Welcome to Reader Request Day! We had two subscribers that sent me input and they really came up with some great choices in areas other than Biotechs. I feel like we've beat the drum long enough on that group. It continues to outperform. Full disclosure, I did add XBI (Biotech) to my portfolio as well as TAN (Solar). They are very short-term in nature as both groups are volatile and my stops are in place.

Readers brought "Diamonds in the Rough" from Healthcare Providers (a theme yesterday), Technology (taking advantage of group strength within), Food Products (new strength) and Retail REITS (new strength).

A note about stops and upside targets: Given the bear market, you may want to tighten stops more than I have shown on "Diamonds in the Rough". The stops I show are typically the largest I would consider for myself, but when a chart begins to go south, there is no reason to keep holding it. Upside targets are "best case" so again, if the chart starts to go south, don't hold onto it simply because the target hasn't been hit yet.

Currently I'm running a "Bear Market Special" for new subscribers (first month of "Bundle" for $14). Let your cohorts and colleagues know. I'd like to extend the special to you if you'd like to try the DP Alert for one month. As a current subscriber, I'll give you DP Alert for a month at only $9! You'll need to contact me directly to take advantage of adding DP Alert.

See you in the Diamond Mine tomorrow! Registration information is below.

Good Luck & Good Trading!

Erin

Today's "Diamonds in the Rough": ADC, DDD, LW, PLTR and UNH.

RECORDING LINK (6/17/2022):

Topic: DecisionPoint Diamond Mine (6/17/2022) LIVE Trading Room

Start Time: Jun 17, 2022 09:00 AM

Meeting Recording Link

Access Passcode: June#17th

REGISTRATION FOR Friday 6/24 Diamond Mine:

When: Jun 24, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (6/24/2022) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (6/21/2022) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Jun 21, 2022 09:00 AM

Meeting Recording Link

Access Passcode: June@21st

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

Agree Realty Corp. (ADC)

EARNINGS: 7/25/2022 (AMC)

Agree Realty Corp. is a real estate investment trust, which focuses on the ownership, development, acquisition, and management of retail properties net leased to national tenants. It specializes in acquiring and developing net leased retail properties for retail tenants. The company was founded by Richard Agree in 1971 and is headquartered in Bloomfield Hills, MI.

Predefined Scans Triggered: New CCI Buy Signals, Moved Above Upper Bollinger Band, Moved Above Upper Price Channel, P&F Double Top Breakout and P&F Triple Top Breakout.

ADC is up +0.52% in after hours trading. Today it had quite a breakout from a bullish ascending triangle. The pattern suggests it has much further to run (possibly +$8). The RSI is rising and isn't overbought. The PMO triggered a crossover BUY signal today. The OBV is confirming the rising trend and Stochastics are nearing 80. What I liked most was that the group was beginning to outperform because this one has been a clear outperformer against its group and the SPY. The stop is set around the 200-day EMA and late March tops.

Price is rebounding off the 43-week EMA and early January high. The weekly RSI has landed in positive territory and the weekly PMO is turning back up. The SCTR is a strong reading of 94. Upside potential is near 19%.

3D Systems Corp. (DDD)

EARNINGS: 8/8/2022 (AMC)

3D Systems Corp. is a holding company, which engages in the provision of comprehensive three-dimensional printing solutions. It offers a comprehensive range of 3D printers, materials, software, haptic design tools, 3D scanners, and virtual surgical simulators. The company was founded by Charles W. Hull in 1986 and is headquartered in Rock Hill, SC.

Predefined Scans Triggered: None.

DDD is down a whopping -4.20% in after hours trading, basically shaving most of today's gains away. I felt better about this chart until I saw how it's trading after hours. The chart does have merit, but I have to say I'd be careful here despite the bullish indications. There is a bullish double-bottom that hasn't been confirmed yet. The RSI just hit positive territory. The PMO turned up above its signal line which is especially bullish. Stochastics are rising, but haven't hit positive territory above net neutral (50). Relative strength is building within the group and given DDD travels inline with the group, that should be good. The stop is set below the late May trough.

