Today the defensive sectors took the reins. The only sectors to finish higher were Utilities (+0.60%), Healthcare (+0.51%) and Real Estate (+0.19%). Consumer Staples didn't finish higher, but they finished fourth (-0.23%).

So, it wasn't a surprise to see plenty of Utilities in my scans today. I have a Conventional Electricity stock and a Multiutilities stock for your review. I also found the Proctor & Gamble (PG) chart to be quite favorable. One nice thing about defensive sectors, you can set tight stops. Of course, upside potential isn't as exciting as a tech stock. Two of these stocks report earnings this week and the other next week, so be prepared for possible volatility.

I wanted to give you a heads up on an article I recently read regarding Copper. The headline was compelling "Copper just collapsed. Time to go long!". Here is a link to this article. I looked at FCX, which was how the author suggested trading Copper. The chart just isn't there yet for me, but it is now on my radar. If you haven't signed up for any of the free newsletters from MauldinEconomics.com, I highly recommend you do so. In particular, Dad and I often discuss John Mauldin's free weekly email, "Thoughts from the Frontline". His last article was on how the Fed works using the word "hubris" to describe their history and actions. Absolutely brilliant! He's VERY easy to read.

All of us are over COVID, but Mom is still in need of prayers as her progress has been slow. Thank you again for allowing me to take last week off to heal. I'm ready to go!

Good Luck & Good Trading!

Erin

Today's "Diamonds in the Rough": DTE, PG and WEC.

Runners-Up: CMS and D.

RECORDING LINK (7/15/2022. There was no Diamond Mine 7/22):

Topic: DecisionPoint Diamond Mine (7/15/2022) LIVE Trading Room

Start Time: Jul 15, 2022 09:01 AM

Meeting Recording Link

Access Passcode: July%15th

REGISTRATION Friday, 7/29 Diamond Mine:

When: Jul 29, 2022 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (7/29/2022) LIVE Trading Room

Register in advance for this webinar HERE

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

StockChartsTV is now producing the recording for the free DP Trading Room! It airs at 3p ET, much sooner than I was able to get out the recording links. Carl has joined so you can "ask the master" all those questions you've always wanted his opinion on! If you haven't registered to attend live at Noon ET, you can do so HERE.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint Scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

"Predefined Scans Triggered" are taken from StockCharts.com using the "Symbol Summary" option instead of a "SharpChart" on the workbench.

DTE Energy Co. (DTE)

EARNINGS: 7/28/2022 (BMO)

DTE Energy Co. operates as a diversified energy company, which engages in the development and management of energy-related businesses and services. It operates through the following segments: Electric, Gas, DTE Vantage, Energy Trading, and Corporate and Other. The Electric segment consists of generation, purchase, distribution, and sale of electricity to residential, commercial, and industrial customers in southeastern Michigan. The Gas segment is involved in the purchase, storage, transportation, distribution, and sale of natural gas to residential, commercial, and industrial customers throughout Michigan, and the sale of storage and transportation capacity. The DTE Vantage segment focuses on projects that deliver energy and utility-type products and services to industrial, commercial, and institutional customers, produce reduced emissions fuel, and sell electricity and pipeline-quality gas from renewable energy projects. The Energy Trading segment covers energy marketing and trading operations. The Corporate and Other segment composed of various holding company activities, holds certain non-utility debt, and holds certain investments, as well as funds supporting regional development and economic growth. The company was founded in January 1995 and is headquartered in Detroit, MI.

Predefined Scans Triggered: Entered Ichimoku Cloud.

DTE is unchanged in after hours trading. It hasn't quite broken out of its declining trend, but it came close. overhead resistance is also there at March highs/May lows. Note that it reports earnings in two days. Price closed above the 50-day EMA. The RSI is now positive and rising. The PMO whipsawed back into a crossover BUY signal and volume is coming in. This is its fourth day higher which constitutes a "follow-through" day that would suggest more upside ahead. Stochastics moved into positive territory. The group is performing well and DTE performs in line so it is currently outperforming the SPY. The stop is below the July low.

Price turned back up after dropping briefly below strong support at the 2021 highs. The weekly RSI is positive and rising. The weekly PMO needs work, but is decelerating. The SCTR is strong as it sits above 70.

Procter & Gamble Co. (PG)

EARNINGS: 7/29/2022 (BMO)

Procter & Gamble Co. engages in the provision of branded consumer packaged goods. It operates through the following segments: Beauty, Grooming, Health Care, Fabric & Home Care, and Baby, Feminine & Family Care. The Beauty segment offers hair, skin, and personal care. The Grooming segment consists of shave care like female and male blades and razors, pre and post shave products, and appliances. The Health Care segment includes oral care products like toothbrushes, toothpaste, and personal health care such as gastrointestinal, rapid diagnostics, respiratory, and vitamins, minerals, and supplements. The Fabric and Home Care segment consists of fabric enhancers, laundry additives and detergents, and air, dish, and surface care. The Baby, Feminine and Family Care segment sells baby wipes, diapers, and pants, adult incontinence, feminine care, paper towels, tissues, and toilet paper. The company was founded by William Procter and James Gamble in 1837 and is headquartered in Cincinnati, OH.

Predefined Scans Triggered: None.

