I decided to change the Diamond Ratio chart up a little. It's much cleaner. You can view it at the bottom of this blog. I will definitely be using the Diamond Dog indicator to pick bottoms. When we get a plethora of bearish scan results it nearly always leads to an upside reversal. I don't see any real correlation on tops being picked, unless you consider the last few climaxes on the Diamond Ratio. With so little data it is difficult to make conclusions, but it has given me ideas for other indicators.

Reader Requests Day! One of the requests was a symbol that I nearly included yesterday so I'm going to take joint credit on tomorrow's spreadsheet. I was asked to look at Sunrun (RUN) which I previously owned and bailed on in the middle of its serious decline. It has now reversed course and is looking like I good choice in the Renewable Energy space.

SIGN UP NOW for tomorrow's Diamond Mine trading room! Looking forward to discussing Diamonds and your hot symbol requests. Looking forward to "seeing" you there!

Today's "Diamonds in the Rough" are: AVNT, HBM, ISRG, LOB and RUN.

Diamond Mine Registration Information:

Diamond Mine Registration Information:

When: Feb 12, 2021 09:00 AM Pacific Time (US and Canada)

Register Below:

https://zoom.us/webinar/register/WN_45P3AHvzSyeaUcNy3nZKPQ

After registering, you will receive a confirmation email containing information about joining the webinar, including the password.

=======================================================================

Recording Link:

Topic: DecisionPoint Diamond Mine (2/5/2021) LIVE Trading Room

https://zoom.us/rec/share/quKhVEg1DLqYLbPPJxo2Rn3ZtHXoyqNtIg9Ni2MvPkdPUrFYOuTEJbc2Yg2cGfil.7e3ArGOZA6H6DeOh

Access Passcode: 2vi+nYV*

* * Free Trading Room Rescheduled for Tuesday, 2/16! * *

I'll be taking Monday 2/15 off so I have decided to move the free trading room to Tuesday!

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Here is the information for the Monday 2/8/2021 recording:

Topic: DecisionPoint Trading Room Recording

Meeting Recording:

https://zoom.us/rec/share/nwbGIyGJQch_e4JlI8Rw0-d0RtpjUDAByiD5mt3cD5nDBVZpURlT7RcARS3870FU.qRofBCbCSjetBkBU

Access Passcode: H!2B$fn3

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

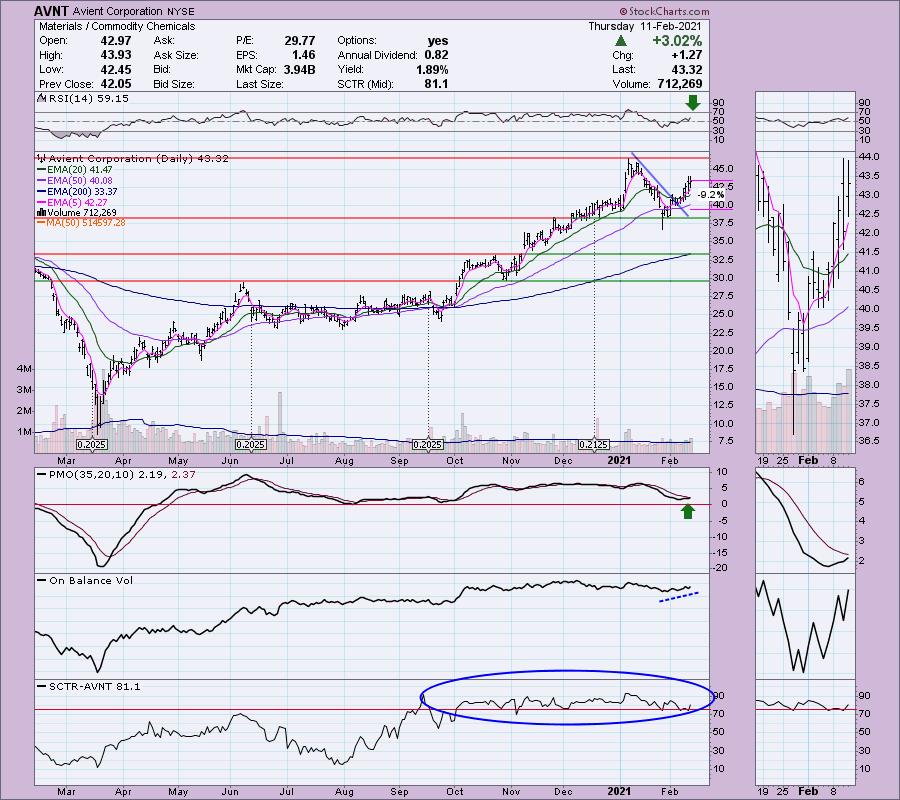

Avient Corporation (AVNT)

