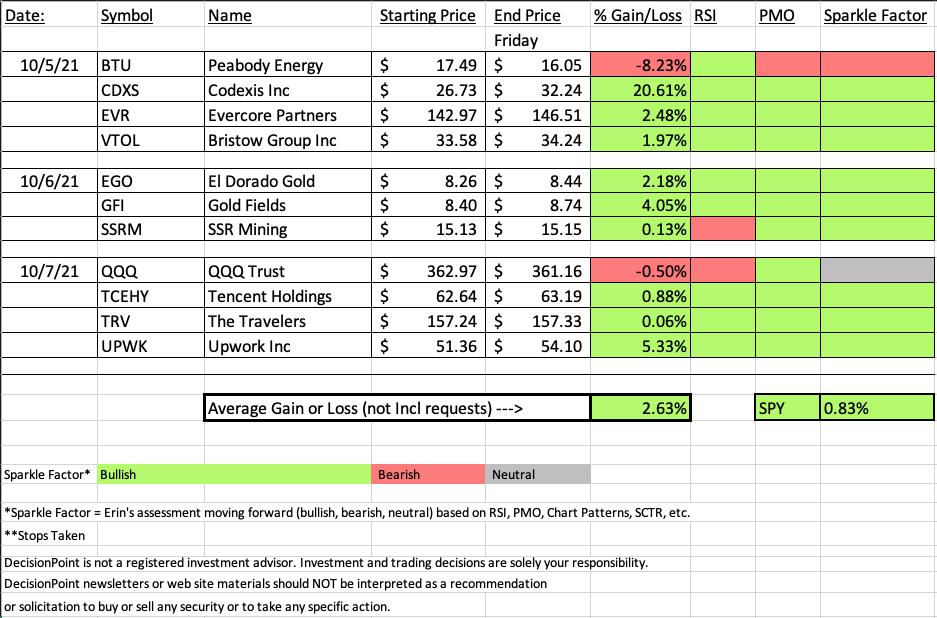

The SPY was up on the week +0.83%. "Diamonds in the Rough" averaged +2.63% on the week. This was largely due to our three Gold Mining picks from Wednesday, but we also had a great deal of help from the Materials stock picked on Tuesday.

Codexis (CDXS) was up over 20% since being picked on Tuesday. Materials sector is starting to outperform again and this Specialty Chemicals stock broke out in a big way making it this week's "Darling".

Peabody Energy (BTU) was our big loser. The loss is -8.23%. The stop was set at 9.7% so it escaped being triggered. The only other stock to finish down on the week was yesterday's reader requested QQQ. That was more of a demonstration and answer to a question about shorting, but it still goes on the spreadsheet.

Register now for next Friday's Diamond Mine trading room below or right HERE.

RECORDING LINK Friday (10/8):

Topic: DecisionPoint Diamond Mine (10/8/2021) LIVE Trading Room

Start Time : Oct 8, 2021 09:01 AM

Meeting Recording Link HERE.

Access Passcode: October@8

REGISTRATION FOR FRIDAY 10/15 Diamond Mine:

When: Oct 15, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (10/15/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (10/4) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time : Oct 4, 2021 09:00 AM

Meeting Recording Link HERE.

Access Passcode: October%4th

For best results, copy and paste the access code to avoid typos.

A few items about the spreadsheet: I've put on the spreadsheet whether the RSI is positive (green) or negative (red). The PMO column tells you if it is rising (green) or falling (red). Finally I've added my own "Sparkle Factor" that gives you my assessment going forward, bullish (green), bearish (red) or neutral (gray). The Sparkle Factor is basically my thoughts on whether I expect it to rise or fall. A neutral means it could really go either way so it could be added to a watch list. If you're in a stock I consider "neutral" going forward, the ball is in your court.

Darling:

Codexis Inc. (CDXS)

EARNINGS: 11/4/2021 (AMC)

Codexis, Inc. is an enzyme engineering company, which engages in the development and sale of therapeutics. It operates through the Performance Enzymes and Novel Biotherapeutics segments. The Performance Enzymes segment commercializes CodeEvolver protein engineering technology platform and products in the pharmaceuticals market. The Novel Biotherapeutics segment targets new opportunities to discover and improve biotherapeutic drug candidates. Its products include screening kits and Codex HiFi Hot Start DNA Polymerase. The company was founded in January 2002 and is headquartered in Redwood City, CA.

Predefined Scans Triggered: None.

Below is the commentary and chart from Tuesday (10/5):

"CDXS is up +1.16% in after hours trading. I covered CDXS as a reader request on August 26th 2021. The 5.5% stop was hit on the late September decline, but it was up almost 13% at the September top.

I like it again. The RSI is positive and we saw a ton of accumulation on the gap up which usually means follow-through. The PMO is rising toward a crossover BUY signal. Stochastics are just getting started. Relative strength is strong. The stop is deep but that is a function of today's more than 4% move. I've set it at the bottom of gap support and below the 50-EMA."