PG is up +0.03% in after hours trading. I've covered it twice before. First on April 23rd 2020 (position is still open and up +20.83%) and December 28th 2020 (position is closed). Today it formed a bullish engulfing candlestick on a follow-through day. Price nearly closed above the 50-day EMA. We have a reverse head and shoulders pattern. The upside target of that pattern would put price around $164.50. The RSI is positive and rising. The PMO bottomed above the signal line which is especially bullish. Stochastics are rising in positive territory. Relative strength is picking up this last week. The stop can be set very thinly at 4.5%.

PG did not test support at $120 before turning up. That is a very bullish sign. Price is holding above strong support. The weekly RSI is negative, but nearing positive territory as it rises. The PMO is in decline, but has managed to hold above the zero line...so far. The SCTR is mediocre at 56.3%, but it is improving after hitting 2022 lows. The upside target is good at 14.6%.

WEC Energy Group, Inc. (WEC)

EARNINGS: 8/2/2022 (BMO)

WEC Energy Group, Inc. is a holding company, which engages in the generation and distribution of electricity and natural gas. It operates through the following segments: Wisconsin, Illinois, Other States, Electric Transmission, Non-Utility Energy Infrastructure and Corporate & Other. The Wisconsin segment refers to the electric and gas utility operations. The Illinois segment deals with natural gas utility and non-utility activities. The Other States segment pertains to natural gas operations of the firm's subsidiaries. The Electric Transmission segment holds interests in state regulatory commissions. The Non-Utility Energy Infrastructure segment includes Wisconsin Electric Power, which owns and leases generating facilities. The Corporate and Other segment refers to the firm's administrative and holding activities. The company was founded in 1981 and is headquartered in Milwaukee, WI.

Predefined Scans Triggered: Three White Soldiers, Bullish MACD Crossovers and Moved Above Ichimoku Cloud.

WEC is up +1.34% in after hours trading. I've covered it twice: June 29th 2022 (position is open and up +1.35%) and February 26th 2020 (position is closed). We have a possible cup with handle pattern (although it looks a bit more like a failed "V" Bottom). Price has broken from its declining trend. The RSI just moved into positive territory. The Pro triggered a crossover BUY signal. Like the RSI, Stochastics just hit positive territory and is rising. Relative strength is picking up for the group and WEC in the last week. The stop is set below the July low and 200-day EMA.

This one is generally range bound and it is at the top of its range which does make it less attractive, particularly in the longer term. However, the weekly RSI is now positive and the weekly PMO is starting to bottom. The SCTR is a respectable 82.4%. It's 8.7% away from all-time highs so consider an upside target of 14% at $114.74.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to send me an email. I read every email I receive and try to answer them all!

Current Market Outlook:

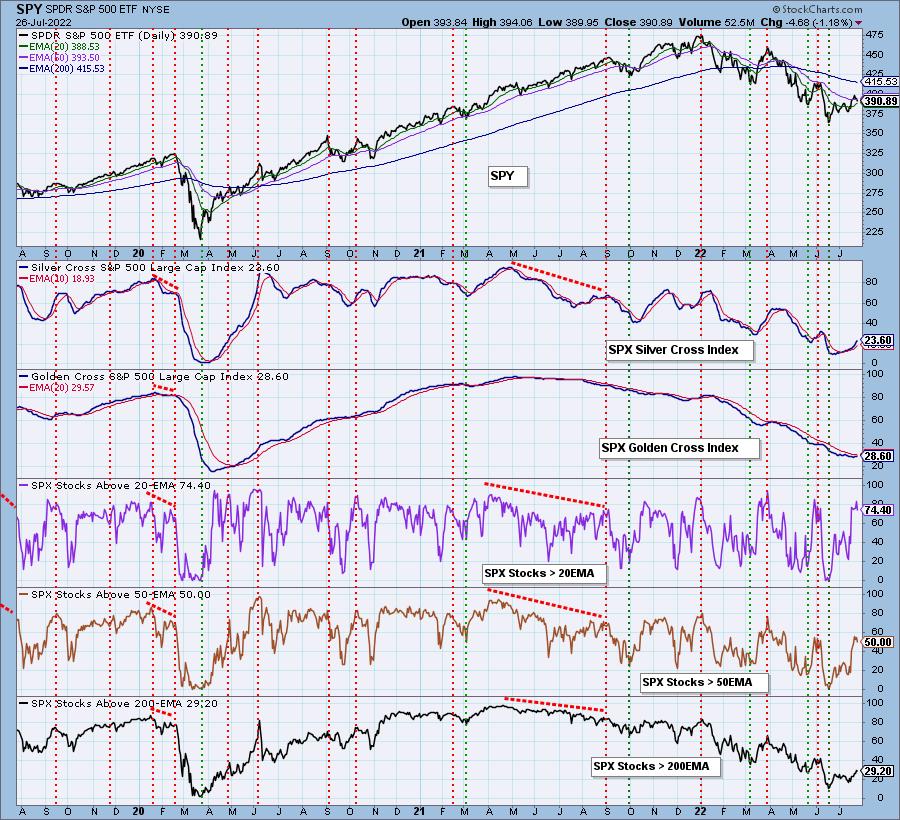

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 40% exposed.

I'm required to disclose if I currently own a stock I mention and/or may buy/short it within the next 72 hours.

"Technical Analysis is a windsock, not a crystal ball." - Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com