Even on Reader Request Day I run my scans and take a look. I had a plethora of results yesterday and today. Since reader requests were light this week, I added some of my own. I've also put other stocks I liked in the "Stocks to Review".

Interesting industry group themes in the scan results were Software, Medical Equipment, Telecom Equipment, Health Care Providers, Hotels, Banks and Life Insurance. While the "Diamonds in the Rough" don't include some of those groups, I thought you'd find it interesting to see what groups were well represented.

Tomorrow is the Diamond Mine trading room! Don't forget to sign up here! If you can't attend, you'll always find the latest recording links in this report.

Today's "Diamonds in the Rough": AMED, DGII, EW, JNPR and REGN.

"Stocks to Review": VMC, AEL, NTCT, TECK and MMYT

RECORDING LINK Wednesday (12/3):

Topic: DecisionPoint Diamond Mine (12/3/2021) LIVE Trading Room

Start Time: Dec 3, 2021 09:00 AM

MeetingRecording Link.

Access Passcode: December*3

REGISTRATION FOR Friday 12/10 Diamond Mine:

When: Dec 10, 2021 09:00 AM Pacific Time (US and Canada)

Topic: DecisionPoint Diamond Mine (12/10/2021) LIVE Trading Room

Register in advance for this webinar HERE.

Save the registration confirmation email with login instructions in case Zoom doesn't notify you in time.

Free DP Trading Room (12/6) RECORDING LINK:

Topic: DecisionPoint Trading Room

Start Time: Dec 6, 2021 09:00 AM

Meeting Recording Link.

Access Passcode: December@6

For best results, copy and paste the access code to avoid typos.

Welcome to DecisionPoint Daily Diamonds, wherein I highlight ten "Diamonds in the Rough" per week. These are selected from the results of my DecisionPoint scans, which search for stocks that could benefit from the trend and condition of the market. Remember, these are not recommendations to buy or sell, but are the most interesting of the stocks that surfaced in my scans. My objective is to save you the work of the initial, tedious culling process, but you need to apply your own analysis to see if these stocks pique your interest as well. There are no guaranteed winners here!

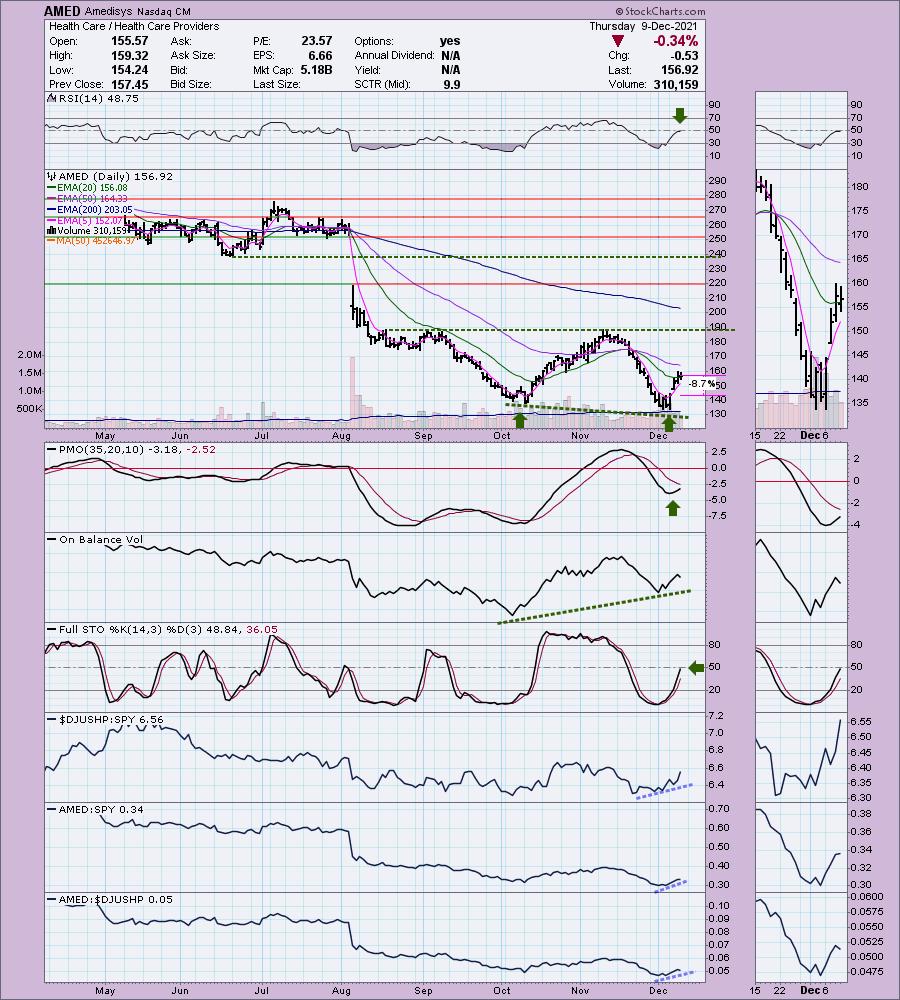

Amedisys (AMED)

