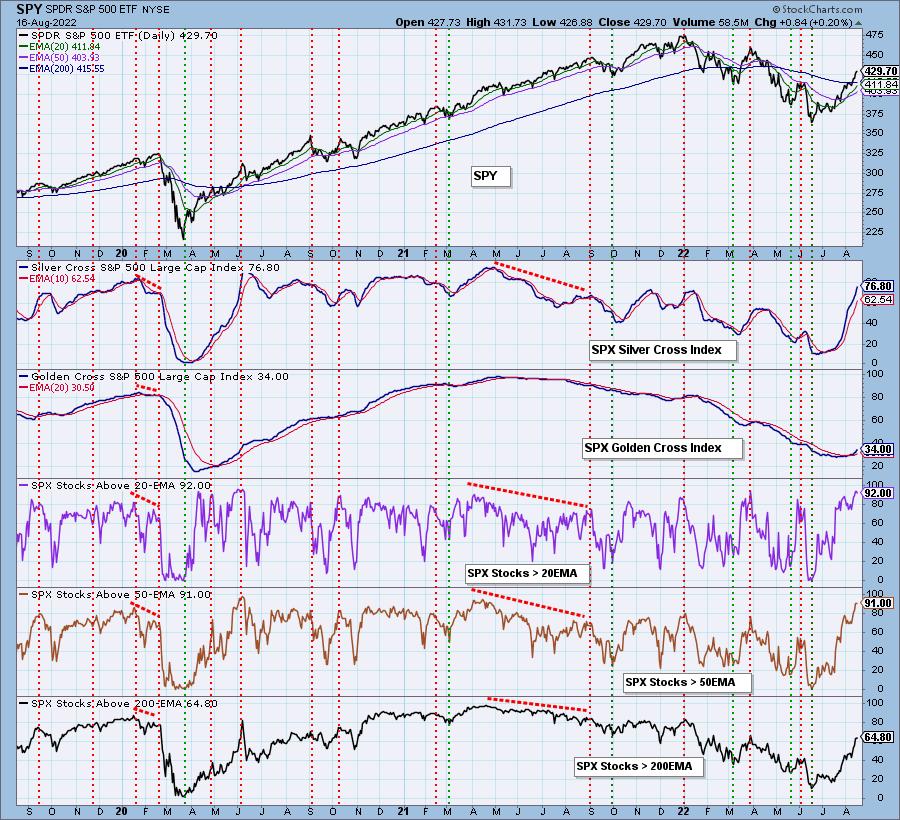

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I am 45% exposed. I may add HEP, IMO or MRO.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Regarding BUY/SELL Signals: The signal status reported herein is based upon mechanical trading model signals and crossovers. They define the implied bias of the price index/stock based upon moving average relationships and momentum, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com