I do have a "buy alert" for after hours trading right now. See today's second "diamond in the rough" below.

Sifting through scans today was quite difficult as I had 82 results on the Diamond PMO Scan. Additionally, a few of my other favorite scans yielded hundreds of results. I managed to whittle it down to three stocks with additional "Stocks to Consider".

Under "Stocks to Consider" I basically copy my notes. I add possible picks on paper in front of me and then look at all of them as a group. After that I pick the cream off the top based on the analysis. I'll always analyze three, but sometimes I can't make up my mind and you get a bonus or two.

I presented a few solar stocks yesterday on the DecisionPoint Show, but narrowed it down to what I believe is the strongest one in the industry group.

Today's "Diamonds in the Rough" are: AVEO, ENPH, and PYPL.

Stocks/ETFs to Consider (no order): AVAV, DQ, RIO, TPIC, SRC and TWLO.

Diamond Mine REGISTRATION Information:

Diamond Mine REGISTRATION Information:

When: Apr 30, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine LIVE Trading Room

Register in advance for this webinar.

After registering, you will receive a confirmation email containing information about joining the webinar, including the password. SAVE IT! Zoom doesn't always send out the reminders.

=======================================================================

Diamond Mine RECORDING Link from 4/9/2021:

Topic: DecisionPoint Diamond Mine (04/23/2021) LIVE Trading Room

Start Time : Apr 23, 2021 08:58 AM

Here is the Meeting Recording.

Access Passcode: April/23

***Click here to register for this recurring free DecisionPoint Trading Room on Mondays at Noon ET!***

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Free DP Trading Room RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Apr 26, 2021 08:51 AM

Here is the Meeting Recording.

Access Passcode: April/26

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight five "diamonds in the rough." These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