Here is today's chart:

Price is overbought based on the RSI, but the PMO is on a BUY signal and not overbought. Stochastics are still on the rise. Our best entry has passed, but I would look for a possible pullback to the breakout point near $29. I don't believe it will go that low, but any pullback should offer an opportunity to ride this one higher.

Don't forget, on Thursdays I look at reader-requested symbols, so shoot me an email at erin@decisionpoint.com. I read every email I receive and try to answer them all!

Dud:

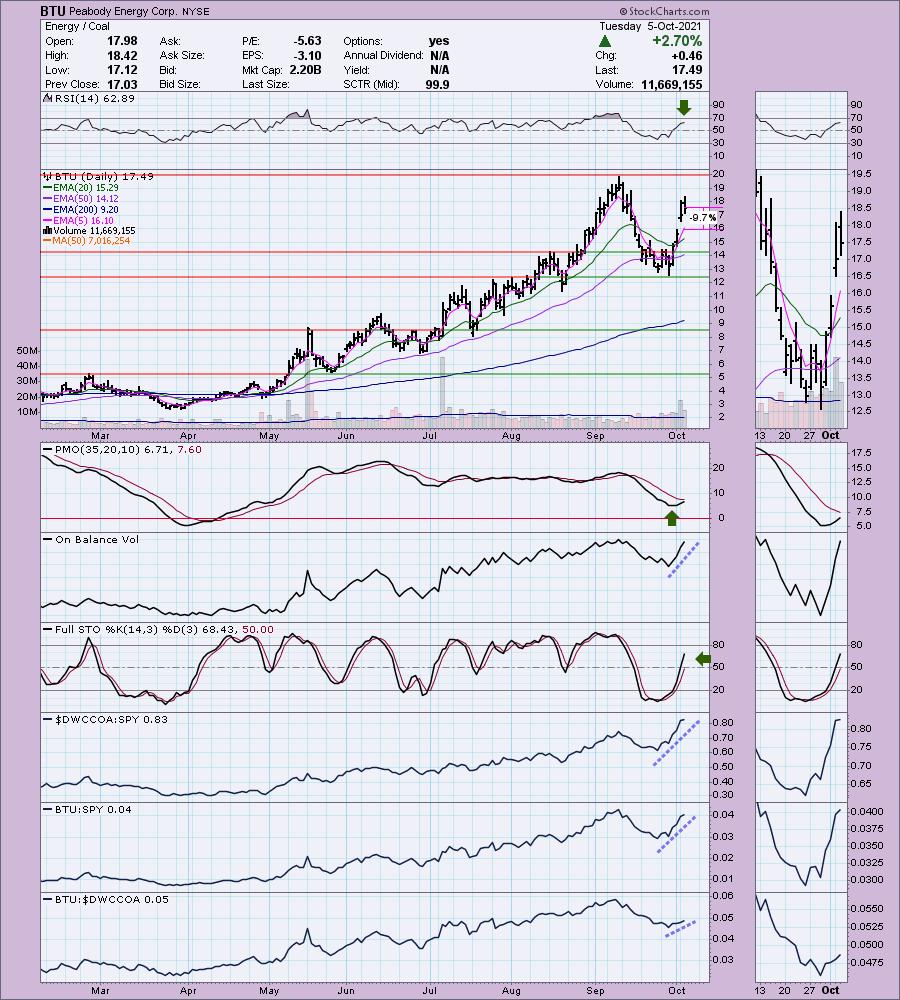

Peabody Energy Corp. (BTU)

EARNINGS: 11/8/2021 (BMO)

Peabody Energy Corp. engages in the business of coal mining. It operates through the following segments: Powder River Basin Mining, Midwestern U.S. Mining, Western U.S. Mining, Seaborne Metallurgical Mining, Seaborne Thermal Mining and Corporate and Other. The Powder River Basin Mining segment consists of its mines in Wyoming. The Midwestern U.S. Mining segment includes Illinois and Indiana mining operations. The Western U.S. Mining segment reflects the aggregation of its New Mexico, Arizona and Colorado mining operations. The Seaborne Metallurgical Mining segment covers mines in Queensland, Australia. The Seaborne Thermal Mining segment handles operations in New South Wales, Australia. The Corporate and Other segment includes selling and administrative expenses, results from equity affiliates, corporate hedging activities and trading and brokerage activities. The company was founded by Francis S. Peabody in 1883 and is headquartered in St. Louis, MO.

Predefined Scans Triggered: Filled Black Candles and P&F Double Top Breakout.

Below is the commentary and chart from Tuesday (10/5):

"BTU is up +0.91% in after hours trading. I covered BTU on September 3rd 2020 and September 10th 2020 on a relook. The stop was hit so the position was closed at a -6.9% loss. It was hovering around $3 then... wish that stop had not hit!