The weekly chart is encouraging, but not really that ripe. Just be aware that this one was trading at $5 in late 2020. It could find its way back down there. The weekly RSI is rising but is still very negative. The OBV is in a long-term positive divergence with price that would suggest a breakout rally ahead, but the SCTR is in the basement which tells us relative strength is almost non-existent.

Lamb Weston Holdings, Inc. (LW)

EARNINGS: 7/27/2022 (BMO)

Lamb Weston Holdings, Inc. engages in the production, distribution, and marketing of value-added frozen potato products. It operates through the following business segments: Global, Foodservice, Retail, and Other. The Global segment includes branded and private label frozen potato products sold in North America and international markets. The Foodservice segment comprises branded and private label frozen potato products sold throughout the United States and Canada. The Retail segment consists of consumer facing retail branded and private label frozen potato products sold primarily to grocery, mass merchants, club, and specialty retailers. The Other segment comprises vegetable and dairy businesses. The company was founded on July 5, 2016, and is headquartered in Eagle, ID.

Predefined Scans Triggered: None.

LW is up +0.48% in after hours trading. I covered LW on April 14th 2022. The position is closed. There is a large bullish ascending triangle about to trigger. Upside potential on this pattern could take price above $78. The RSI is positive and rising gently. The PMO just generated a crossover BUY signal. Stochastics are rising and about above 80. The group is starting to underperform somewhat, but overall it has been alright this month. LW is a big outperformer of both its group and the SPY in the intermediate term. The stop is set at the 200-day EMA.

LW does have some overhead resistance to deal with soon, but based on the pattern on the daily chart, upside potential is above 14%. I've chosen the target of $80. The weekly RSI is positive. The PMO is on a whipsaw BUY signal and recently has accelerated its rise. The OBV shows a positive divergence that led into this bullish ascending triangle. The SCTR is top notch at 94.4.

Palantir Technologies, Inc. (PLTR)

EARNINGS: 8/11/2022 (BMO)

Palantir Technologies, Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The Commercial segment offers services to clients in the private sector. The Government segment provides solutions to the United States (US) federal government and non-US governments. The firm offers automotive, financial compliance, legal intelligence, mergers and acquisitions solutions. Its products include Palantir Gotham and Palantir Foundry. The company was founded by Stephen Cohen, Nathan Dale Gettings, Joseph Lonsdale, Alexander C. Karp, and Peter Andreas Thiel in 2003 and is headquartered in Denver, CO.

Predefined Scans Triggered: New CCI Buy Signals, Stocks in a New Uptrend (Aroon), Moved Above Upper Price Channel, Entered Ichimoku Cloud and P&F Double Top Breakout.

PLTR is down -0.32% in after hours trading. This looks very much like DDD. It has a triple or double-bottom pattern that will be confirmed with a breakout. The RSI is positive and rising. The PMO recently bottomed above the signal line which is especially bullish. Stochastics are nearing 80. The group is beginning to outperform. Given this one is inline or slightly better than the group, we should see a breakout. The stop is set at the 20-day EMA.

The weekly RSI is rising, but is still in negative territory. The weekly PMO has turned up. Price is above the lows at time of issue, but not above the early 2022 low. The SCTR is anemic at 15.5. I don't know that we'll see the upside target, but if this one breaks out it should offer some great profit.

