It was a very successful trading room this morning as we discussed Tesla (TSLA) in depth and reviewed various symbol requests. I'm always asked about Gold and Gold Miners. I am bullish on Gold moving forward and consequently Gold Miners as well. The Materials sector has been a solid performer and I suspect we will continue to see strength here. Today I was asked to look at Silver (SLV). I'm bullish on Gold, but after seeing SLV's chart, I'm every bit as bullish on Silver. Had I recorded a new DecisionPoint Show today, SLV would've been my "Diamond of the Week". I believe I will add that to my personal portfolio as well as a Miner.

Today's "Diamonds in the Rough" are: DE, DHR, PCTY, RGEN and SLV.

** HOLIDAY SCHEDULE 12/21/2020 - 1/4/2021 **

Diamonds:

Monday & Tuesday --Eleven Diamonds in the Rough (no reader requests).

Wednesday: Diamonds Recap & LIVE Diamond Mine Trading Room at 9:00a PT

DecisionPoint Alert:

Publishing Monday - Wednesday

** There will be no reports sent on 12/24 and 12/25. Additionally no reports will be sent 12/31 and 1/1 **

Diamond Mine Information:

Diamond Mine Information:

Here is the last Friday's (12/18) recording link. Use Access Passcode: 6?i8uv&f

Register in advance for the THIS WEDNESDAY's "DecisionPoint Diamond Mine" trading room (12/23/2020) 12:00p ET:

Here is the registration link for Wednesday (12/23) Password: merry

Please do not share these links! They are for Diamonds subscribers ONLY!

It's Free!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

Did you miss the 12/21 free trading room? Here is a link to the recording. Access Code: fg#n^HF7

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

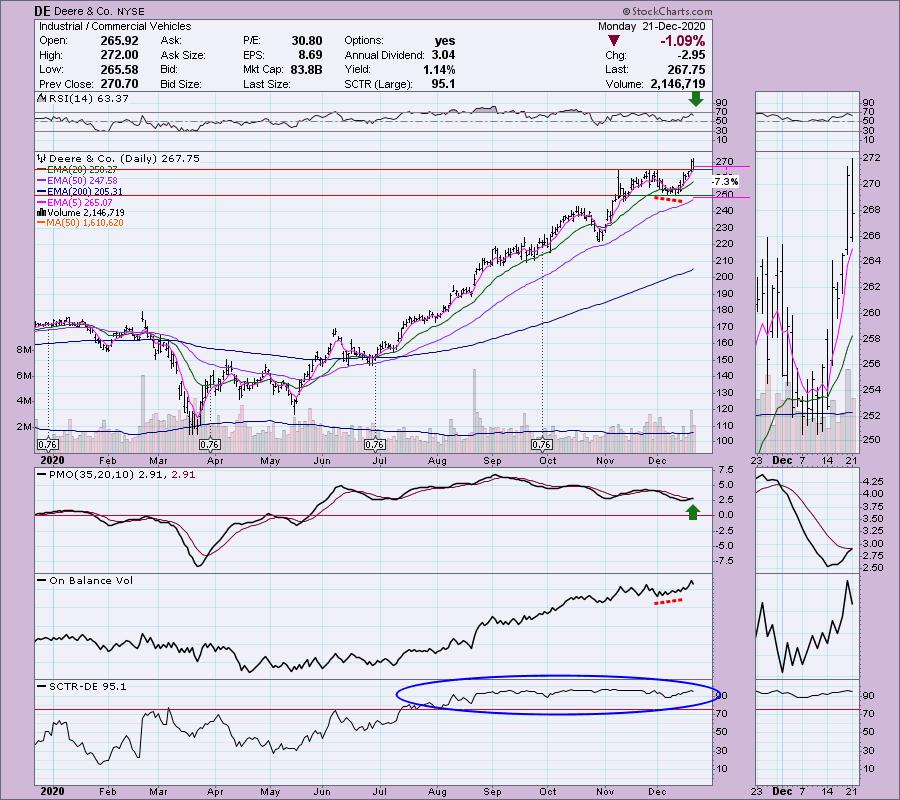

Deere & Co. (DE)