I think BTU is a great way to get into coal if you haven't already. It's only recently begun to rally and we know that the other coal stocks we've presented have broken above their resistance levels at September highs. I believe this one will do the same. The RSI is positive and not overbought. The PMO has bottomed and is closing in on a crossover BUY signal. The Stochastics are very positive and not overbought. We saw quite a bit of accumulation on this gap up move. Relative strength looks great. The stop is deep, but it lines up with the gap... basically if price closes that gap, there could be continued follow-through to the downside."

Below is today's chart:

Looks like we picked at the top on this one. The -9.7% stop did not trigger and price is holding above the 20-EMA. The RSI is positive but now in decline and the PMO has topped beneath its signal line which is especially bearish. I still see coal as a good buy. This could be forming a cup and handle. I did give it a Sparkle Factor of bearish, but you could make a case that this could be a nice pullback and bounce off the 20-EMA. Keep an eye on Coal stocks. This pullback could become an opportunity, I am just not looking for a rebound just yet given the very negative PMO.

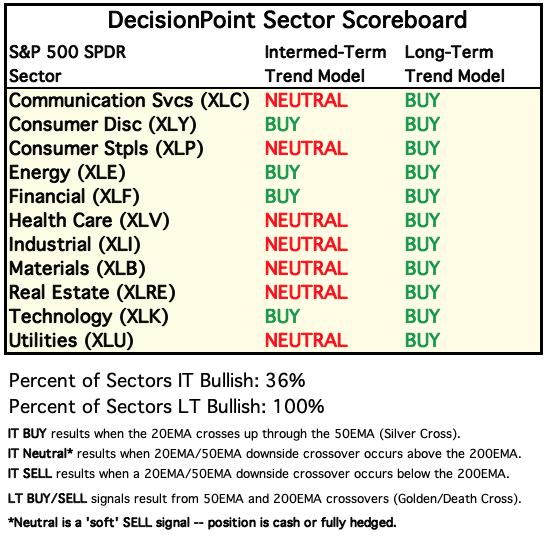

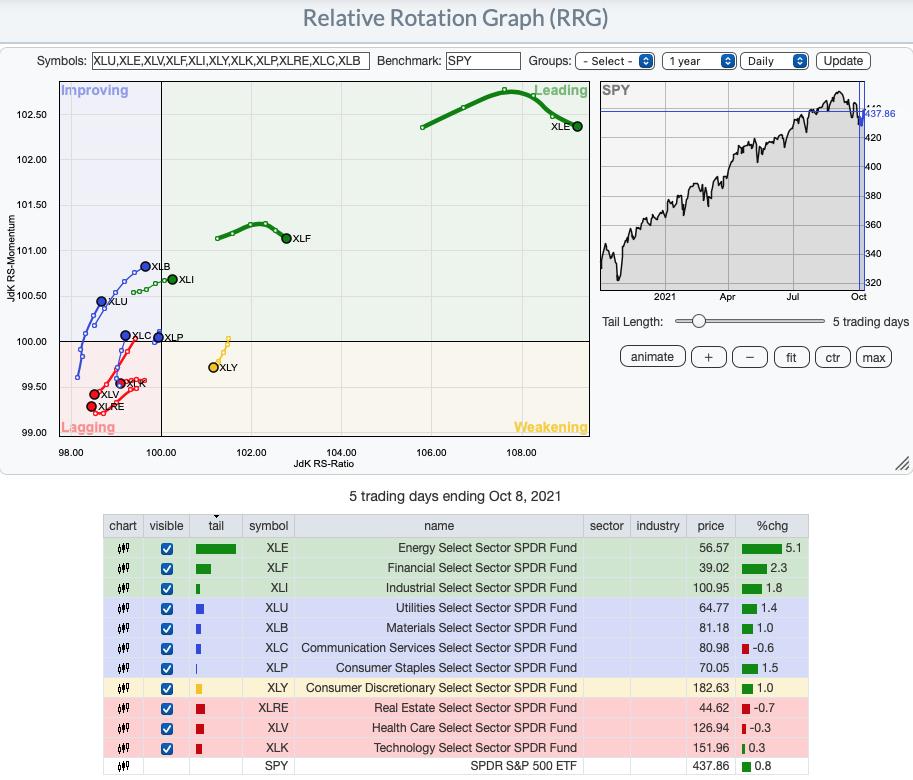

THIS WEEK's Sector Performance:

DecisionPoint Sector Scoreboard (Mechanical Trend Model Signals):

Click Here to view Carl's annotated Sector ChartList!

Short-term RRG: XLE and XLF are beginning to rotate downward, but are still Leading. The two that caught my eye were XLI and XLB which are showing improvement. XLY is falling out of favor. I believe the jobs report could cause further damage to this sector.