EARNINGS: 2/23/2022 (AMC)

Amedisys, Inc. engages in the provision of healthcare services. It operates through the following business segments: Home Health, Hospice, and Personal Care. The Home Health segment delivers services in the homes of individuals who may be recovering from an illness, injury, or surgery. The Hospice segment provides care that is designed to provide comfort and support for those who are facing a terminal illness. The Personal Care segment gives patients assistance with the essential activities of daily living. The company was founded by William F. Borne in 1982 and is headquartered in Baton Rouge, LA.

Predefined Scans Triggered: Bullish MACD Crossovers and Hollow Red Candles.

AMED is unchanged in after hours trading. I covered AMED in the April 15th 2020 Diamonds Report. The position was closed fairly quickly when the 7.5% stop was hit. Right now AMED is forming a double-bottom. That double-bottom has a positive divergence with the OBV. The RSI isn't positive and is moving sideways for now. The PMO looks more promising. Stochastics are very positive rising purposefully toward positive territory. Relative strength studies are positive. I set an 8.7% stop below gap support from earlier this week.

The OBV positive divergence is clear on the weekly chart too. The weekly RSI is negative, but rising. The PMO had topped below the signal line which is very bearish, but it has again turned up. If it comes close to fulfilling the target of the double-bottom that would be an over 43% gain. If it only makes it to the confirmation line that would be a 23% gain.

Digi Intl Inc. (DGII)

EARNINGS: 2/2/2022 (AMC)

Digi International, Inc. provides business and mission-critical Internet of Things (IoT) connectivity products, services and solutions. It operates through the following segments: IoT Products and Services, and IoT Solutions. The IoT Products and Services segment offers products and services that help original equipment manufacturers, enterprise and government customers create and deploy, secure IoT connectivity solutions. The IoT Solutions segment provides wireless temperature and other condition-based monitoring services as well as employee task management services. The company was founded in 1985 and is headquartered in Hopkins, MN.

Predefined Scans Triggered: None.

DGII is up +1.38% in after hours trading. I covered it back on September 17th 2020. The position is still open and is up +64.9%. I like the "V" shaped recovery on this stock. The RSI is positive and the PMO is rising toward a crossover BUY signal. Stochastics are positive and are rising with no hesitation. Relative strength studies are strong for DGII. As I noted earlier, this group is beginning to really outperform this week. The stop is set below support at $22 (October top).

DGII is triggering a weekly PMO crossover BUY signal currently. There is a large bullish ascending triangle. It isn't textbook as it has a lot of "white space" between the two tops, but the psychology is the same as investors slowly push back toward resistance. The expectation is a breakout. It's near all-time highs so I would set an upside target of 16% or $27.75.

Edwards Lifesciences Corp. (EW)

EARNINGS: 1/26/2022 (AMC)

Edwards Lifesciences Corp. engages in the patient-focused medical innovations for heart disease and critical care monitoring. Its products are categorized into three areas: Transcatheter Heart Valves, Surgical Structural Heart, and Critical Care. The Transcatheter Heart Valves portfolio includes technologies designed to treat heart valve disease using catheter-based approaches as opposed to open surgical techniques. The Surgical Structural Heart portfolio includes tissue heart valves and heart valve repair products for the surgical replacement or repair of a patient's heart valve. The Critical Care portfolio products through hemodynamic monitoring system measures a patient's heart function and fluid status in surgical and intensive care settings. The company was founded by Miles Lowell Edwards in 1958 and is headquartered in Irvine, CA.

Predefined Scans Triggered: New CCI Buy Signals.

EW is up +0.27% in after hours trading. Today it broke above resistance at the November top. It wasn't able to close there, but the indicators suggest it will breakout to new all-time highs. The RSI is positive and not overbought. The PMO just generated a crossover BUY signal. Stochastics are rising and have reached above 80. Relative strength studies are very bullish. The group is clearly outperforming and EW is a leader in that group. The set is rather deep. I set it below the late October low.

This may look like a double-bottom, but those formations are reversal patterns and therefore wouldn't happen at the top of a rising trend. It could be a flag which is very positive. The weekly RSI is positive and the weekly PMO turned up on today's strong rally.

Juniper Networks (JNPR)

EARNINGS: 1/27/2022 (AMC)

Juniper Networks, Inc. engages in the design, development, and sale of products and services for high-performance networks. Its products address network requirements for global service provides, cloud providers, national governments, research and public sector organizations, and other enterprises. The company was founded by Pradeep S. Sindhu on February 6, 1996 and is headquartered in Sunnyvale, CA.