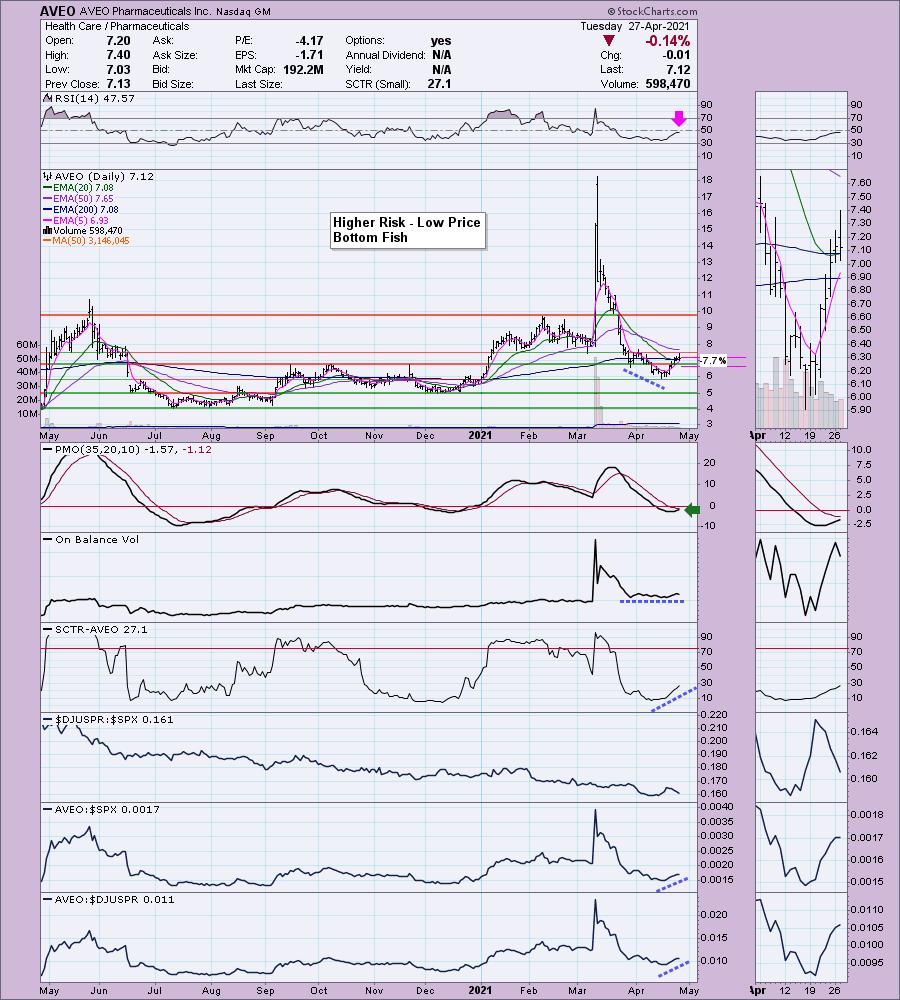

AVEO Pharmaceuticals Inc. (AVEO)

EARNINGS: 4/29/2021 (AMC) *** Reports Thursday!

AVEO Pharmaceuticals, Inc. is a biopharmaceutical company, which engages in the advancement of therapeutics for oncology, and other areas of unmet medical need. Its product candidates include Tivozanib, Ficlatuzmab, AV-203, AV-380 and AV-353. The company was founded by Ronald A. DePinho, Lynda Chin, and Kenneth E. Weg on October 19, 2001 and is headquartered in Cambridge, MA.

AVEO is currently up +0.84% in after hours trading. This is a risk on trade. It is low-priced and clearly is volatile. Additionally, it has been beaten down. Another possible risk is that they report earnings on Thursday. Position size appropriately for your risk appetite.

The set-up was irresistible for me, but then last week I couldn't resist FIZZ and it's about to hit its stop. Being low-priced it caught my attention as well. There is a nice looking base. Price has made it back above the 20-EMA. The PMO is rising and the RSI is very close to reaching positive territory above net neutral (50). The 5-EMA should cross the 20-EMA soon and that would be a ST Trend Model BUY signal. The SCTR is improving and despite its industry group underperforming, it is outperforming both the group and the SPX. I've set a stop around $6.90.

The weekly chart isn't great. There is a risk that it will test $5.00 before making its way to overhead resistance at the 2020 high. The RSI is just about in positive territory and the PMO is at least decelerating. Keep this on a very short leash until it gets above $8.00.

Enphase Energy Inc. (ENPH) - "Buy Alert"

EARNINGS: 4/27/2021 (AMC) *** REPORTED

Enphase Energy, Inc. engages in the design, development, manufacture and sale of micro inverter systems for the solar photovoltaic industry. Its products include IQ 7 Microinverter Series, IQ Battery, IQ Envoy, IQ Microinverter Accessories, IQ Envoy Accessories and Enlighten & Apps. The company was founded by Raghuveer R. Belur and Martin Fornage in March 2006 and is headquartered in Fremont, CA.

*** A buy alert is NOT a call to action! ***

ENPH is down -6.78% in after hours trading after reporting earnings. I don't have the details of the earnings report, but I took advantage of this pullback to grab some shares in after hours trading a short while ago. Consequently we are likely going to see this one suffer on this week's Recap spreadsheet, but this opportunity had to be presented.

I covered ENPH in May 4th 2020 Diamonds Report (hit its stop on the mid-June crash to the 200-EMA) and the July 6th 2020 Report (the stop has not been hit so it is up +241.1% since). I'm not happy to hear that price is falling tonight and was below the 50-EMA last time I checked. We need for gap support to hold. If it drops below $155, it will be time to reevaluate.

What I see is an ascending triangle pattern. The expectation is an upside breakout. Well, we know right now that we aren't getting that, but we do have the luxury of lowering the stop level from where I have it on the chart right now. The RSI and PMO are in positive territory. The PMO is rising very strongly. The SCTR is in the "hot zone" above 75. Its performance is what makes it so attractive (as well as actually having earnings, unlike many in that group). We know we like Solar right now so finding a stock that is outperforming the group by so much is a 'win'.