EARNINGS: 4/20/2021 (BMO)

Avient Corp. engages in the business of thermoplastic compounds. It specializes in polymer materials, services, and solutions with operations in specialty polymer formulations, color and additive systems, plastic sheet and packaging solutions and polymer distribution. The firm is also involved in the development and manufacturing of performance enhancing additives, liquid colorants, fluoropolymers and silicone colorants. It operates through the following segments: Color, Additives and Inks; Specialty Engineered Materials; and Distribution. The Color, Additives and Inks segment provides custom color and additive concentrates in solid and liquid form for thermoplastics, dispersions for thermosets, speciality inks, plasticols, and vinyl slush molding solutions. The Specialty Engineered Materials segment makes polymer formulations, services, and solutions for designers, assemblers, and processors of thermoplastic materials. The Distribution segment distributes engineering and commodity grade resins, including PolyOne-produced solutions, principally to the North American, Central American, and Asian markets. The firm's products include polymer distribution, screen printing inks, and thermoplastic elastomers. Its services include IQ design and color services. The company was founded on August 31, 2000 and is headquartered in Avon Lake, OH.

This is my pick for the day. AVNT is unchanged in after hours trading. It shouldn't surprise you I came up with another Materials stock given my affinity for that sector right now. AVNT has been rallying nicely since breaking its short-term declining trend. The RSI is now in positive territory and the PMO is about to trigger a crossover BUY signal. The SCTR has been healthy for some time. The stop is set below the 50-EMA. The support line is about 12% down if you want a loose stop.

The weekly PMO is overbought, but it is bottoming above its signal line which is especially bullish. We can that price is about to break above the 2018 tops. My main concern with this one is that it has been in a trading range for years. Granted it is a wide range, but that could be an issue if it is ready to drop back down to the bottom of the range. I still like it, or I wouldn't have presented it. Just consider it a shorter-term trade and be sure to set a stop.

Hudbay Minerals Inc. (HBM)

EARNINGS: 2/18/2021 (AMC)

HudBay Minerals, Inc. operates as a mining company, which engages in the production of copper concentrate, molybdenum concentrate and zinc metal. It focuses on the discovery, production, and marketing of base and precious metals. The company was founded on January 16, 1996 and is headquartered in Toronto, Canada.

HBM is unchanged in after hours trading. It reports earnings next week. The chart is set up nicely with a positive RSI and fresh PMO crossover BUY signal. This is a nice breakout from a declining trend. My only caution is a possible reverse island setting up, but more than likely this is just a continuation gap. I used my default 8% stop level here as there really weren't any discernible areas of support to line it up with.

The PMO SELL signal in overbought territory is concerning, but the RSI is positive and price is reversing nicely after testing support at the annotated 2016 and 2019 tops.

Intuitive Surgical, Inc. (ISRG)

EARNINGS: 4/20/2021 (AMC)

Intuitive Surgical, Inc. engages in the development, manufacture, and marketing of da Vinci Surgical Systems, and related instruments and accessories for invasive surgery. Its products include Da Vinci and Ion. The company was founded by Frederic H. Moll, John Gordon Freund, and Robert G. Younge in November 1995 and is headquartered in Sunnyvale, CA.

ISRG is currently up +0.15% in after hours trading. I covered ISRG in the April 2nd 2020 Diamonds Report as a Reader Request that I was lukewarm on. It was a brilliant call by my reader. The stop was never hit as it bottomed practically on that day. It is currently up +70.8% since then. It looks quite nice again with a new PMO BUY signal and positive RSI. The OBV does have a reverse divergence in that it has set a new high but price has not. This tells us that despite heavy volume coming in, price hasn't moved very much. I think it still has some rally to go. The SCTR is continuing to improve. You can also set a reasonable 7.8% stop.