Predefined Scans Triggered: P&F Double Top Breakout.

JNPR is up +0.43% in after hours trading. Price broke out and is now consolidating on top of support at all-time highs. The RSI is positive and the PMO is rising toward a crossover BUY signal. Stochastics are rising strongly. Relative strength studies are bullish with JNPR outperforming the group and the SPY. I like that I can set a stop that isn't too deep at 6.9% that aligns with the December low and the 50-EMA.

The weekly PMO is on a crossover BUY signal. The RSI is rising but has now hit overbought territory. I would consider a 15% upside target at $37.65.

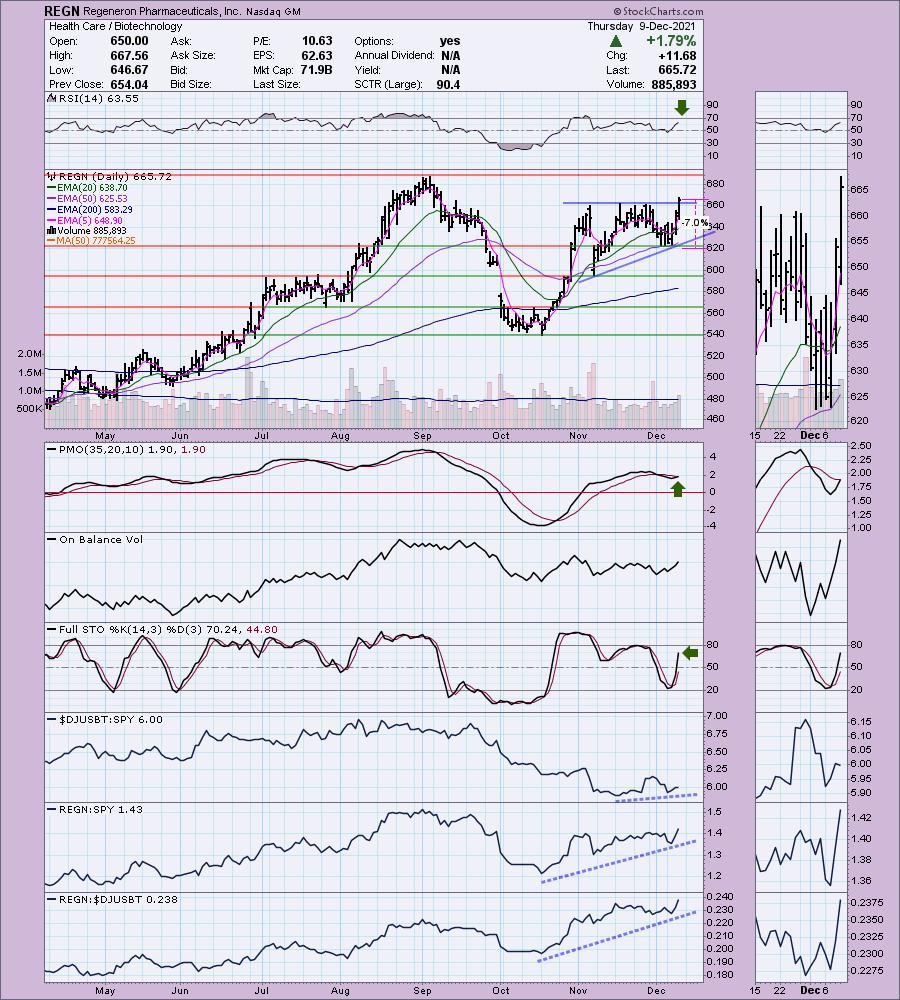

Regeneron Pharmaceuticals, Inc. (REGN)

EARNINGS: 2/4/2022 (BMO)

Regeneron Pharmaceuticals, Inc. is a biotechnology company, which engages in the discovery, invention, development, manufacture, and commercialization of medicines. It product portfolio includes the following brands: EYLEA, Dupixent, Praluent, Kevzara, Libtayo, ARCALYST, and ZALTRAP. The firm accelerates the traditional drug development process through its proprietary VelociSuite technologies such as VelocImmune, which uses unique genetically-humanized mice to produce optimized fully-human antibodies and bispecific antibodies. The company was founded by Alferd G. Gilman, Leonard S. Schleifer, and Eric M. Shooter on January 8, 1988 and is headquartered in Tarrytown, NY.

Predefined Scans Triggered: New CCI Buy Signals, P&F Double Top Breakout, P&F Spread Triple Top Breakout, Moved Above Upper Bollinger Band, Stocks in a New Uptrend (Aroon) and Moved Above Upper Price Channel.