The weekly PMO is showing some signs of deceleration in the thumbnail. The RSI is positive. Upside potential is at least 34%.

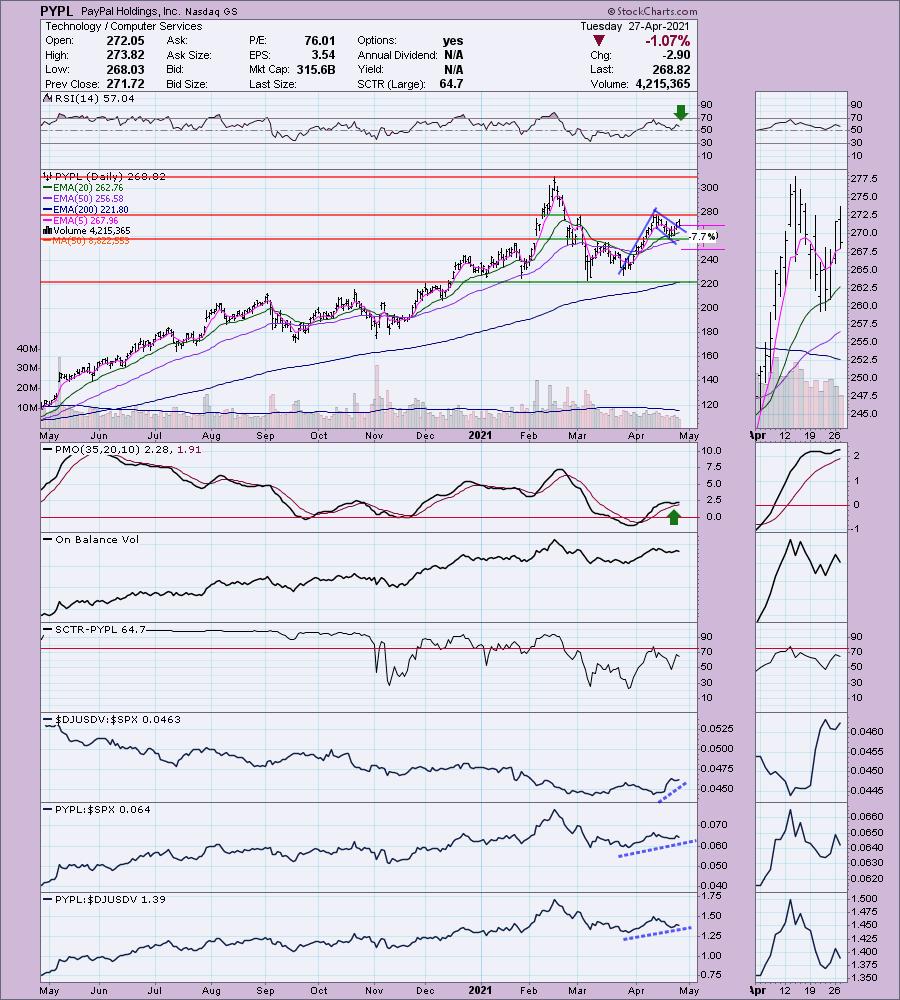

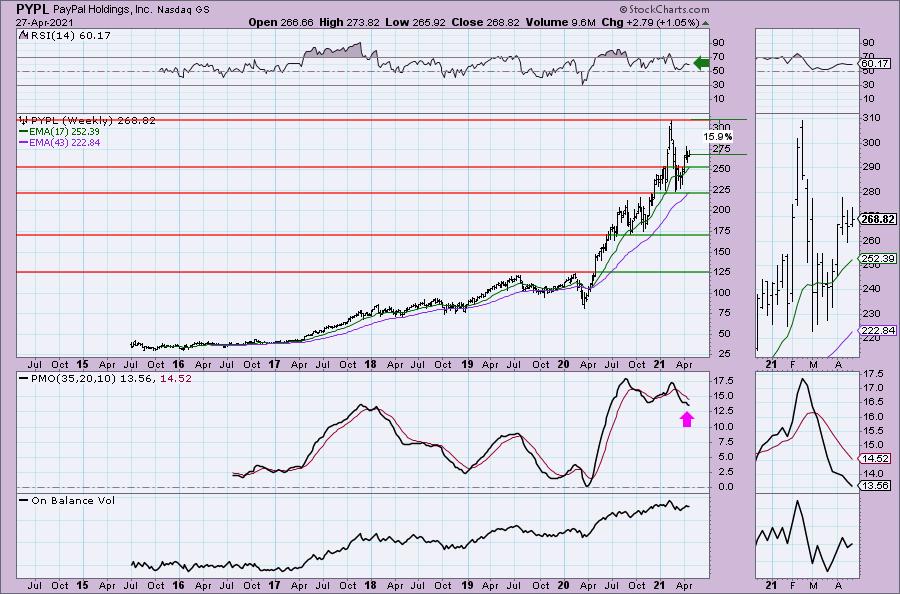

PayPal Holdings, Inc. (PYPL)

EARNINGS: 5/5/2021 (AMC)

PayPal Holdings, Inc. engages in the development of technology platform for digital payments. Its solutions include PayPal, PayPal Credit, Braintree, Venmo, Xoom, and Paydiant products. The firm manages a two-sided proprietary global technology platform that links customers, which consist of both merchants and consumers, to facilitate the processing of payment transactions. It allows its customers to use their account for both purchase and paying for goods, as well as to transfer and withdraw funds. The firm also enables consumers to exchange funds with merchants using funding sources, which include bank account, PayPal account balance, PayPal Credit