EARNINGS: 2/19/2021 (BMO)

Deere & Co. engages in the manufacturing and distribution of equipment used in agriculture, construction, forestry, and turf care. It operates through the following segments: Agriculture and Turf; Construction and Forestry; and Financial Services. The Agriculture and Turf segment focuses on the distribution and manufacturing of full line of agriculture and turf equipment and related service parts. The Construction and Forestry segment offers machines and service parts used in construction, earthmoving, road building, material handling, and timber harvesting. The Financial Services segment finances sales and leases by John Deere dealers of new and used agriculture and turf equipment and construction and forestry equipment. The company was founded by John Deere in 1837 and is headquartered in Moline, IL.

Deere is unchanged in after hours trading right now. On Friday DE broke out and today it pulled back to that breakout point. That is a mechanical reaction that I always expect and look for after a strong breakout. This now gives us an excellent point of entry. There was a positive OBV divergence ahead of this current rally. The RSI was starting to get overbought, but today's pullback righted that ship and it is back into positive territory and is no longer overbought. The PMO is in the process of triggered a BUY signal. The SCTR remains strong. You can set a shallow stop.

Both the RSI and PMO are overbought, but as you can see it can persist in a bull market environment.

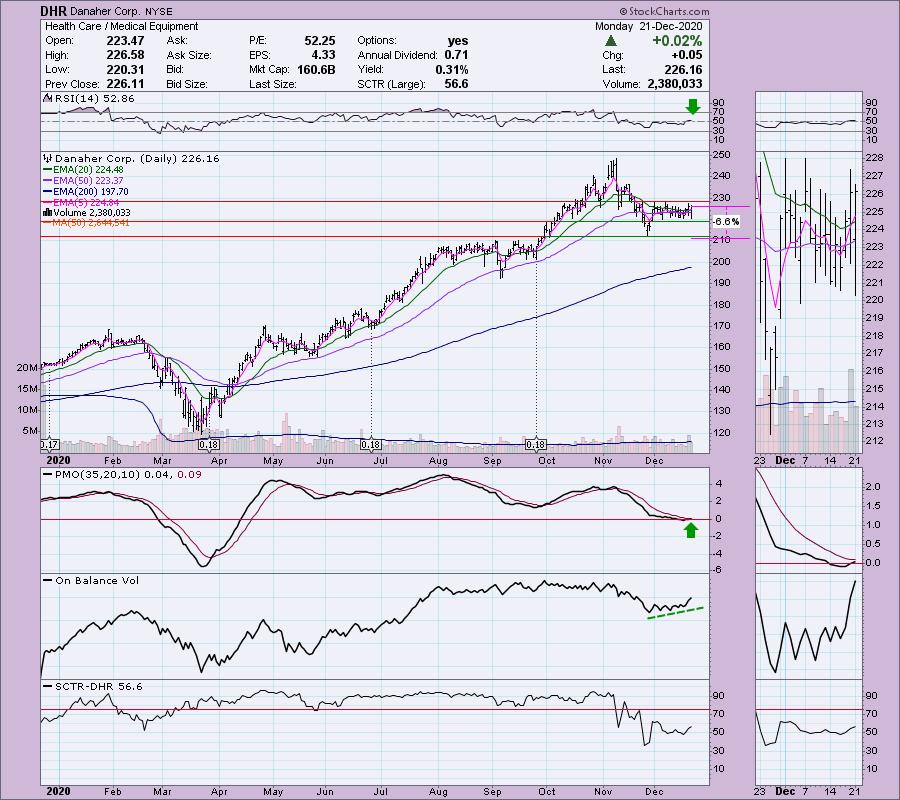

Danaher Corp. (DHR)

EARNINGS: 1/28/2021 (BMO)