REGN is up +0.21%. I've covered REGN four times previously, the last time was on August 19th 2021 (The 9% stop was hit on the September decline. I also covered it March 3rd 2020 (The stop has never been hit so the position is up +44.2%), April 1st 2020 (I set a very deep stop which hasn't been hit so the position is up +34.0%) and June 1st 2020 (It gained about 10% before turning over and triggering the 7.6% stop).

REGN broke out of a trading range today. The RSI is positive and the PMO is generating a crossover BUY signal today. There is a bullish ascending triangle pattern that was confirmed on the breakout. REGN's relative strength is very good and Biotechs are beginning to show some strength themselves. The stop is set below the 50-EMA and December low.

The weekly RSI is positive and best of all we have a weekly PMO BUY signal. Price is nearing all-time highs so I would set an upside target of about 15% at $765.58.

Don't forget, on Thursdays I look at reader-requested symbols, click HERE to shoot me an email. I read every email I receive and try to answer them all!

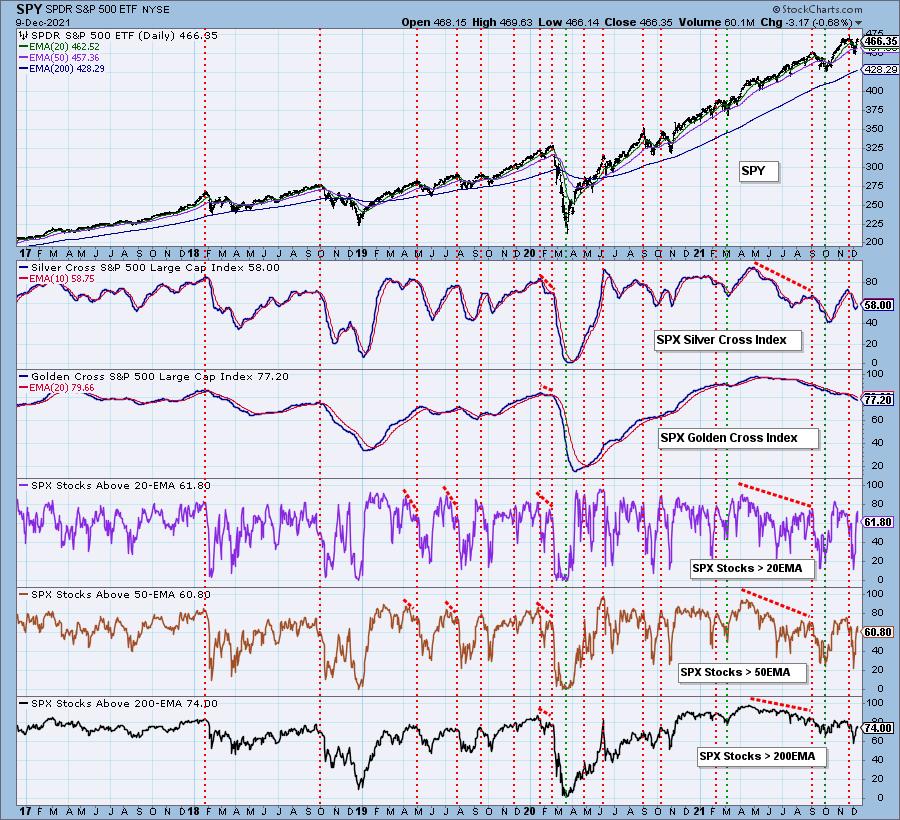

Current Market Outlook:

Market Environment: It is important to consider the odds for success by assessing the market tides. The following chart uses different methodologies for objectively showing the depth and trend of participation for intermediate- and long-term time frames.

- The Silver Cross Index (SCI) shows the percentage of SPX stocks on IT Trend Model BUY signals (20-EMA > 50-EMA)

- The Golden Cross Index (GCI) shows the percentage of SPX stocks on LT Trend Model BUY signals (50-EMA > 200-EMA)

Don't forget that as a "Diamonds" member, you have access to our GCI/SCI curated ChartList on DecisionPoint.com. You'll find it under "Members Only" links on the left side on the Blogs and Links Page.

Here is the current chart:

Full Disclosure: I'm 15% invested and 85% is in 'cash', meaning in money markets and readily available to trade with.

I'm required to disclose if I currently own a stock and/or may buy it within the next 72 hours.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erin@decisionpoint.com

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin on Mondays 7:00p EST or on the DecisionPoint playlist on the StockCharts TV YouTube channel here!

NOTE: The stocks reported herein are from mechanical trading model scans that are based upon moving average relationships, momentum and volume. DecisionPoint analysis is then applied to get five selections from the scans. The selections given should prompt readers to do a chart review using their own analysis process. This letter is not a call for a specific action to buy, sell or short any of the stocks provided. There are NO sure things or guaranteed returns on the daily selection of "Diamonds in the Rough."

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

For more links, go to DecisionPoint.com