account, credit and debit card or other stored value products. It offers consumers person-to-person payment solutions through its PayPal Website and mobile application, Venmo and Xoom. The company was founded in December 1998 and is headquartered in San Jose, CA.

PYPL is down -0.01% in after hours trading. I covered it on September 29th 2021. The stop wasn't hit so it is up 38.2% as of today. I like the breakout from the bullish flag formation. The PMO has bottomed above its signal line which is very positive. The RSI is positive. Performance overall is good and the SCTR is a respectable 64.7. The stop can be tighter than what I have.

The weekly chart is okay except for the PMO.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

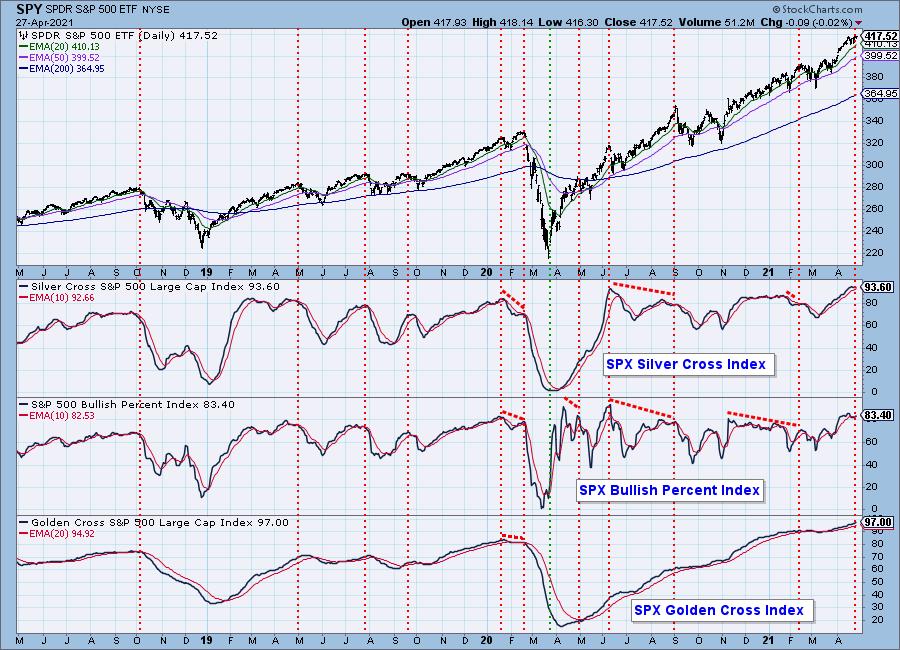

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

- The Bullish Percent Index (BPI) shows the percentage of SPX stocks on Point & Figure BUY signals.