Danaher Corp. operates as a medical company, which designs, manufactures, and markets professional, medical, industrial and commercial products and services. It operates through the following segments: Life Sciences, Diagnostics, and Environmental & Applied Solutions. The Life Sciences segment offers a range of research tools that scientists use to study the basic building blocks of life, including genes, proteins, metabolites and cells, in order to understand the causes of disease, identify new therapies and test new drugs and vaccines. The Diagnostics segment comprises of analytical instruments, reagents, consumables, software, and services that hospitals, physician's offices, reference laboratories, and other critical care settings use to diagnose disease and make treatment decisions. The Environmental & Applied Solution segment offers products and services that help protect important resources and keep global food and water supplies safe. The company was founded by Steven M. Rales and Mitchell P. Rales in 1969 and is headquartered in Washington, DC.

DHR is already up +0.81% in after hours trading. I did cover this one in the June 1st Diamond Report (up 36.7%). DHR has been in a tight trading range for a few weeks now. Based on the improving PMO and newly positive RSI, I believe it is ready to breakout. The SCTR is improving and the OBV is confirming there is something under the surface as bottoms rise while price bottoms are flat. This is another one that wouldn't require a deep stop.

The weekly chart has a positive RSI, but that PMO SELL signal in overbought territory is somewhat ominous. For now, price is holding above the 17-week EMA and bounced off support at the third quarter top.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

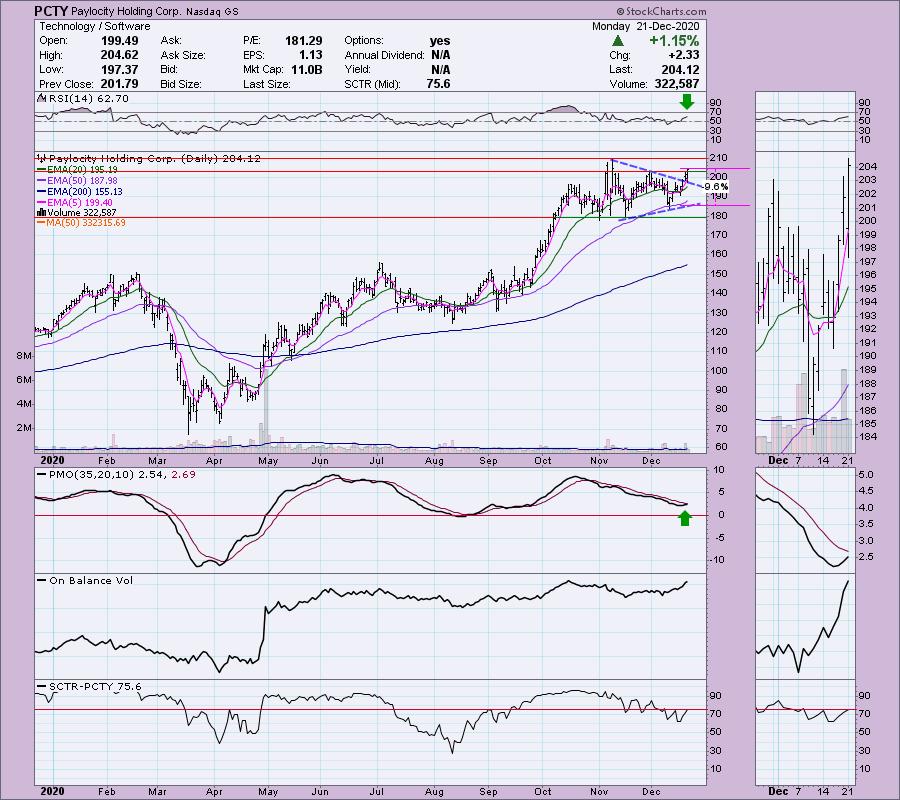

Paylocity Holding Corp. (PCTY)

EARNINGS: 2/4/2021 (AMC)

Paylocity Holding Corp. engages in the development and provision of cloud-based software solution. It offers cloud-based payroll, human capital management applications, time labor tracking, benefits administration, and talent management. The company was founded by Steve I. Sarowitz in 1997 and is headquartered in Arlington Heights, IL.