I like the price action on the weekly chart as it is traveling in a long-term rising trend channel. The PMO is in decline but it is decelerating. The RSI is positive. If it can get to where it was in January, that would be a 5% gain.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Live Oak Bancshares, Inc. (LOB)

EARNINGS: 4/28/2021 (AMC)

Live Oak Bancshares, Inc. operates as a bank holding company for Live Oak Banking Company, which operates an established national online platform for small business lending. It is focused on lending to small businesses and professionals in the veterinary practices, healthcare services, independent pharmacies, death care management, investment advisors, family entertainment centers and poultry agriculture regions. The company was founded by James S. Mahan III in December 2008 and is headquartered in Wilmington, NC.

I'm taking joint credit for this one as I likely would've made it my selection even had it not been a reader request. Unfortunately it is down -1.19% in after hours trading so we'll see how it opens tomorrow. The PMO is rising toward a crossover BUY signal and the RSI just turned positive. The rally comes off strong support at the December low. Banks have been looking good and continue to fill my scan results and this one looks especially good.

The weekly chart is mixed with a declining PMO on a SELL signal, but a positive RSI. Price is back above the 17-week EMA. If price can challenge the January high, that would be a 16% gain.

Sunrun Inc. (RUN)

EARNINGS: 2/25/2021 (AMC)

SunRun, Inc. engages in the design, development, installation, sale, ownership and maintenance of residential solar energy systems. It sells solar service offerings and install solar energy systems for homeowners through its direct-to-consumer channel. It also offers plans such as monthly lease, full amount lease, purchase system, and monthly loan. The company was founded by Edward H. Fenster, Robert N. Kreamer and Lynn M. Jurich in January 2007 and is headquartered in San Francisco, CA.

RUN is unchanged in after hours trading. I covered RUN officially in the November 19th 2020 Diamonds Report, but I had been talking it up since July along with the rest of Renewable Energy industry group. Due to its terrible pullback in January, it is only up +38.2% since. My SPWR position is up triple digits right now and I purchased at similar times. I got out on the January pullback and would consider reentering right now except I'm already exposed to that sector with TAN and SPWR. This seems an excellent entry for RUN. The PMO is rounding upward and the RSI is positive. The only issue right now is overhead resistance at the October top.

A PMO top below the signal line is especially bearish. There is a distinct possibility that RUN won't break above that overhead resistance level. However, if it does puncture overhead resistance, there is no doubt it will "run" to its all-time high with a 24% gain possible.

Full Disclosure: I'm about 85% invested and 15% is in 'cash', meaning in money markets and readily available to trade with. I didn't add any Diamonds and my stops are intact.

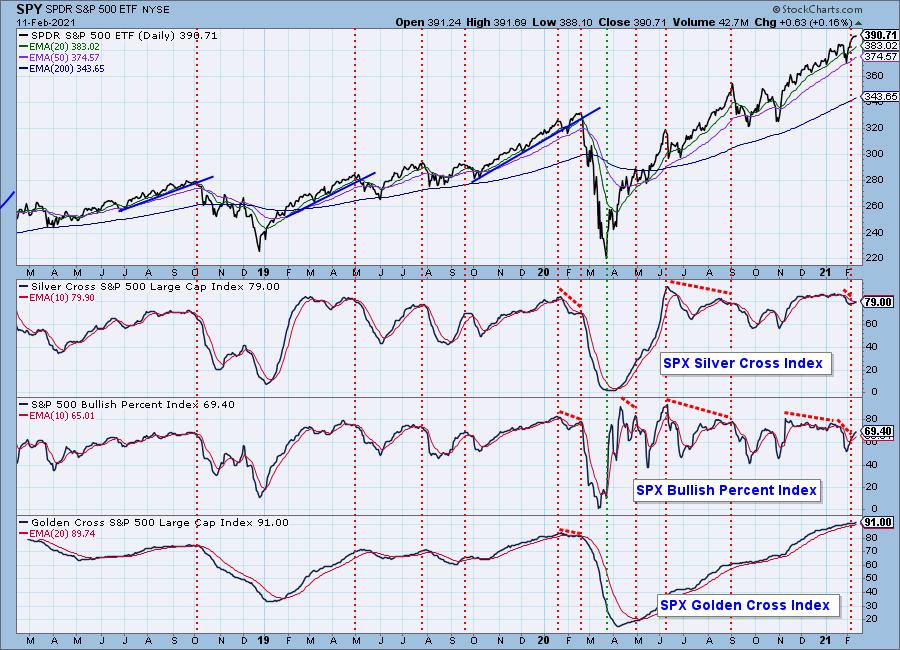

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Diamond Index:

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!f