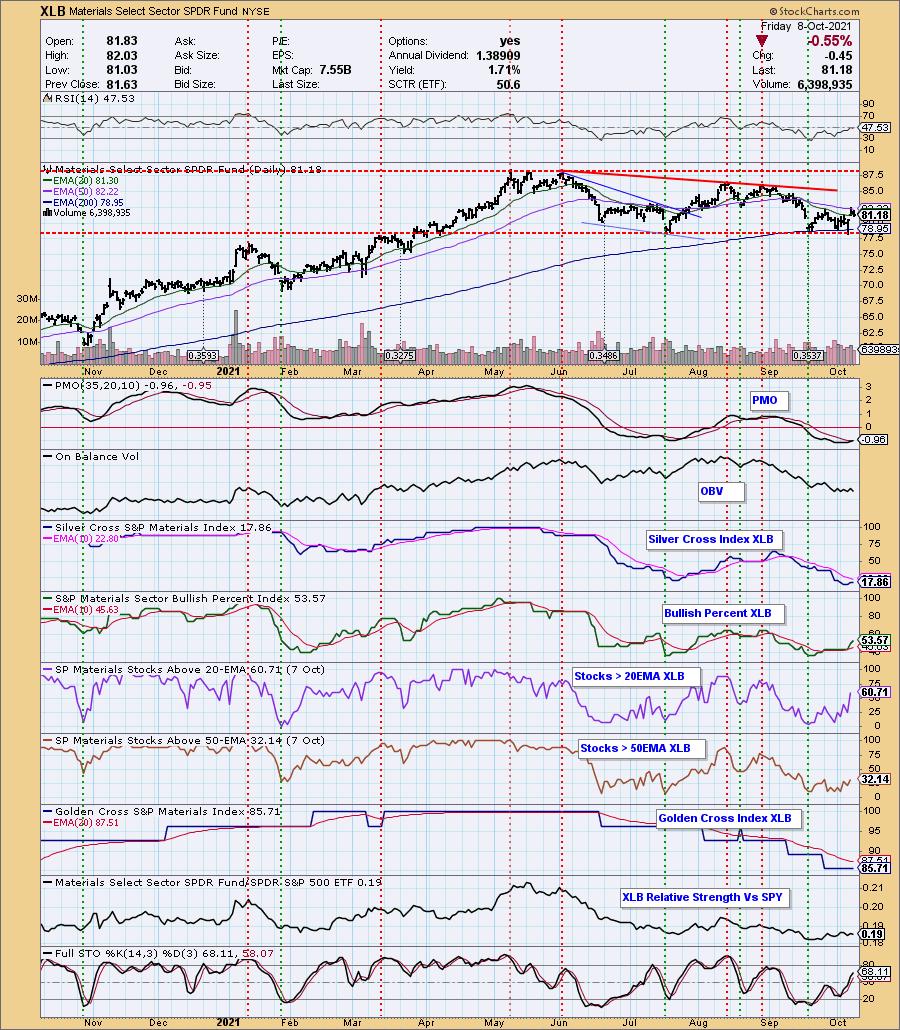

Sector to Watch: Materials (XLB)

It was a tie between XLI and XLB for the sector to watch. I opted to go with XLB because it had a rising Silver Cross Index (SCI) in the Diamond Mine trading room. After the close, the SCI flattened on both sectors. It's still a tie. Since I'm bullish on Gold and Gold Miners as well as Chemicals now, I decided to go with Materials. The PMO is nearing a crossover BUY signal and the RSI is rising, albeit negative. Stochastics are strong and rising. Participation is shifting bullish as more stocks are finding their way above their 20/50-EMAs. One problem for XLB is its unsuccessful test of the 50-EMA. However, the picture is bullish enough to look for a breakout here.

Industry Group to Watch: Nonferrous Metals ($DJUSNF)

While sifting through the various industry groups within Materials, I decided I liked Nonferrous Metals best. We have a bullish falling wedge and within that is a bullish double bottom that has triggered. Price pulled back to the breakout point, but I expect to see a rebound here. The RSI is positive but I'd read it more as neutral. The PMO and Stochastics are quite bullish. I picked this group, but chemicals are beginning to look interesting as well as General Mining.

Go to our Sector ChartList on DecisionPoint.com to get an in depth view of all the sectors.

Technical Analysis is a windsock, not a crystal ball.

Have a great weekend & Happy Charting! Next Diamonds Report is Tuesday 10/12.

- Erin

erin@decisionpoint.com

Full Disclosure: I'm about 70% invested right now and 30% is in 'cash', meaning in money markets and readily available to trade with. I have moved primarily into energy and materials. I will be offloading a position or two next week that would bring my exposure to 60% or lower depending on how many and how much.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "diamonds in the rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

(c) Copyright 2021 DecisionPoint.com