Unitedhealth Group, Inc. (UNH)

EARNINGS: 7/15/2022 (BMO)

UnitedHealth Group, Inc. engages in the provision of health care coverage, software, and data consultancy services. It operates through the following segments: UnitedHealthcare, OptumHealth, OptumInsight, and OptumRx. The UnitedHealthcare segment utilizes Optum's capabilities to help coordinate patient care, improve affordability of medical care, analyze cost trends, manage pharmacy benefits, work with care providers more effectively, and create a simpler consumer experience. The OptumHealth segment provides health and wellness care, serving the broad health care marketplace including payers, care providers, employers, government, life sciences companies, and consumers. The OptumInsight segment focuses on data and analytics, technology, and information to help major participants in the healthcare industry. The OptumRx segment offers pharmacy care services. The company was founded by Richard T. Burke in January 1977 and is headquartered in Minnetonka, MN.

Predefined Scans Triggered: Entered Ichimoku Cloud and P&F Double Top Breakout.

UNH is down -0.32% in after hours trading. I covered this on August 19th 2021 (the position is closed). We have a large double-bottom pattern that will be confirmed with a breakout above the late May top. The conservative upside target of the pattern would put price around $560, meaning a breakout above the April top. The RSI is positive and rising. The PMO just triggered a crossover BUY signal. There is a slight positive OBV divergence that led into this strong rally. Stochastics moved above 80 today. The group is having a great month against the SPY and this one generally outperforms the group. The stop is set at the 200-day EMA.

At first glance I was concerned about the price pattern. It is a bearish head and shoulders. However, price failed to execute the pattern. Instead it bounced off the neckline and broke the declining trend. The weekly RSI is back in positive territory and the weekly PMO just turned up. The SCTR is a strong 91.8.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

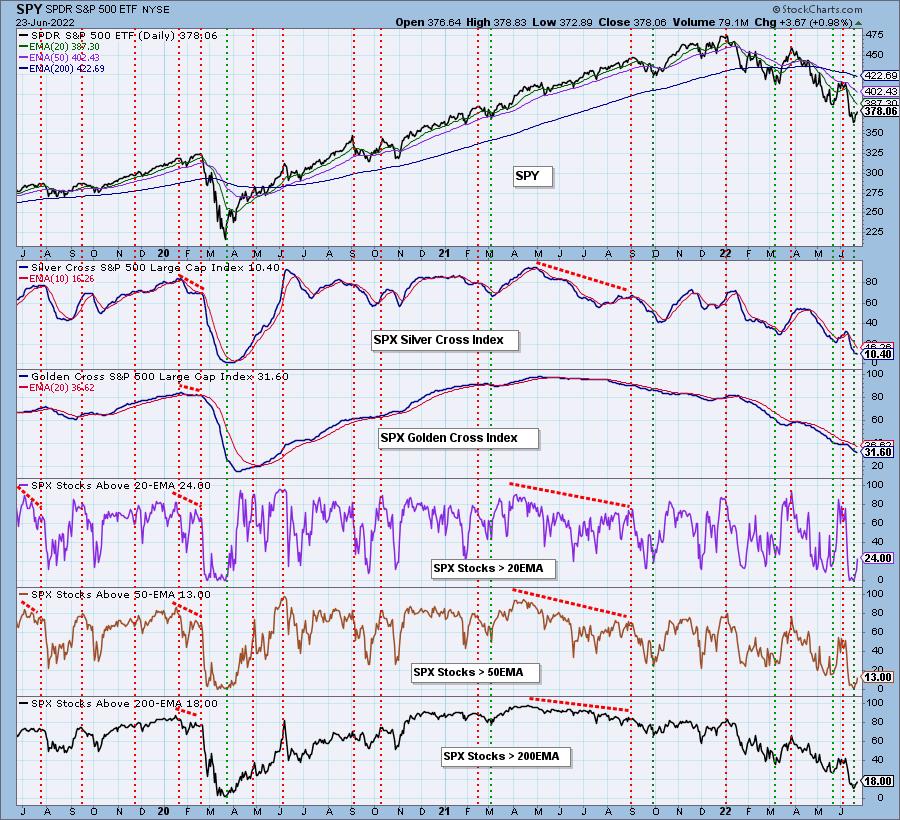

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% exposed.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com