PCTY is unchanged in after hours trading. We saw a breakout from a symmetrical triangle. It is a continuation pattern so that was expected. Now PCTY has to deal with some overhead resistance at the November tops. I like the PMO which is only now turning up and moving in for a crossover BUY signal. The RSI has entered positive territory. The SCTR just entered the "hot zone" above 75. The stop level is rather deep. It is set below the 50-EMA.

At first glance the PMO appears to be a problem. However, we can see that it has flattened and could turn back up. The RSI is on the overbought side, but that has been the case for some time.

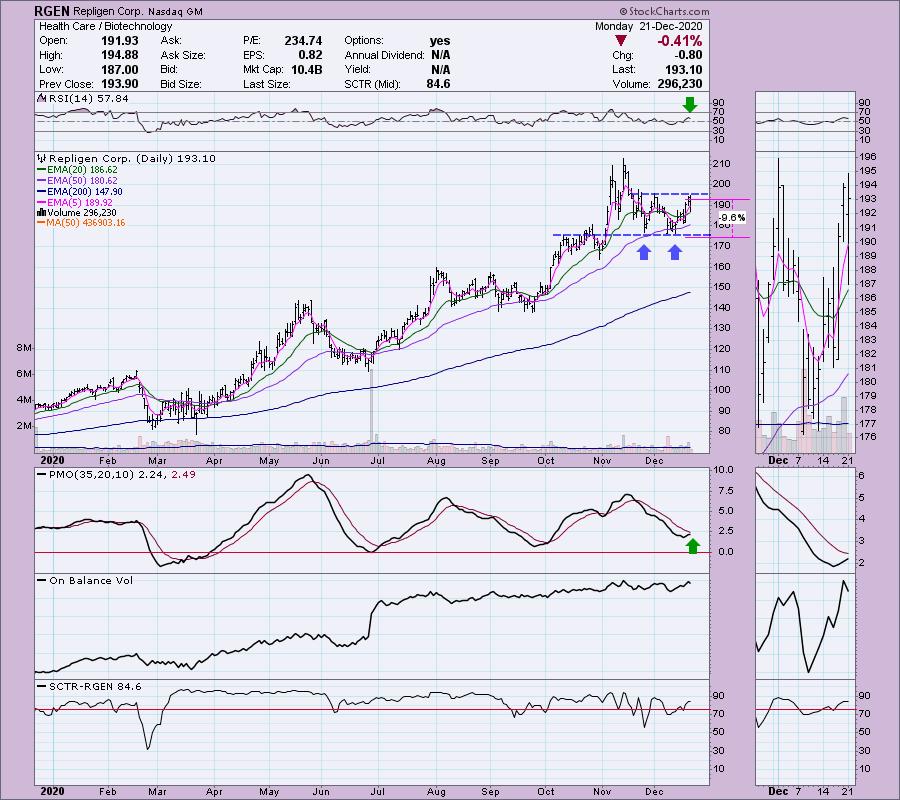

Repligen Corp. (RGEN)

EARNINGS: 2/18/2021 (BMO)

Repligen Corp. provides advanced bioprocessing technologies and solutions used in the process of manufacturing biologic drugs. The firm serves through the following product lines: Chromatography; Filtration; and OEM Products (Proteins). The Chromatography product line includes a number of products used in the downstream purification and quality control of biological drugs. The Filtration products offer a number of advantages to manufacturers of biologic drugs at volumes that span from pilot studies to clinical and commercial-scale production. The OEM products are represented by Protein A affinity ligands, which are a critical component of Protein A chromatography resins used in downstream purification, and cell culture growth factor products. The company was founded by Alexander G. Rich and Paul R. Schimmel in May 1981 and is headquartered in Waltham, MA.