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

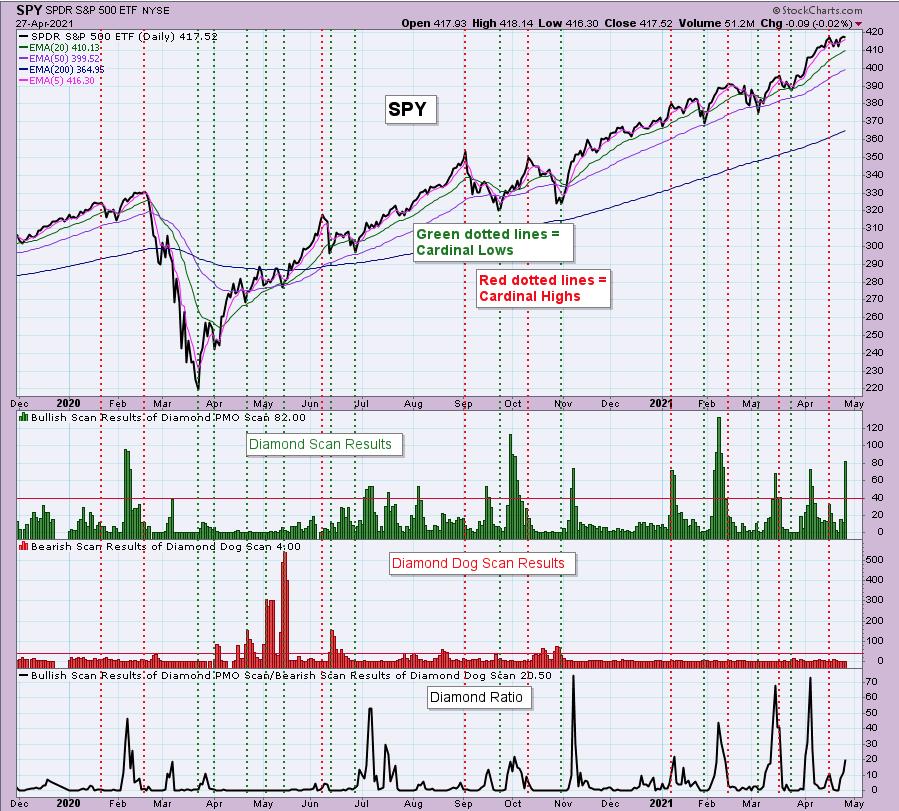

Diamond Index:

The Diamond Index chart looks at the number of scan results from my bullish Diamond PMO Scan and the number of scan results from the inverse Diamond Dog Scan. The Diamond Ratio divides the bullish results by the bearish results.

I only have data going back to October 2019 so I won't make any sweeping conclusions about the Diamond Index chart. I have marked cardinal tops with red dotted vertical lines and cardinal price bottoms with green dotted vertical lines. I believe that when the Diamond Dog results spike, it usually comes at a price bottom, or marks a strong continuation of the rising trend.

Unfortunately, the Diamond PMO Scan result numbers aren't providing much insight. The Diamond Ratio has promise, but again I don't see a clear correlation to the market tops/bottoms right now. I need to study and manipulate the data some more. Keep you posted!

Full Disclosure: I'm about 80% invested and 20% is in 'cash', meaning in money markets and readily available to trade with. I purchased ENPH in after hours trading on earnings pullback.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com!