Full disclosure, I own RGEN. I covered RGEN twice before. Once in the July 23rd Diamond Report (up +41.2%) and in the September 2nd Diamond Report (up +23.7%). I think another entry is approaching. The RSI is positive and the PMO is going in for a crossover BUY signal. It has been in a trading range of sorts and appears to have formed a double-bottom off the November decline. My expectation is an upside breakout. The stop is set in the obvious place beneath the double-bottom pattern.

The weekly PMO is falling, but the RSI is still positive. If it can return to its all-time high that would be a tidy 11% gain.

iShares Silver Trust (SLV)

EARNINGS: N/A

SLV tracks the silver spot price, less expenses and liabilities, using silver bullion held in London.

I've been paying more attention to Gold, but Silver is coming on strong as well. It's been in an established trading range for months and on Friday it broke out. Today it traded completely above new support. The RSI is positive, albeit a little on the overbought side. The PMO is rising quickly. I set the stop about halfway down the trading range. The SCTR has improved quite a bit. There is a slight positive divergence on the OBV.

The breakout looks even more interesting on the weekly chart. There is a double-bottom that triggered with trading today. This suggests a move back to 2020 highs. The PMO has turned up and the RSI rebounded at 50 and is moving higher. It is not overbought.

Full Disclosure: I'm about 50% invested and 50% is in 'cash', meaning in money markets and readily available to trade with. I probably will add a Gold Miner and SLV to my portfolio soon.

Current Market Outlook:

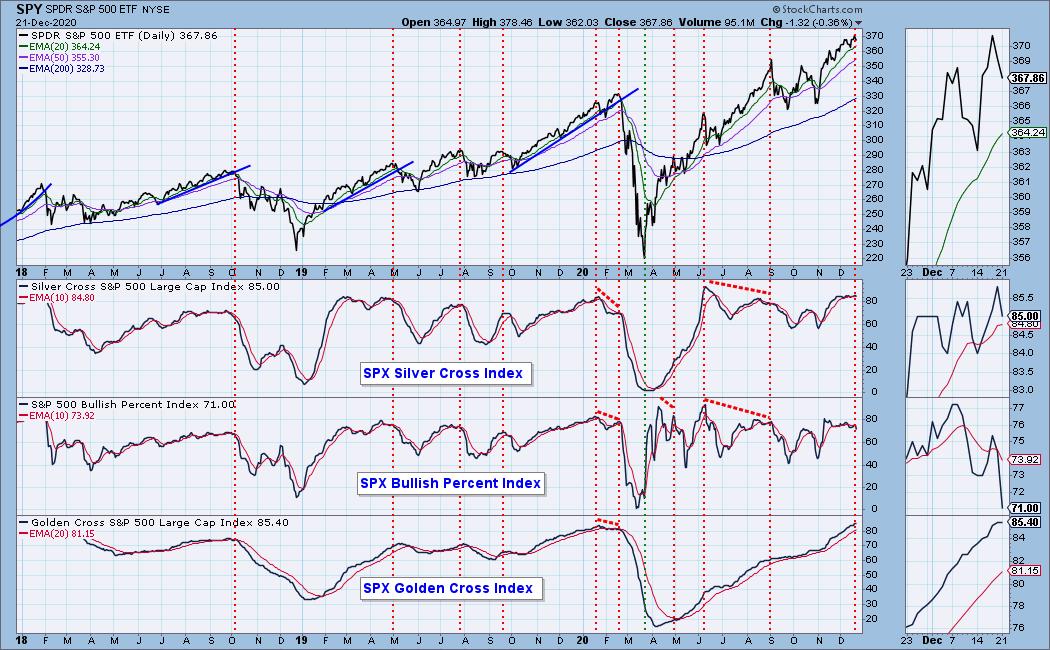

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

- Diamond Scan Results: 12

- Diamond Dog Scan Results: 3

- Diamond Bull/Bear Ratio: 4.00

I'm in the process of trying to plot the Diamond Index, but with time at a premium, it is on the back burner.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!